Dogecoin has surged 7%, challenging a key resistance trendline. Bulls now eye the $0.20 level amid rising long positions and a broader market recovery.

As the crypto market bounces back after Easter, Bitcoin crosses above the $87,000 mark. Amid the recovering market, the meme coin segment has soared by nearly 4%, reaching a market cap of $47.45 billion.

Among the top meme coins, Dogecoin has soared by nearly 4% over the past 24 hours, crossing the $0.16 barrier. Will this short-term recovery in Dogecoin result in a breakout rally to $0.20?

Dogecoin Price Analysis: Targeting Trendline Breakout Toward $0.20

On the 4-hour chart, Dogecoin’s price action reveals a bullish recovery, now testing a key resistance trendline. The rally has pushed prices above both the 50 and 100 EMA levels.

Bulls have also broken through the 38.20% Fibonacci retracement level at $0.1597. The recovery began with a Morning Star pattern, followed by five consecutive bullish candles, resulting in a nearly 7% surge.

This upward movement has triggered a positive crossover in the MACD and signal lines. Additionally, it sets the stage for a potential bullish crossover between the 50 and 100 EMAs.

Currently, Dogecoin faces resistance at a short-term descending trendline, which is temporarily limiting further gains. However, as broader market sentiment improves, increased momentum and hype may help propel DOGE prices.

In such a scenario, Dogecoin could break through the overhead resistance confluence formed by the 200 EMA and the 50% Fibonacci level near $0.1680.

If an extended rally pushes past this critical level, the uptrend could reach $0.20, representing a potential 25% surge. Conversely, prices may retest the psychological support at $0.15 if a bearish reversal occurs.

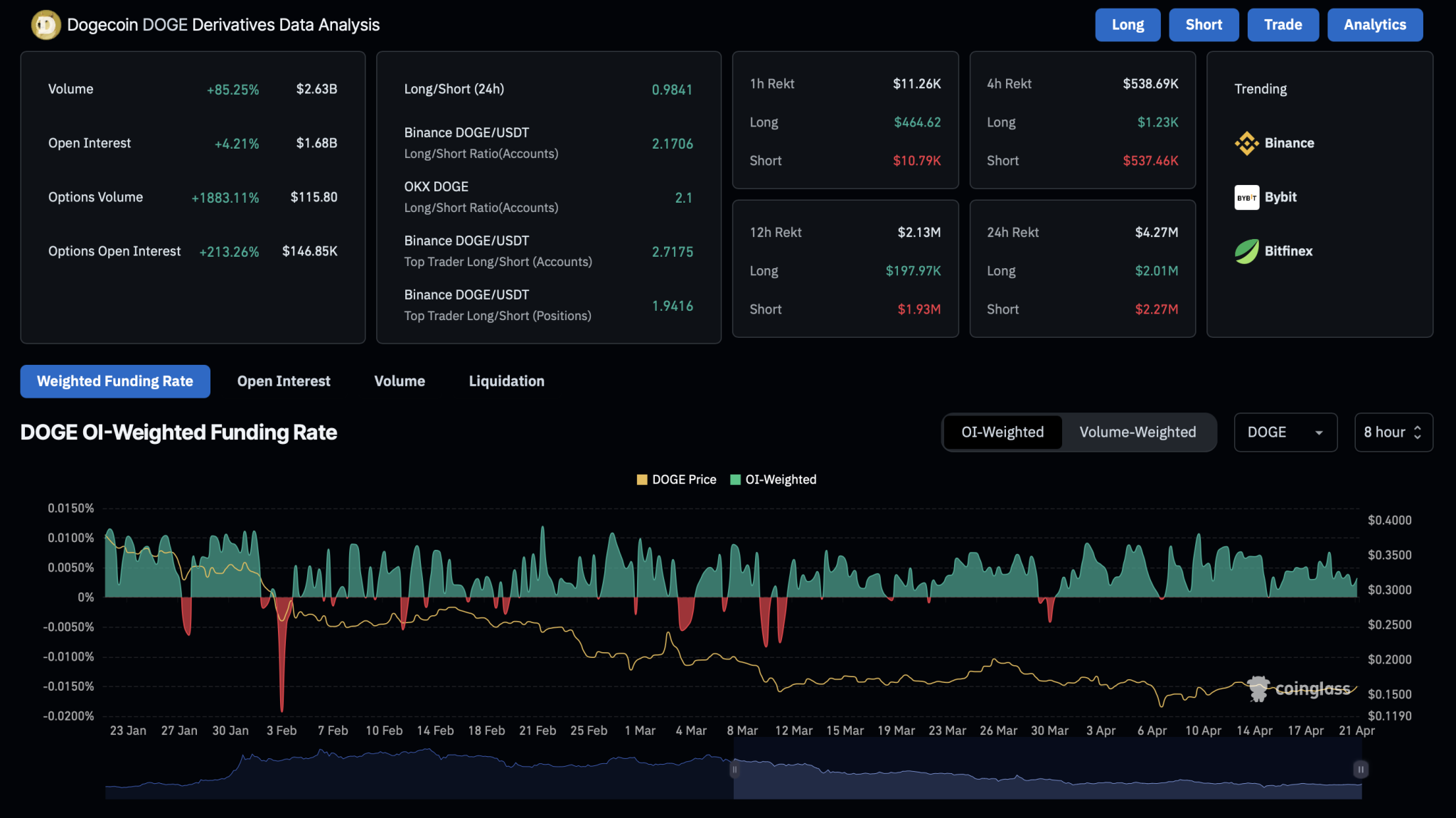

Bullish Sentiment Drives Surge in Dogecoin Derivatives

As the broader market anticipates a potential breakout in Dogecoin, interest in DOGE derivatives is surging. Open interest has jumped 3.74%, reaching $1.67 billion.

Dogecoin Derivatives

Additionally, the open interest-weighted funding rate has rebounded to 0.0032%, reflecting renewed bullish sentiment. Over the past 36 hours, the long/short ratio in DOGE derivatives has also seen a significant spike.

Long positions have climbed from 46.16% to 51.16%, pushing the long-to-short ratio up to 1.0475. While this ratio still suggests a neutral outlook overall, the sudden increase in long positions signals growing optimism for a recovery.

Dogecoin LongShort Ratio Chart

Bullish Rally to Face Headwinds from $15M DOGE Unlock

Data from Tokenomist reveals a major Dogecoin token unlock. From April 21 to April 28, approximately 96.52 million DOGE—worth $15.32 million—will be unlocked.

This represents about 0.06% of the circulating supply entering the market. With over $15 million in DOGE entering the market daily during this period, the increased supply could present a challenge to the ongoing bullish momentum.

According to Tokenomist, several major token unlocks (over $5 million per event) are scheduled in the next 7 days, including VENOM and ALT. Additionally, significant linear daily unlocks (over $1 million per day) will occur for tokens such as SOL, WLD, TRUMP, TIA, DOGE, TAO,… pic.twitter.com/ATCCFqsIeg

— Wu Blockchain (@WuBlockchain) April 21, 2025

Leave a Reply