Ethereum (ETH) is facing increasing pressure from whale activity as large holders continue to offload significant portions of their holdings.

This ongoing sell-off comes during a challenging season for the cryptocurrency, with Ethereum grappling with poor price performance.

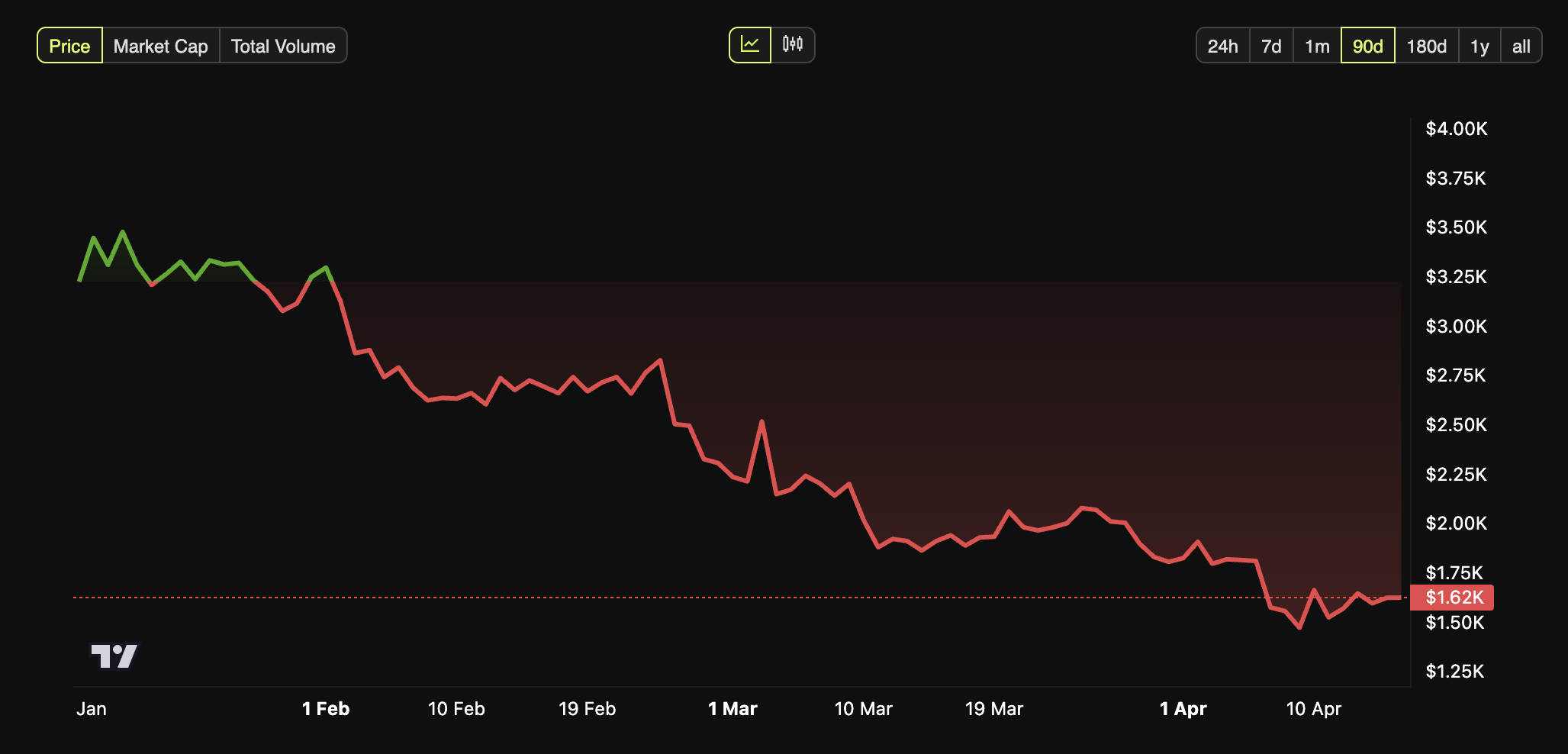

According to data from BeInCrypto, ETH has depreciated by 51.3% since the beginning of the year. While macroeconomic factors have weighed heavily on the entire crypto market, Ethereum’s struggles have been especially pronounced. In fact, last week, the altcoin plunged to lows not seen since March 2023.

Nonetheless, the tariff pause triggered a modest recovery in ETH shortly after. At press time, Ethereum was trading at $1,623, a slight increase of 0.3% over the past day.

