Crypto US stocks are under pressure this morning, with Marathon Digital (MARA), Riot Platforms (RIOT), and Coinbase (COIN) all showing weakness in pre-market trading.

MARA and RIOT, both heavily exposed to Bitcoin mining, continue to slide amid BTC’s muted performance. COIN, while still up sharply over the past five days, is now testing a key support level. Here’s a quick breakdown of these three names to watch today.

MARA Holdings (MARA)

Marathon Digital Holdings (MARA) closed down 2.86% yesterday and is down another 1.8% in pre-market trading. The decline continues the stock’s recent weakness.

MARA is a Bitcoin mining company that operates large-scale mining facilities and earns revenue by validating transactions on the Bitcoin network in exchange for BTC rewards.

MARA Price Analysis. Source: TradingView.

The stock is down 25% year-to-date and its performance reflects ongoing concerns around the mining sector and Bitcoin’s price stagnation.

As a pure-play crypto miner, MARA’s fortunes appear to be tied to Bitcoin. When BTC struggles, mining becomes less profitable—leading investors to pull back from stocks like MARA. If tests the support at $12.06 and that one is lost, MARA could continue going down and possibly fall below $11.

Riot Platforms (RIOT)

Riot Platforms (RIOT) is also a Bitcoin mining company that runs large-scale mining operations and earns Bitcoin by securing and validating transactions on the network.

RIOT closed down 6.56% yesterday and is down another 1.22% in pre-market trading. The drop adds to a steep decline in recent sessions.

RIOT Price Analysis. Source: TradingView.

The stock is trading at its lowest levels since February 2023 and is down nearly 36% year-to-date—far worse than Bitcoin’s -10% YTD performance.

This gap suggests investors are pricing in additional risks for miners, such as rising costs, weaker margins, and broader skepticism toward crypto-exposed equities.

Coinbase (COIN)

Coinbase (COIN) closed yesterday down 0.57% and is down another 1.46% in pre-market trading, showing some short-term weakness.

Coinbase is a leading US crypto exchange where users can buy, sell, and store digital assets like Bitcoin and Ethereum. It generates revenue through transaction fees and subscriptions.

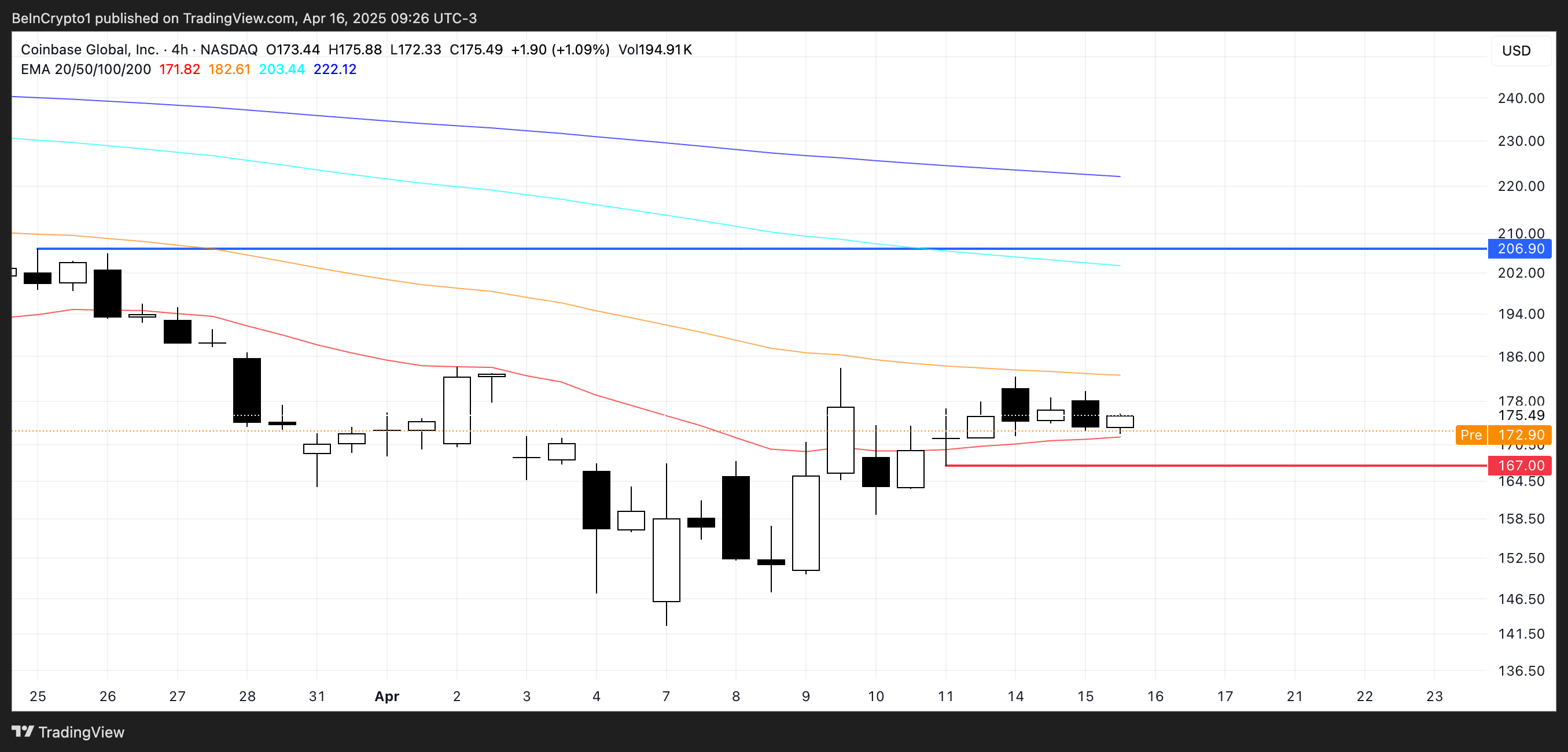

COIN Price Analysis. Source: TradingView.

Despite the recent pullback, COIN is still up nearly 16% over the past five days, supported by renewed interest in crypto-related stocks.

However, the stock is hovering near key support at $167. If that level breaks, selling pressure could increase, pushing COIN below $160 in the near term.