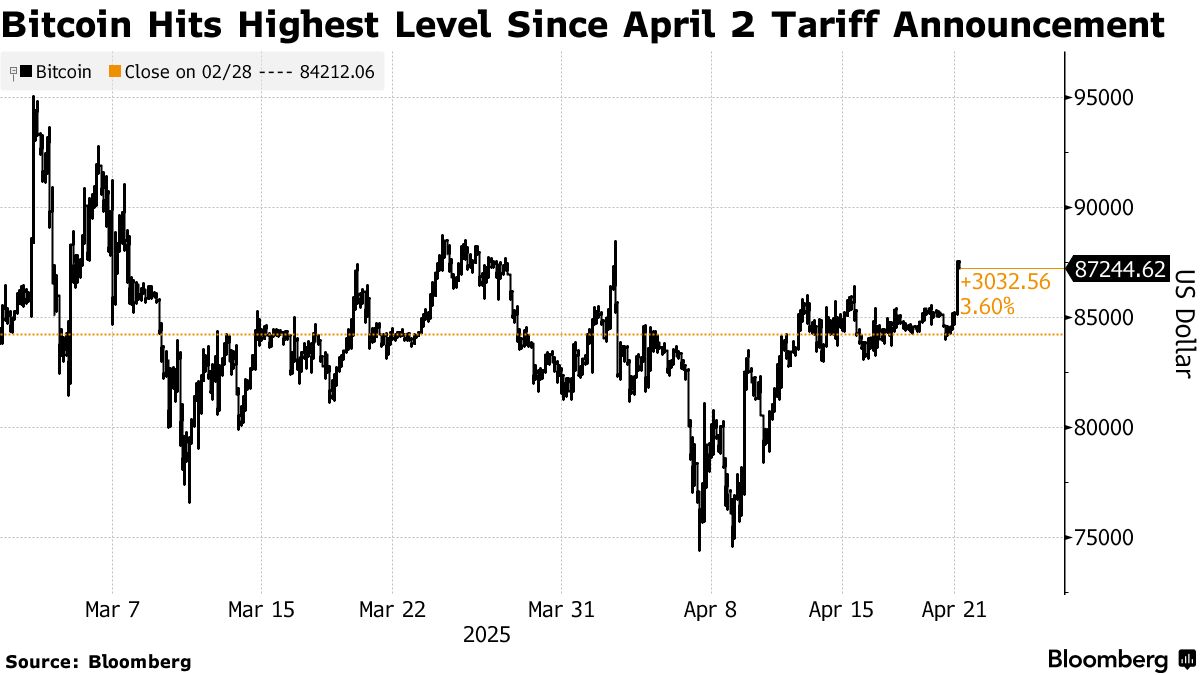

Bitcoin blasted through $87,600 on Monday morning in Singapore after president Donald Trump threatened to fire Federal Reserve Chair Jerome Powell, slamming the dollar and sending panic across global markets.

The 3% rise in Bitcoin wiped out nearly all the damage from April 2, the day Trump announced his new round of retaliatory tariffs.

Source: Bloomberg.

Bitcoin wasn’t the only thing flying. Gold also shot up to a new all-time high as people started running toward safer places to park their money. With the dollar bleeding and trust in central policy falling apart, crypto and metals were where the panic money went.

Markets bleed as stocks post third loss in four weeks

The rally came while U.S. stock futures were getting hammered and the dollar hit its lowest since January 2024. The pressure started piling after Kevin Hassett, who runs the National Economic Council, said Friday that Trump was “studying” whether he had the power to boot Powell from his post.

That single comment drove the greenback into the ground and put the independence of the Fed straight into question. Trump himself had said on Truth Social:

“Too Late’ Jerome Powell of the Fed, who is always TOO LATE AND WRONG, yesterday issued a report which was another, and typical, complete ‘mess!’ Oil prices are down, groceries (even eggs!) are down, and the USA is getting RICH ON TARIFFS. Too Late should have lowered Interest Rates long ago, but he should certainly lower them now. Powell’s termination cannot come fast enough!”

On Monday morning, S&P 500 futures fell 0.79%. Nasdaq-100 futures dropped 0.82%. And the Dow Jones crashed 318 points, down 0.81%. It followed three straight losing weeks, and this time the selling hit hard. Even though Thursday gave a tiny bump, the S&P 500 still closed the shortened holiday week down 1.5%.

The Dow and Nasdaq Composite both sank over 2% during the four-day stretch. U.S. markets didn’t even open Friday because of Good Friday, but the selloff picked up speed the moment trading resumed.

Thursday’s trading was brutal. UnitedHealth lost more than 22% after cutting its full-year forecast and dropping weaker-than-expected earnings. That single stock tanked the Dow.

Then Nvidia came in with more pain. The chip giant saw shares fall nearly 3% after already losing 7% earlier in the week. On Tuesday, Nvidia admitted it would take a $5.5 billion hit in the next quarter due to U.S. controls on shipping its H20 GPU chips to China and other countries.

Leave a Reply