⚈ Bitcoin must hold above $91,400 to reach a potential top around $155,000.

⚈ Rising global liquidity (M2 supply) could fuel Bitcoin’s rally toward $150,000.

⚈ Large exchange outflows and strong technical indicators signal continued bullish momentum.

While Bitcoin (BTC) has found momentum above the $90,000 mark, an expert views this position as crucial for the asset to reach a record high of over $150,000.

Citing the Pi Cycle Top Indicator, prominent on-chain cryptocurrency analyst Ali Martinez suggested that Bitcoin could climb as high as $155,400 but must maintain a price above $91,400, he said in an X post on April 27.

The Pi Cycle Top Indicator, which tracks the 111-day moving average (MA) against twice the 350-day moving average, is used to predict major peaks in the Bitcoin market. Now, Martinez’s outlook is that the two averages are converging again, signaling a potential top if Bitcoin holds above $91,400.

Although the analyst did not provide a timeline for Bitcoin to remain above this level, it comes at a time when the digital currency is seeing short-term momentum, driven by supposedly easing trade tensions between the United States and China.

More catalysts support Bitcoin to $150,000

In the same breadth, another cryptocurrency analyst, Ted Pillows, believes that Bitcoin will likely trade at $150,000 during this cycle but pointed to a different catalyst.

In an X post on April 27, Pillows noted that a surge in global M2 supply could trigger Bitcoin’s rally, as the asset has historically tracked expansions in global liquidity.

He also addressed concerns over misleading data suggesting a drop in India’s M2 supply, attributing it to a technical glitch. Even if M2 stabilizes, Pillows believes strong fundamentals and technical indicators position Bitcoin to surpass $150,000.

Meanwhile, as reported by Finbold, crypto trading expert TradingShot believes that Bitcoin has a chance of claiming $140,000 by August, citing the asset’s technical outlook and historical trends.

Indeed, further on-chain data supports the possibility of Bitcoin hitting a new high, with insights from crypto analytics platform Santiment suggesting investors anticipate a continued price rebound for BTC.

Specifically, as of April 26, over 40,000 BTC had been withdrawn from centralized exchanges within a week. Such a shift often signals a growing trend of investors moving their assets to cold storage, suggesting strong confidence in Bitcoin’s long-term value.

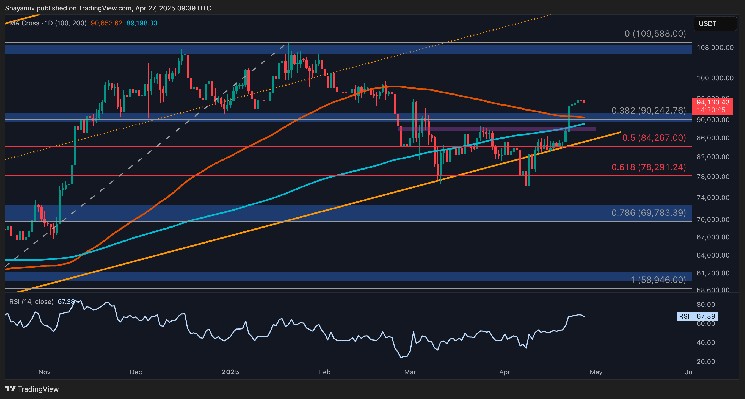

As Bitcoin has broken out on the weekly chart, the asset’s relative strength index (RSI), with a reading of 68.65, suggests it may be entering the overbought zone.

Additionally, the price remains well above both the 50-day and 200-day simple moving averages (SMA), with the 200-day SMA currently at $86,241, reinforcing the strong upward trend.

Featured image from Shutterstock

Leave a Reply