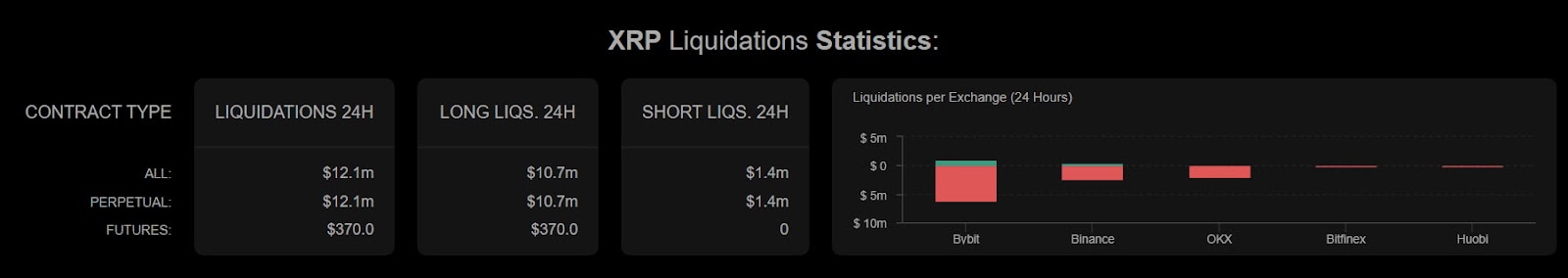

⚈ XRP dropped 5.28%, triggering $10.7 million in long liquidations.

⚈ Token fell below key support after peaking at $2.29 on April 23.

⚈ XRP may mirror Bitcoin and gold, suggesting more sideways trading ahead.

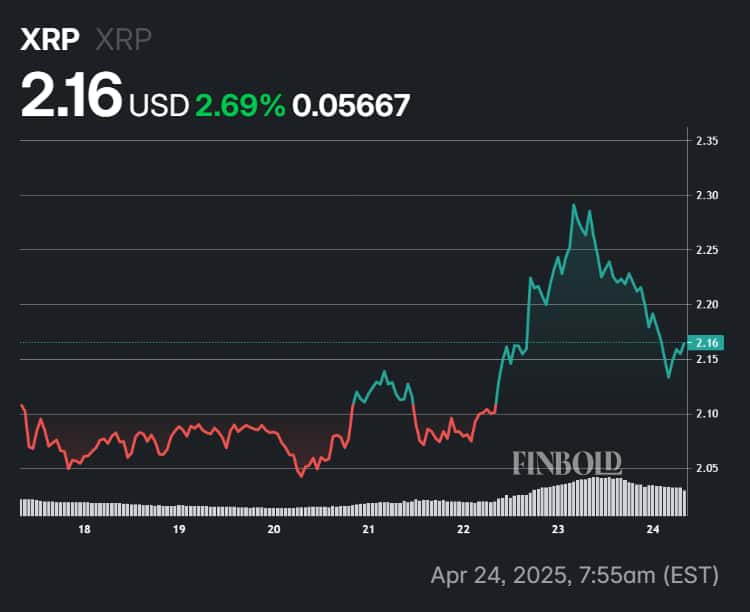

Shortly after Bitcoin (BTC) entered its rally, pivoting away from mirroring stocks and toward tracing gold, XRP soared on April 23, promising to reclaim highs not seen since January as it surged above $2.20 and headed toward $2.30.

Despite it appearing like the token was aiming ‘for the moon,’ it soon followed BTC and the precious metal into a correction as it hit unsustainable highs just above $2.29.

By April 24, XRP had retraced to its press time of $2.16, and the 5.28% 24-hour drop erased $10.7 million worth of long positions within just one day, according to data Finbold retrieved from Coinalyze on the day.

Furthermore, despite the cryptocurrency remaining 2.69% in the green in the weekly chart even after the correction, the value of short positions liquidated within the last 24 hours is comparatively trivial at $1.4 million.

Will the XRP rally resume?

In stark contrast to its trajectory on April 23, XRP appears poised to continue its drop on April 24. On the one hand, its relative strength index (RSI) reached 56.65, indicating the token might be overbought.

On the other hand, with a press time price of $2.16, XRP is below its previous nearest support zone, near $2.18, and threatens to lose the next one, close to $2.14. Simultaneously, even reclaiming the levels keeps it relatively distant from the nearest resistance at $ 2.28.

Still, as long as the token does not plunge below $2.08, consolidation in the $2.12 to $2.29 range is likely, with a greater upside being as likely as a downside.

Could Gold and Bitcoin predict XRP’s next move?

Considering XRP’s performance in recent trading, it stands to reason that it will, indeed, trade sideways. Specifically, a curious correlation has emerged between Gold, Bitcoin, and XRP, with each subsequent asset lagging slightly behind but offering matching performance.

Gold hit a new all-time high (ATH) above $3,500 on April 22, then smashed below $3,300 on April 23. It recovered above $3,360 on April 24 and, at press time, is trading just under $3,330.

Bitcoin soared above $95,000 early on April 23, then dropped below $92,000 later the same day, only to surge above $93,500. By press time on April 24, it had fallen back to approximately $92,725.

Lastly, XRP soared to $2.29 mere hours after BTC hit $95,000, then plunged to $2.12 early on April 24. By press time on the same day, it had recovered to $2.16. If the mirroring persists, investors can expect a new high, possibly near $2.20, followed by a renewed decline to $2.17 or $2.18.

Featured image via Shutterstock

Leave a Reply