Ethereum has started this week with a minor relief bounce after last week’s flush below $1,500. While the price has held support for now, momentum is weak, and on-chain sentiment still leans bearish, suggesting any upside might be limited unless the buyers reclaim key resistance levels.

Technical Analysis

By Edris Derakhshi

The Daily Chart

ETH’s daily structure remains heavily bearish. The asset continues to trade below the 200-day moving average, located around the $2,800 mark, and has printed multiple lower highs and lower lows over the past two months. After breaking below the $1,800–$2,000 range last week, ETH is struggling to hold onto the $1,550 support zone.

The RSI also remains suppressed, hovering just above oversold levels, and momentum indicators show no strong bullish divergence. A break below $1,550 would open the door toward the next major demand zone around $1,300–$1,400, while reclaiming $1,900 is needed to slow the current bearish trend.

The 4-Hour Chart

On the 4-hour timeframe, ETH has recently bounced from the $1,550 support but now faces a major descending trendline that has acted as dynamic resistance for over a month. The price is currently testing the $1,650–$1,700 intraday resistance range.

A breakout above the trendline and a successful flip of this zone could trigger a short-term rally toward $1,800. However, sellers remain active at every bounce, and the market structure still favors lower highs unless ETH can close above $1,700 and hold.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

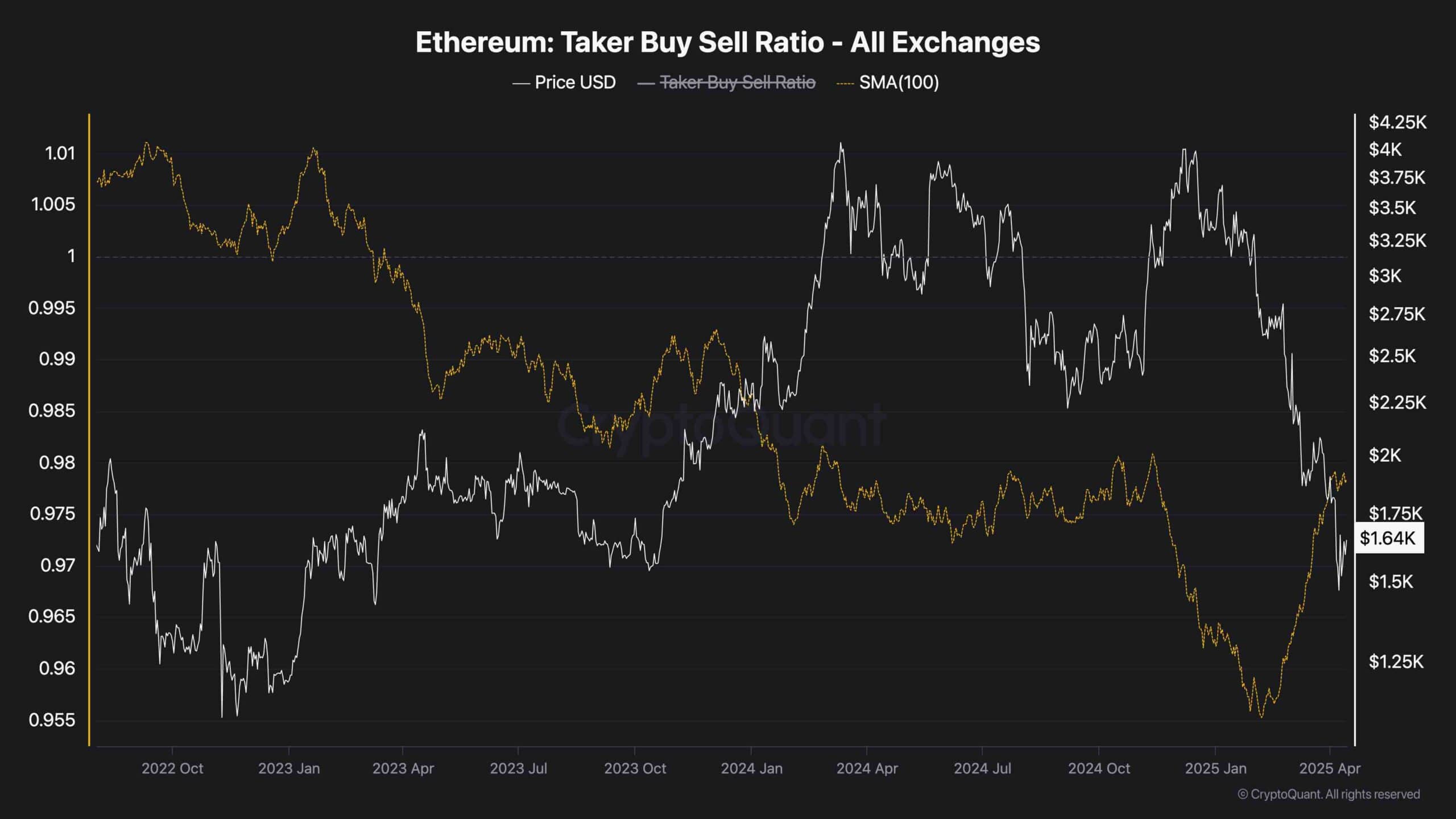

Taker Buy-Sell Ratio

The Taker Buy Sell Ratio for ETH trends below 1, signaling that market orders are predominantly sell-driven. While there’s been an uptick in recent days, the overall trend remains bearish, suggesting the bounce is not backed by strong demand. This aligns with the lack of bullish conviction on the charts.

Until the ratio shifts decisively above 1 and sustains, buyer aggression will likely remain weak. In short, the sentiment shows lingering fear, and the broader trend points toward further downside unless the buyers can force a shift in structure and volume.

Leave a Reply