Jobless claims surged at the end of April according to fresh data from the Department of Labor, but both traditional and crypto markets still rallied Thursday morning.

Markets Rally: Bitcoin Hits $97K Even as Jobs Data Disappoints

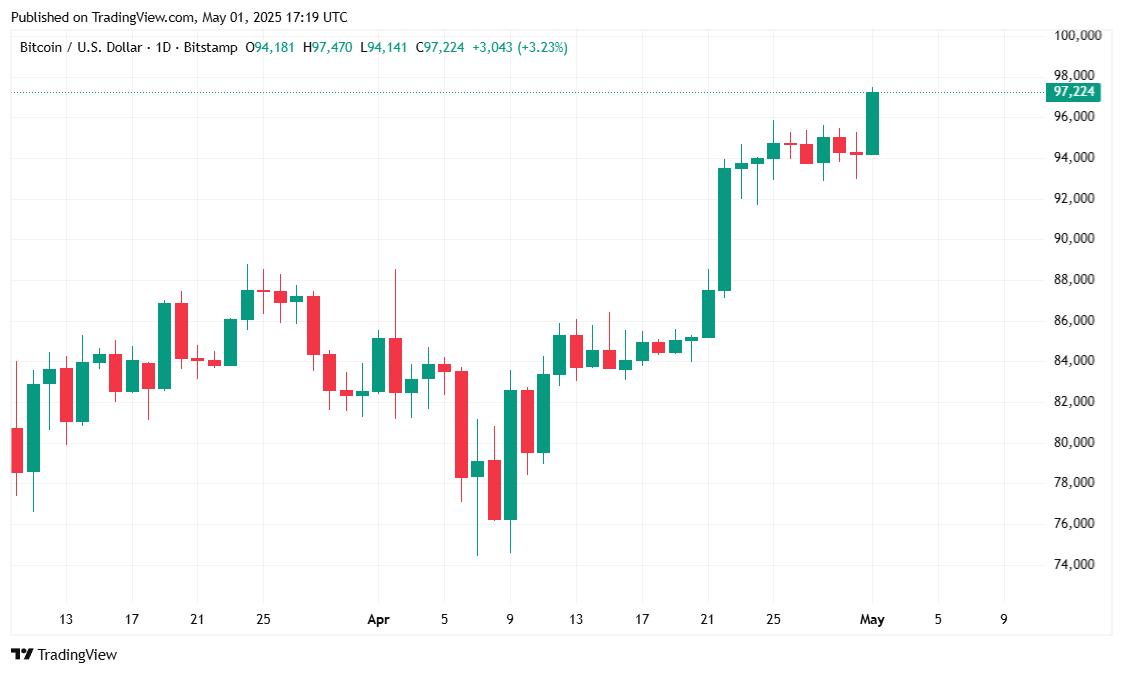

The number of unemployed Americans filing for jobless benefits swelled to a seasonally adjusted 241,000 for the week ending April 26, an increase of 18,000 from the prior week, according to data from the U.S. Department of Labor released on Thursday morning. However, markets seemed unaffected, with bitcoin (BTC) rallying past $97K and traditional market indices trending upward.

Reporting from Reuters indicates that investors weren’t spoofed because the disappointing numbers were triggered by spring break in the state of New York and don’t reflect a fundamental weakening of the employment landscape.

Interestingly, bitcoin’s surge stood in stark contrast to gold, which edged lower, trading at $3,216.00, down 2.17% at the time of reporting. “I will repeat my rationale,” said Geoffrey Kendrick, head of digital assets research at London-based Standard Chartered Bank in a Thursday note to clients. “I think bitcoin is a better hedge than gold against strategic asset reallocation out of the U.S.”

Overview of Market Metrics

Bitcoin climbed 3.37% in the past 24 hours, reaching $97,178.85 at the time of reporting, according to Coinmarketcap. The cryptocurrency traded between $93,762.50 and $97,437.96 over the same period, marking one of its strongest intraday performances this week, which saw a 7-day price appreciation of roughly 4.05%.

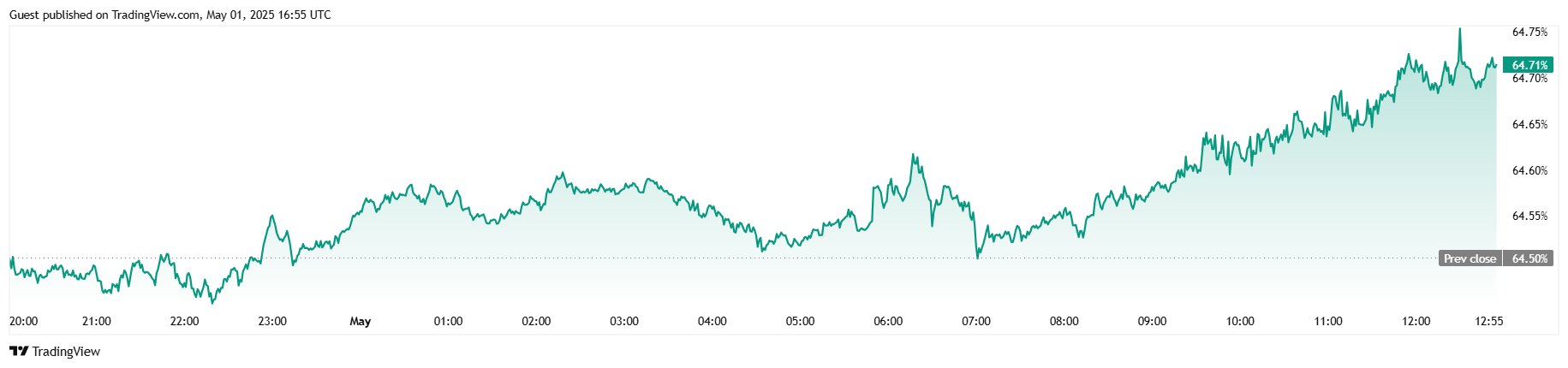

Trading activity intensified alongside the price rally, with 24-hour volume rising 7.45% to $31.20 billion. Market capitalization also reflected the price surge, climbing to $1.92 trillion, an increase of 3.40% since yesterday. Bitcoin’s dominance in the broader crypto market now stands at 64.72%, up slightly by 0.085 percentage points.

The derivatives market also echoed the bullish sentiment. Coinglass data shows BTC futures open interest jumped by 8.96% to $67.93 billion over the last 24 hours, indicating increased trader confidence. Liquidations totaled $892,840, but short sellers bore the brunt of it, with $860,900 in losses compared to just $31,940 from long positions. The imbalance in liquidations hints at a possible shift in short-term market sentiment toward further gains.

Leave a Reply