Whales, the large investors in the Bitcoin market, may offer a critical boost, countering bearish pressure and possibly driving Bitcoin toward new highs.

Bitcoin’s Market Top or A Temporary Setback?

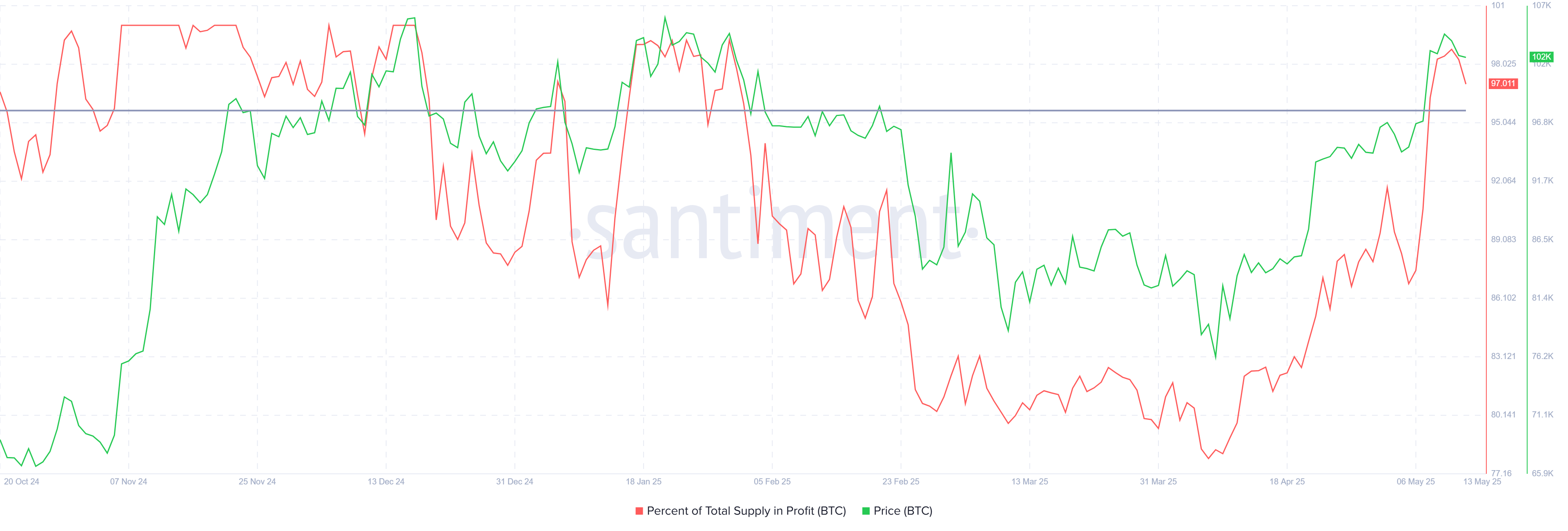

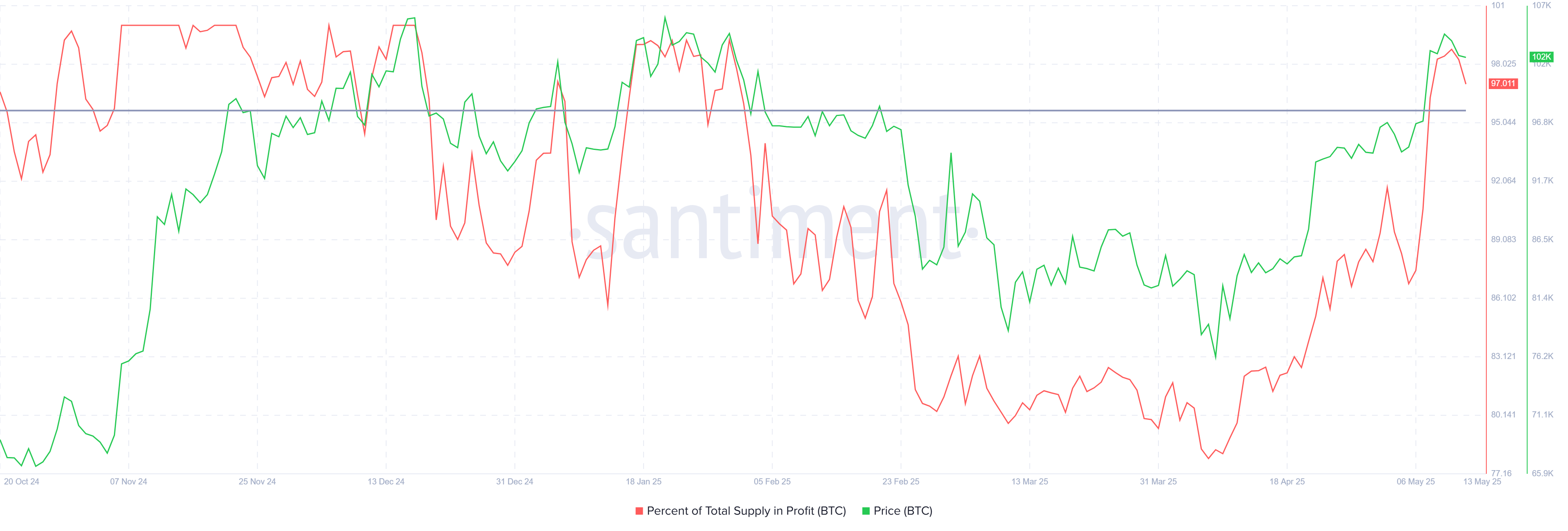

Bitcoin is showing signs of fulfilling the conditions needed to form a market top. Currently, over 98% of the total Bitcoin supply is in profit, surpassing the 95% threshold typically associated with market tops. Historically, Bitcoin has seen price reversals and declines following such conditions, but the situation could be different this time.

The high percentage of profitable supply suggests that many investors are sitting on gains. While this usually points to a market top and possible correction, it could also indicate sustained strength, especially with whale behavior playing a pivotal role. In the past, Bitcoin’s large holders (whales) have been able to move markets, potentially preventing a drastic reversal.