Ethereum Price Performance. Source: BeInCrypto

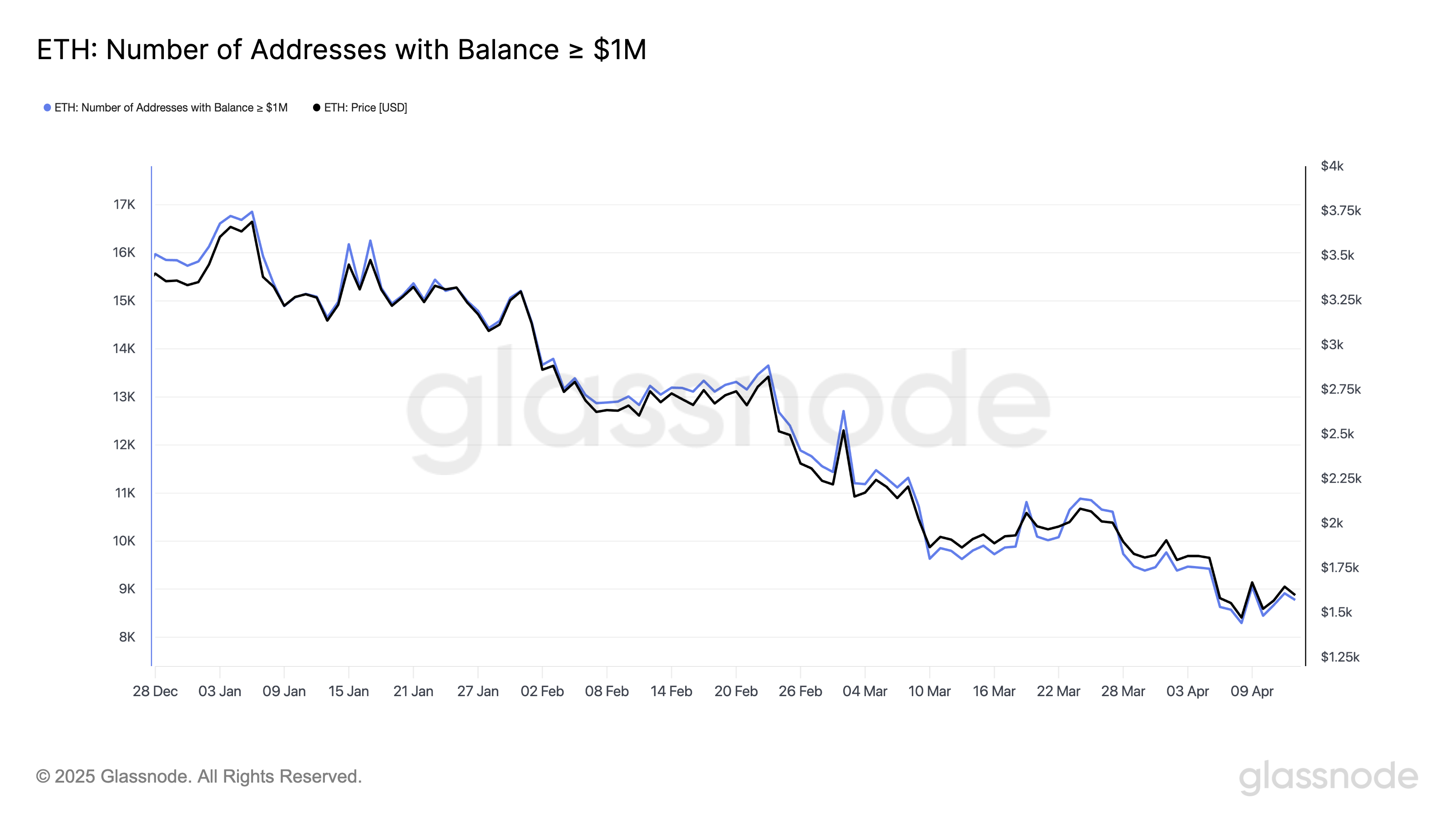

Despite this, the underwhelming performance has deterred investors. Glassnode data revealed that the number of addresses holding at least $1 million in ETH has decreased sharply year-to-date (YTD). Last week, these addresses dropped to lows not seen since January 2023, reflecting a notable reduction in high-net-worth investor confidence.

Holders with at least $1 million worth of ETH. Source: Glassnode

A closer look at the latest whale activity corroborated the decline. On April 14, a whale deposited 20,000 ETH worth $32.4 million into the Kraken exchange, likely preparing for further sales.

“The whale still has 30,874 ETH ($50.7 million) left, with $104M (+52.4%) in estimated total profit,” Spot On Chain noted.

In addition, an on-chain analyst revealed that an early 2015 ICO investor has been selling consistently. On April 13, the whale offloaded 632 ETH, worth approximately $1.0 million.

Since the beginning of April, this investor has sold 4,812 ETH, valued at around $8.0 million. Remarkably, the initial investment cost was as low as $0.3 per ETH, leaving the whale with a substantial stash of 30,189 ETH still in its possession.

Moreover, another dormant ETH whale, which had been inactive for years, has also started selling. The address withdrew 3,019 ETH from HTX between August and December 2020. Then, the investor transferred the assets to its current selling address three years ago.

On April 11, the whale made its first deposit of 1,000 ETH to Binance. On April 13, the whale deposited another 1,000 ETH, raising concerns of a potential sell-off.

“Fortunately, the whale only has 1,018 ETH left, so it will not cause too much selling pressure on the market,” the analyst stated.

The recent rise of dormant whales is noteworthy. While their sell-offs still yield profits, their activity suggests they aim to maintain this trend. According to Glassnode, only 36.1% of Ethereum addresses are currently profitable, indicating that a major portion of holders face losses.

Ethereum Holders in Profit. Source: Glassnode

Meanwhile, the current situation with Ethereum has led an analyst to draw comparisons to Nokia’s fall from dominance in the late 2000s. As BeInCrypto reported, the analyst warned that Ethereum could be headed for a decline, with more scalable and faster platforms like Solana (SOL) taking over.

Nevertheless, the pessimism isn’t widespread. Many analysts still foresee a potential for recovery, citing upcoming technological upgrades and the market’s undervaluation of ETH.

Leave a Reply