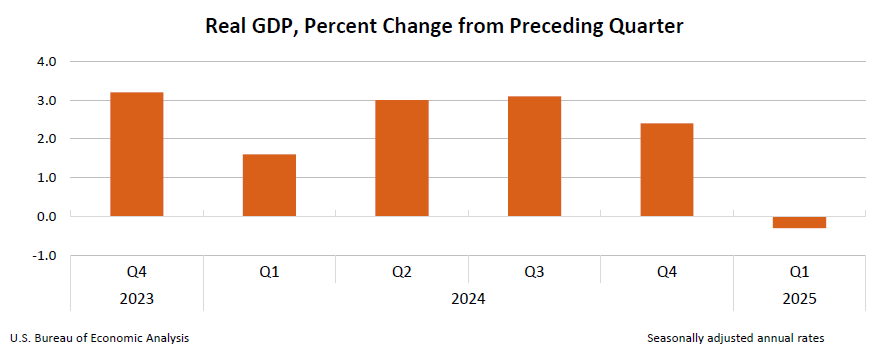

The U.S. economy shrank by 0.3% in the first quarter of 2025 after companies rushed to import goods in the wake of President Donald Trump’s global trade war.

Bitcoin Edges Lower After U.S. Economy Shows Weakness

The world’s largest economy contracted by 0.3% during the first quarter of the year according to a report published by the U.S. Department of Commerce on Wednesday, and economists are pointing the finger at President Donald Trump.

Companies went on a buying spree in an effort to front-run Trump’s controversial tariffs, leading to a surge in imports, but gross domestic product (GDP) took a hit as a result. GDP is a measure of the value of all goods and services produced in the economy and imports are subtracted from the final figure.

(The U.S. economy shrank 0.3% due to higher-than-normal imports in response to Trump’s tariff war / U.S. Department of Commerce)

