Strategy’s stock has soared, coming within a dollar of its highest price this year ahead of the software company’s Q1 earnings report Thursday—and just as the price of Bitcoin itself edges closer to the $100,000 mark.

The Nasdaq-listed stock (MSTR) was recently trading above $400 a share, up over 4% on Thursday, Yahoo Finance data shows. It hit a Thursday high of $403.90, as of this writing, coming just short of a 2025 peak of $404.42 setthe day after President Trump’s inauguration on January 21.

Tysons, Virginia-based software firm—formerly known as MicroStrategy—will share earnings later Thursday.

The company sells>Strategy now owns 553,555 Bitcoin, worth $53.5 billion at today’s price, making it the largest corporate reserve holder of the asset.

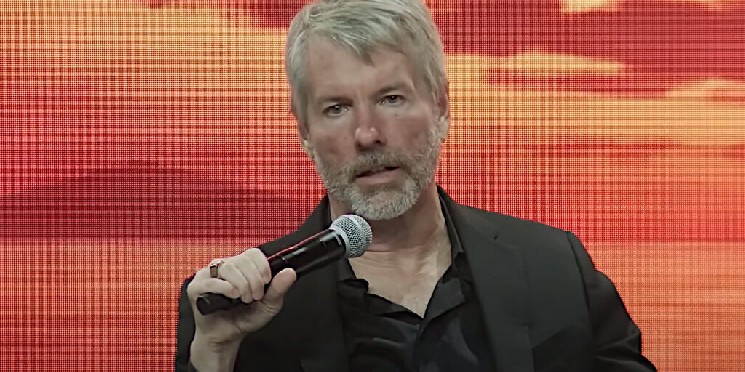

Co-founder and Executive Chairman Michael Saylor now urges other companies to hoard Bitcoin as a way of getting better value for shareholders.

MSTR’s rise comes as the price of Bitcoin soars. Bitcoin was recently trading above $97,000 per coin—its highest level since February.

Bitcoin hit a new all-time high of nearly $109,000 ahead of crypto-friendly President Trump’s inauguration, but took a hit—with stocks and other risk assets—following the new commander in chief’s tariff announcements.

After dropping below $75,000 per coin in early April, the cryptocurrency has since recovered.

Bitcoin first hit the mythical $100,000 mark last December, more than 15 years after it was launched.

Edited by Andrew Hayward

Leave a Reply