Bitcoin Supply In Profit. Source: Santiment

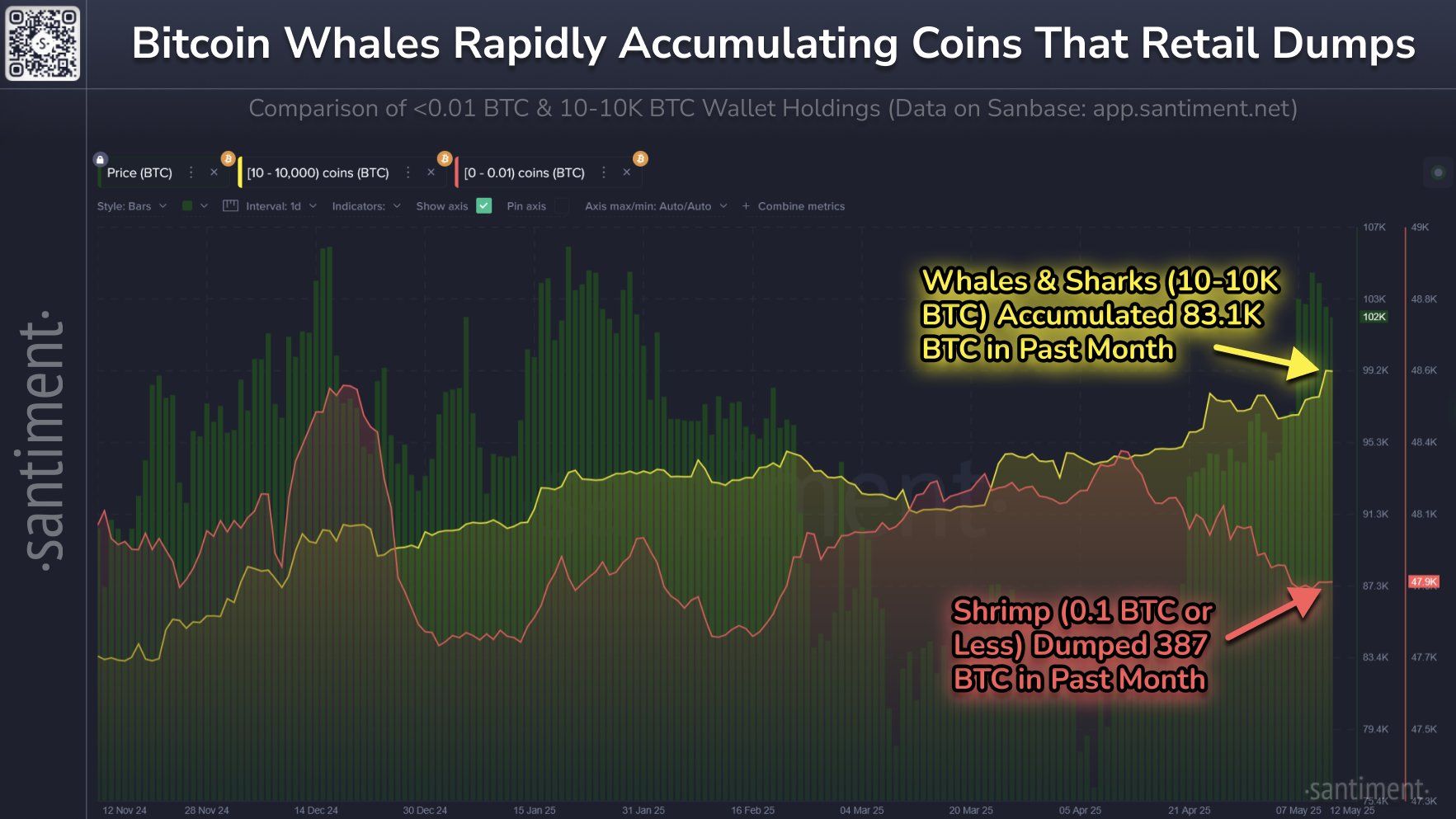

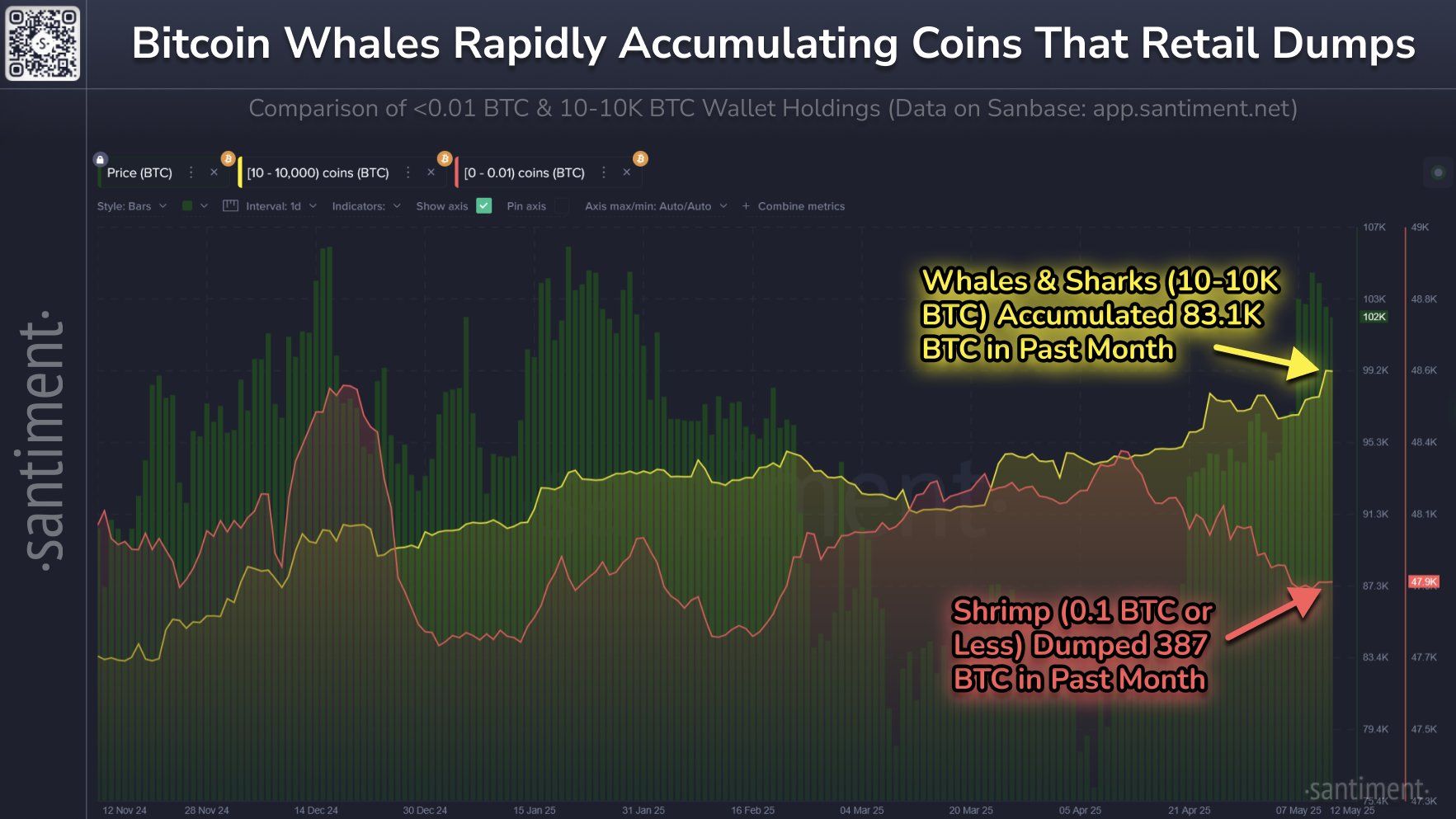

A closer look at whale holdings shows that large investors, specifically those with holdings between 10 and 10,000 BTC, have been accumulating aggressively. In the past month alone, these whales have acquired over 83,100 BTC, worth approximately $8.5 billion. This influx of large investments provides a counterbalance to the selling activity seen among smaller investors.

While smaller investors have shown some signs of profit-taking, the impact has been relatively insignificant. The substantial accumulation from whales suggests that these investors are betting on continued growth, which could mitigate any short-term bearish pressure. This accumulation trend strengthens the overall bullish sentiment for Bitcoin.

