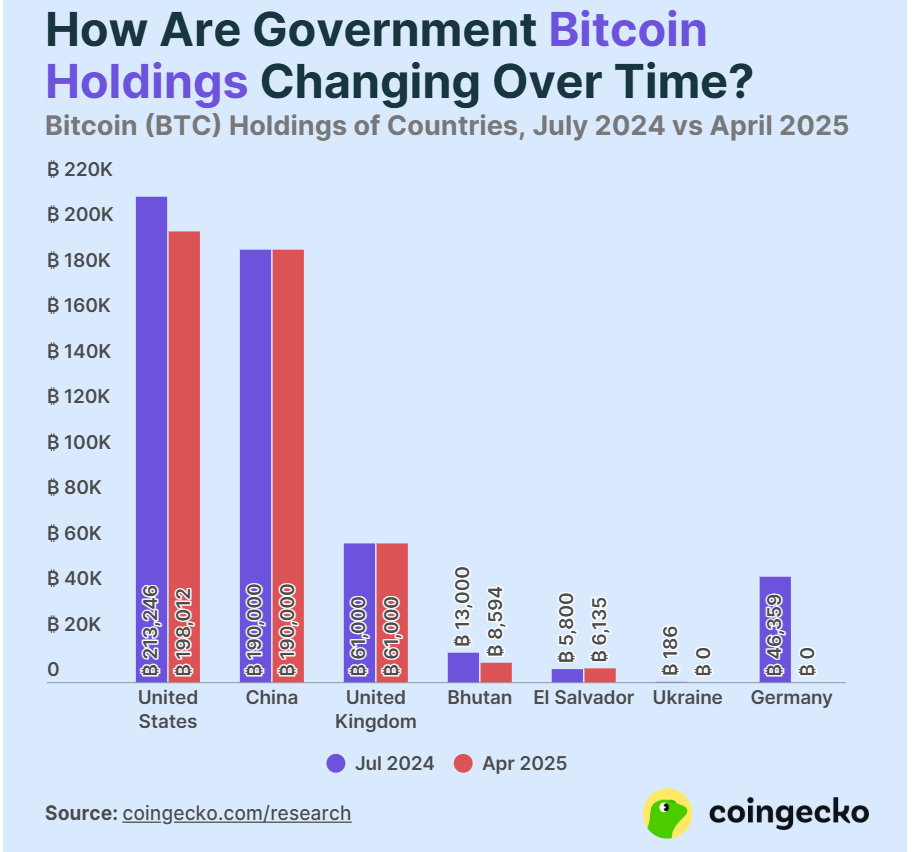

Governments worldwide now hold more than 463,741 BTC, representing approximately 2.3% of Bitcoin’s total supply. The figure, reported by CoinGecko marks a decrease from 529,591 BTC reported in July 2024. While some nations have liquidated portions of their reserves, others, such as El Salvador and Bhutan, are actively expanding their holdings.

U.S. Remains Top Bitcoin Holder With New “Digital Fort Knox” Initiative

Notably, the report highlighted the U.S. government as the largest holder of Bitcoin, with approximately 198,012 BTC valued at around $18.3 billion. This figure is lower than the previous year as the U.S. government has liquidated some of its Bitcoin reserves.

Related: US Bitcoin Reserve implementation is moving faster than expected, with timelines now in days and weeks

In March 2025, President Donald Trump signed an executive order establishing a “Digital Fort Knox,” consolidating Bitcoin seized from asset forfeitures into a strategic federal reserve. This shift moves away from prior policies that required seized Bitcoin to be auctioned into fiat currency.

China’s Silent Holdings Highlight Lingering Market Uncertainty

China holds the second-largest Bitcoin reserve among nations, with approximately 194,000 BTC valued at $17.6 billion. These holdings largely stem from assets recovered during the dismantling of the PlusToken Ponzi scheme in 2019.

Despite its domestic ban on crypto trading and mining, China has remained silent on plans for these holdings. The uncertainty surrounding whether China will eventually liquidate its Bitcoin continues to weigh on long-term market sentiment.

Related: China Could Be the Next Big Catalyst for a Bitcoin Price Surge

United Kingdom, Bhutan, and El Salvador Expand Strategies

The United Kingdom ranks third, holding around 61,000 BTC valued at $5.6 billion. These assets primarily came from law enforcement crackdowns on money laundering networks. While no clear liquidation plans have been announced, discussions around leveraging Bitcoin for public finance initiatives have surfaced.

Bhutan has quietly built a Bitcoin reserve of 8,594 BTC, worth approximately $795.3 million, through sustainable hydroelectric mining operations. Rather than purchasing Bitcoin from the market, Bhutan’s approach taps its renewable energy surplus, offering a unique model for state-led crypto accumulation.

El Salvador continues its aggressive Bitcoin strategy under President Nayib Bukele, growing its reserve to 6,135 BTC valued around $567.8 million. Since November 2022, the country has maintained a “1 Bitcoin per day” purchase program, positioning Bitcoin as a long-term national asset integrated into its economy.

Ukraine’s Bitcoin Donations Fuel Humanitarian Efforts

Notably, Ukraine has seen a surge in Bitcoin donations since 2024, receiving 256 BTC valued at about $21.3 million. These donations have been fully liquidated and used to support military and humanitarian efforts amid the ongoing conflict in the region.

While the Ukrainian government has quickly converted these funds into fiat currency for urgent use, a small portion of the donations remains in Bitcoin.

Why Some Governments Are Selling Their Bitcoin

Not all governments have retained their Bitcoin holdings. Financial pressures, market timing strategies, and legal obligations have driven several large sales.

Countries like Germany have liquidated their Bitcoin holdings to address financial shortfalls. In mid-2024, Germany sold 46,359 BTC, worth roughly $3.9 billion at the time. This large sale caused a significant 15.7% drop in Bitcoin’s price.

Some governments may also sell Bitcoin when prices are high to capitalize on favorable market conditions, generating substantial revenue. Additionally, laws in certain countries, such as the U.S., require that seized Bitcoin be converted into fiat currency, leading to regular auctions of confiscated assets. However, President Trump has prohibited the sale of Bitcoin.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Leave a Reply