Freight Technologies Inc., a cross-border transportation logistics company, announced that it’s offering $20 million in stock to purchase TRUMP meme coins for a MicroStrategy-style treasury.

The company’s justification for this move has almost nothing to do with TRUMP or crypto. Instead, it focuses on impending US-Mexico tariffs, which could substantially impact the company’s operations.

Freight Technologies Invests in TRUMP

Since it first came on the scene, Trump’s eponymous meme coin has caused much controversy. A substantial chunk of the President’s net worth is tied up in crypto, and experts and former regulators alike worry about TRUMP’s potential for corruption.

Freight Technologies’ recent decision to make a $20 million TRUMP Treasury is fueling these concerns.

Specifically, Freight’s press release sheds light on why it would invest $20 million in TRUMP. It briefly discusses the firm’s interest in AI and Web3 developments and discusses how Freight will organize these purchases.

Mostly, however, the press release outlines how Trump’s tariffs will impact the firm’s bottom line:

“At the heart of [our] mission is the promotion of productive and active commerce between the United States and Mexico. Mexico is the United States’ top goods trading partner. We believe that the addition of the Official TRUMP tokens [is] an effective way to advocate for fair, balanced, and free trade between Mexico and the US,” CEO Javier Selgas claimed.

Freight Technologies is heavily involved with cross-border shipping with Mexico; its AI experiments are concerned with optimizing this trade.

In short, a trade war with the US’s southern neighbor could substantially damage the company’s ability to continue functioning. However, President Trump has already approved several tariff carve-outs for specific companies.

To be clear, Freight’s statement did not explicitly appeal to Trump for such a carve-out. However, reports have alleged that several crypto companies received direct or indirect legal benefits from donating to his Inauguration.

According to Fortune, some firms obtained this after donations as low as $100,000. Would $20 million attract his attention?

It’s difficult to make concrete claims, but Freight’s behavior around the TRUMP deal seems unusual. Nearly all of its reasoning for this purchase revolves around trade relations between the US and Mexico.

The firm’s press release briefly calls TRUMP an “excellent way to diversify our crypto treasury,” but this is its only non-tariff justification.

Still, if Freight attempts to petition the President, it may want the Mexico tariffs removed outright. Nothing suggests that it wants a carve-out while the tariffs remain.

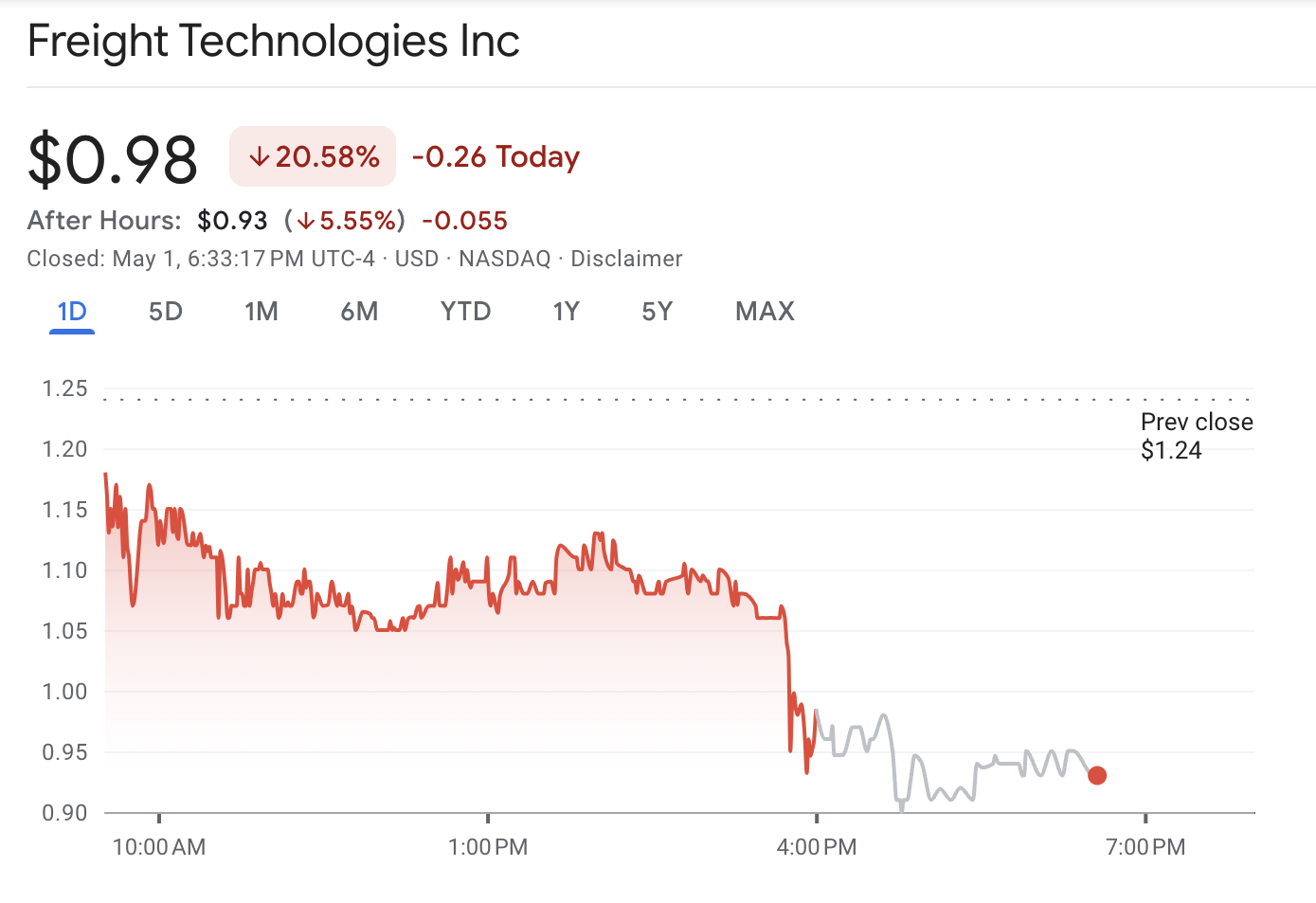

In any event, this TRUMP purchase may backfire for Freight’s stock price. The company first published this press release on April 30, but it began circulating through crypto-centric social media on the afternoon of May 1.

As the news spread in these circles, Freight Technologies’ stock fell by over 20%.

Freight Technologies Stock Price. Source: Google Finance

Moving forward, it’ll be important to keep an eye on this story. Companies have begun creating MicroStrategy-style plans for assets like Solana. While Freight Technologies is the first to do it with TRUMP, it may not be the last.

Leave a Reply