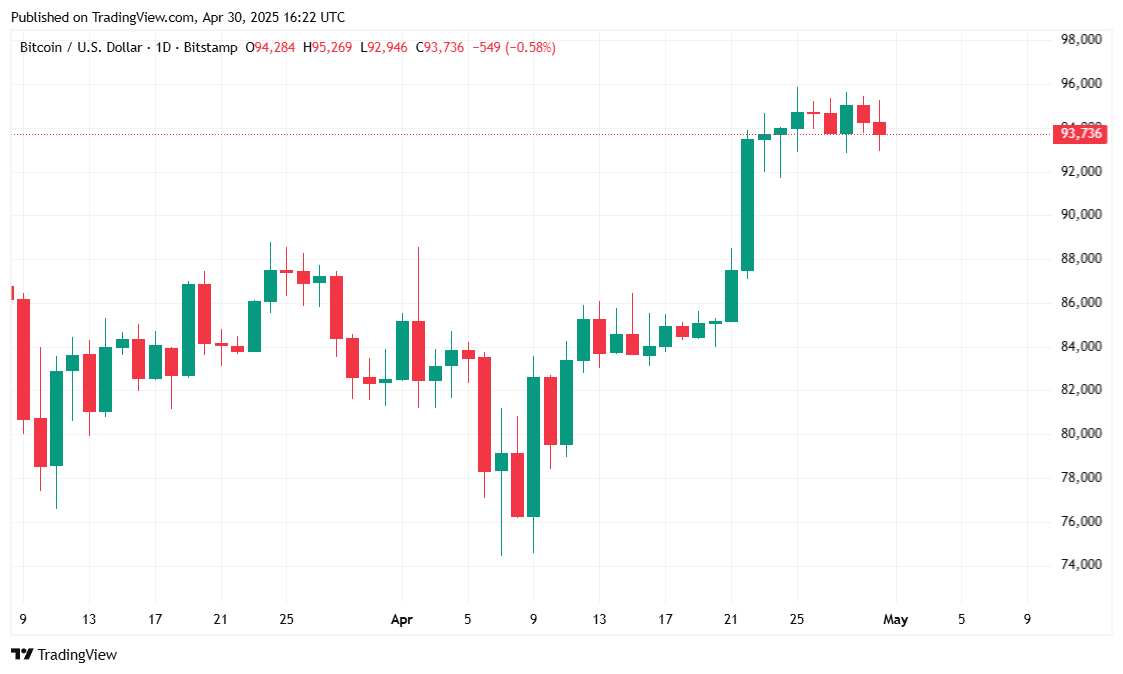

Traditional markets tanked on the news, with the S&P 500, the Nasdaq, and the Dow Jones Industrial Average, all dipping 0.91%, 1.27%, and 0.61%, respectively, at the time of reporting. Bitcoin (BTC) traded mostly sideways, hovering around $94K during the first half of the day.

Trump remained defiant after the report was published, blaming the contraction on his predecessor.

“We have to get rid of the Biden overhang,” the president said. “This will take a while, has nothing to do with tariffs, only that he left us with bad numbers, but when the boom begins, it will be like no other. Be patient.”

Overview of Market Metrics

Bitcoin is trading at $93,721.16 at the time of reporting, according to data from Coinmarketcap. The cryptocurrency experienced a modest 1.48% dip over the past 24 hours, yet maintained a weekly gain of 0.75%. Throughout the day, BTC fluctuated within a relatively tight range between $92,979.64 and $95,485.41.

( BTC price / Trading View)

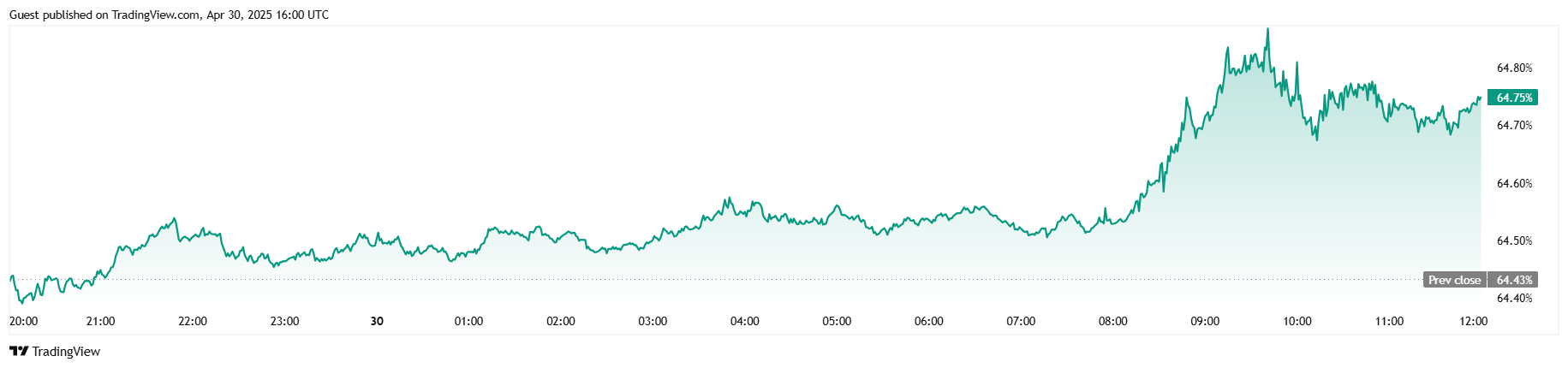

Despite the slight dip in price, Bitcoin’s trading activity jumped, with 24-hour trading volume surging 26.22% to $30.67 billion. Market capitalization dipped 1.03% to $1.86 trillion, but bitcoin’s dominance over the broader crypto market edged up by 0.50 percentage points to 64.75%, as per data from Trading View.

( BTC dominance / Trading View)

In the derivatives market, Coinglass data shows total BTC futures open interest reached $62.48 billion, marking a marginal 0.02% uptick over the past 24 hours. Liquidation activity was minimal, totaling $276,630 and almost evenly split between long and short positions ($141,860 and $134,770, respectively). The balanced liquidations hint at indecision among traders, reinforcing the current sideways price action as the market awaits a clearer signal for the cryptocurrency’s next major move.

Leave a Reply