A TradingView analyst suggests that Dogecoin powerful surge could soon become a reality, driven by a long-term Cup and Handle formation.

Despite a bearish trend over the last 24 hours, Dogecoin has shown signs of recovery after establishing support at the intra-day low of $0.2172. At the time of writing, DOGE is trading at $0.2257, marking a 1.60% increase from its recent support level.

Amid this recovery, crypto analysts have highlighted a strong technical setup in Dogecoin’s price action that may support a long-term rally.

In his post on TradingView, Aram Salimi identified a giant Cup and Handle pattern forming over several years on the DOGE chart. Based on this formation, the analysis projects that DOGE could explode to $2.50.

Dogecoin Setting for Powerful 1,010% Surge

Notably, the Cup and Handle pattern began forming in May 2021, when Dogecoin peaked above $0.70. The price gradually declined, reaching a low of approximately $0.05 between late 2022 and early 2023. During this time, the rounded base of the cup formed, which has slowly reversed as prices have risen.

Dogecoin Price Prediction

By early 2025, Dogecoin returned to the $0.22–$0.25 range, forming the right side of the cup. The handle, a slight pullback from a resistance zone, has recently been completed.

Technical analysts often interpret this as a sign of consolidation before a breakout. The resistance around $0.25 is being tested again, with trading volume showing a steady increase.

According to Salimi’s chart, a breakout above $0.25 could confirm a price surge to targets near $0.45 and $0.50. A longer-term projection points to a potential move toward $2.50.

From Dogecoin’s current level, reaching that high would represent a surge of 1,016%. According to Salimi, this is a “sweet dream” that will most likely come true.

Short-Term Movement for DOGE

Currently, Dogecoin is trading near $0.222 after rising 1.60% in the past day. The price has exceeded the 100-hour simple moving average, often an indicator of stronger short-term momentum. A recent dip brought the price to $0.2157, close to short-term support levels.

Despite this, the token remains above a key trendline at $0.2230. Resistance lies near $0.230 and $0.2350, with breakout confirmation expected around $0.2420.

If this level is surpassed with strong buying volume, Dogecoin could rally toward $0.2550 or even $0.2640. However, a drop below $0.2120 may increase the risk of a deeper pullback toward $0.18 or even $0.15.

The Relative Strength Index (RSI) is near 57, indicating neutral market momentum. Meanwhile, the hourly MACD has slipped into negative territory, causing traders to remain cautious.

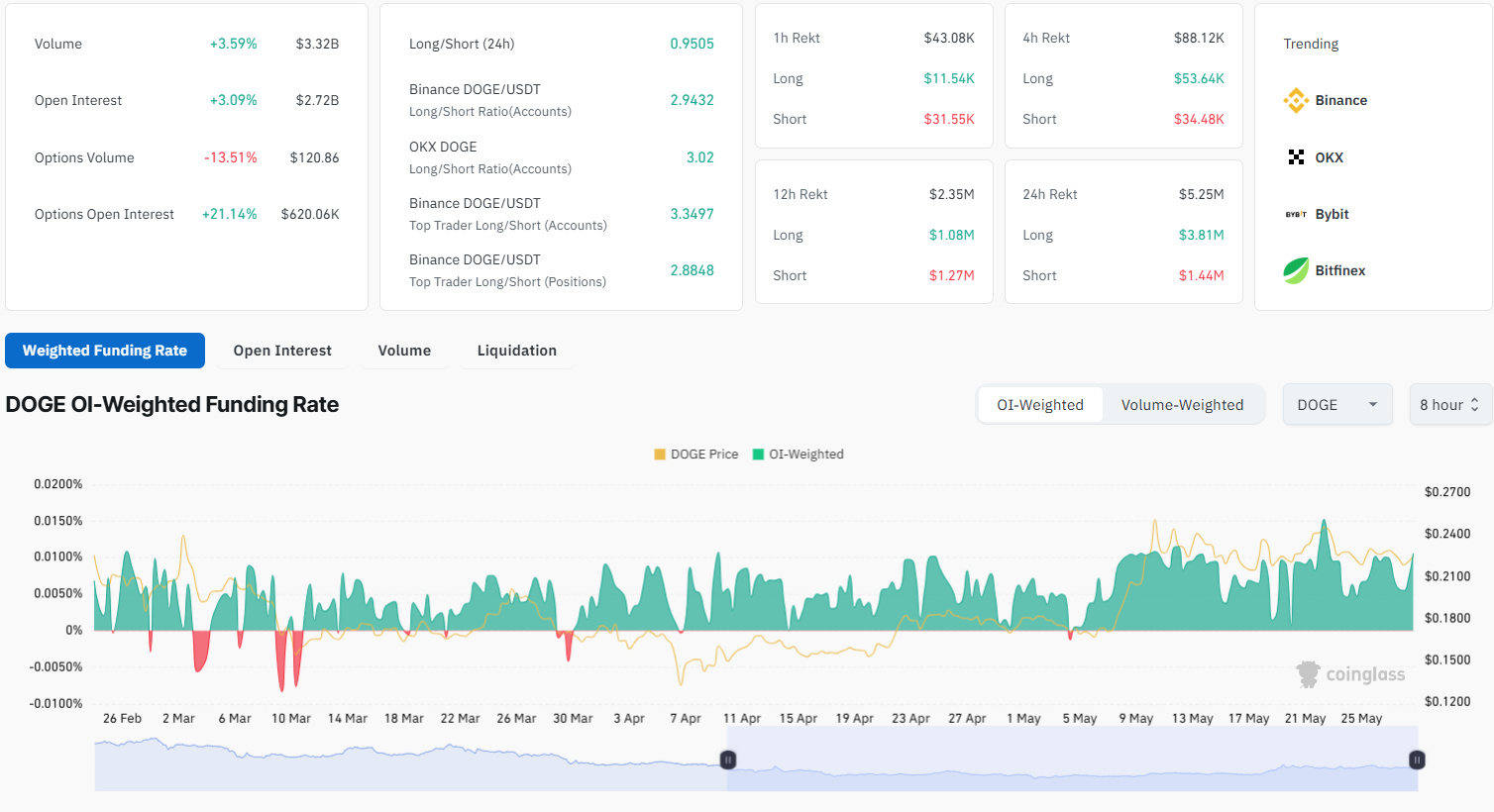

Derivatives and Volume Activity Show Bullish Pressure

Data from the derivatives market shows rising interest among traders. Dogecoin’s trading volume has increased by over 4%, reaching $3.34 billion. Open interest also rose 2.67% to $2.72 billion, indicating a higher number of active positions in the market.

Options markets have shown mixed signals. While options volume declined slightly, open interest rose by over 21%, exceeding $620,000

Dogecoin Derivatives Data

Institutional Interest Adds to Optimism

Institutional investors are also showing growing interest in Dogecoin. Grayscale filed for a spot DOGE ETF with the U.S. SEC, with a decision due soon. Analysts believe that under Paul Atkins’ leadership at the SEC, the DOGE ETF has an improved chance of approval.

Leave a Reply