Bitcoin Investors Holding. Source: Santiment

BTC Price Prepares For A New ATH

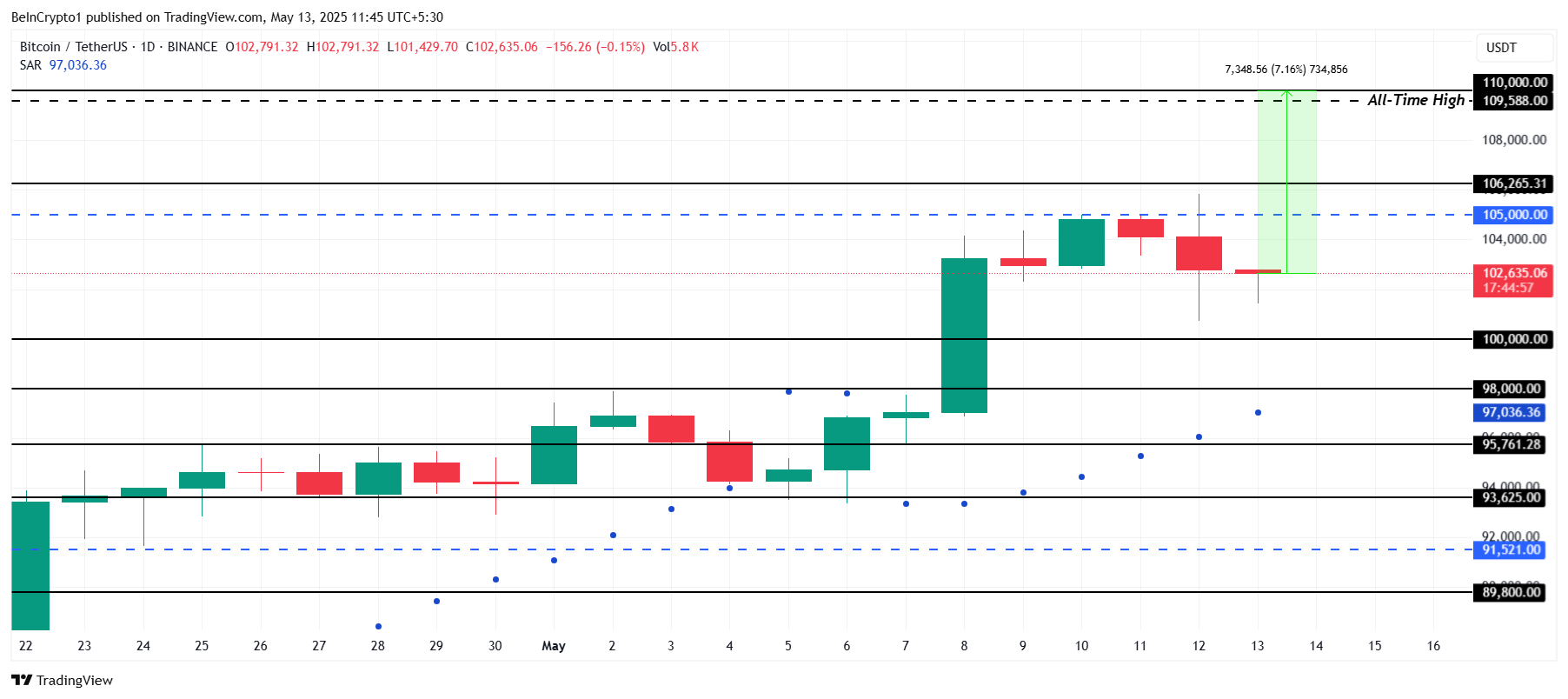

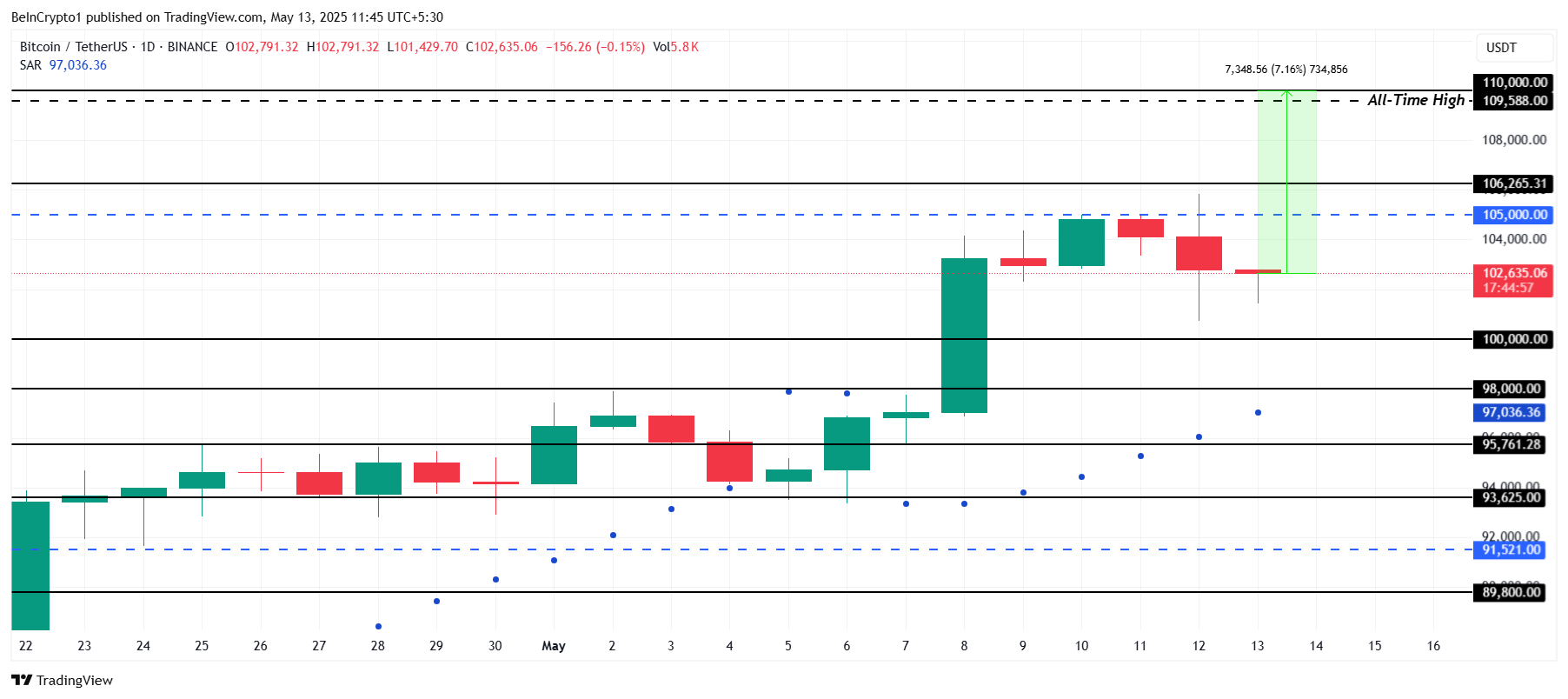

Bitcoin’s current price of $102,635 reflects the recent failure to breach $105,000. This price action typically signals a market top, which would usually drag the price lower.

However, the accumulation by whales could prevent a sharp decline, helping Bitcoin hold above key support levels. The influence of these large investors may lead to a positive turn in the market.

If Bitcoin’s bullish momentum resumes, it could break past the $105,000 resistance and set its sights on $106,265. A successful breach of this level could propel Bitcoin to $110,000, forming a new all-time high (ATH). This would mark a significant milestone in Bitcoin’s ongoing bull run, driven by institutional interest and whale accumulation.

Bitcoin Price Analysis. Source: TradingView

On the other hand, if market sentiment turns negative and investors start to panic sell or secure profits, Bitcoin’s price could face a decline. This would likely lead to a drop below $100,000, potentially pushing the price down to $98,000. A drop of this magnitude would challenge the current bullish thesis, extending the period of uncertainty.

Bitcoin’s price is currently trading at $102,635, struggling to break past the $105,000 resistance level. Although it failed to breach this crucial threshold earlier this week, the cryptocurrency king is far from defeated.

Whales, the large investors in the Bitcoin market, may offer a critical boost, countering bearish pressure and possibly driving Bitcoin toward new highs.

Bitcoin’s Market Top or A Temporary Setback?

Bitcoin is showing signs of fulfilling the conditions needed to form a market top. Currently, over 98% of the total Bitcoin supply is in profit, surpassing the 95% threshold typically associated with market tops. Historically, Bitcoin has seen price reversals and declines following such conditions, but the situation could be different this time.

The high percentage of profitable supply suggests that many investors are sitting on gains. While this usually points to a market top and possible correction, it could also indicate sustained strength, especially with whale behavior playing a pivotal role. In the past, Bitcoin’s large holders (whales) have been able to move markets, potentially preventing a drastic reversal.

Bitcoin Supply In Profit. Source: Santiment

A closer look at whale holdings shows that large investors, specifically those with holdings between 10 and 10,000 BTC, have been accumulating aggressively. In the past month alone, these whales have acquired over 83,100 BTC, worth approximately $8.5 billion. This influx of large investments provides a counterbalance to the selling activity seen among smaller investors.

While smaller investors have shown some signs of profit-taking, the impact has been relatively insignificant. The substantial accumulation from whales suggests that these investors are betting on continued growth, which could mitigate any short-term bearish pressure. This accumulation trend strengthens the overall bullish sentiment for Bitcoin.

Bitcoin Investors Holding. Source: Santiment

BTC Price Prepares For A New ATH

Bitcoin’s current price of $102,635 reflects the recent failure to breach $105,000. This price action typically signals a market top, which would usually drag the price lower.

However, the accumulation by whales could prevent a sharp decline, helping Bitcoin hold above key support levels. The influence of these large investors may lead to a positive turn in the market.

If Bitcoin’s bullish momentum resumes, it could break past the $105,000 resistance and set its sights on $106,265. A successful breach of this level could propel Bitcoin to $110,000, forming a new all-time high (ATH). This would mark a significant milestone in Bitcoin’s ongoing bull run, driven by institutional interest and whale accumulation.

Bitcoin Price Analysis. Source: TradingView

On the other hand, if market sentiment turns negative and investors start to panic sell or secure profits, Bitcoin’s price could decline. This would likely lead to a drop below $100,000, potentially pushing the price down to $98,000. A drop of this magnitude would challenge the current bullish thesis, extending the period of uncertainty.

Leave a Reply