BlackRock is a massive asset manager that manages various different ETFs and trusts, including both gold and digital gold, a.k.a. bitcoin (BTC).

Its iShares Gold Trust ($IAU) currently trades for approximately $61 and has net assets of over $36 billion.

Meanwhile, its iShares Bitcoin Trust ETF (IBIT) currently trades for approximately $48 and boasts net assets of approximately $48 billion.

Read more: CHART: Wasn’t Trump supposed to be good for crypto?

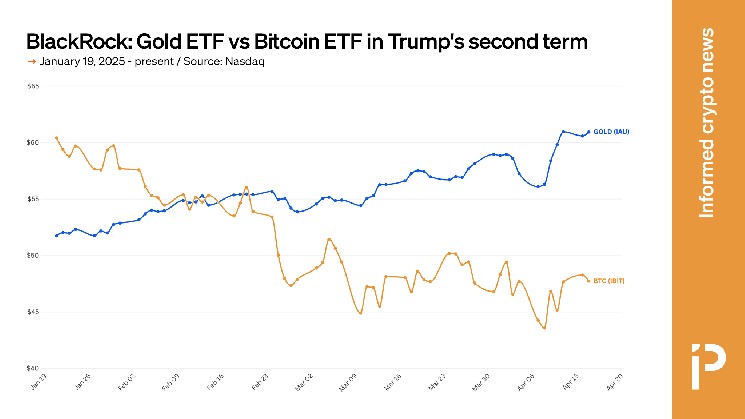

Donald Trump was widely believed to be a president who would help BTC’s value, however, gold has apparently outperformed the world’s leading crypto since his inauguration.

iShares Gold Trust has seen its price increase from approximately $51 to $61, a jump of nearly 20%.

The firm’s iShares Bitcoin Trust, however, has decreased from approximately $60 to $48, a drop of around 20%.

Both of these assets are commonly pitched as “safe-haven” assets during periods of instability, and the recent sudden rearrangement of the global trade arrangement has certainly increased economic instability.

However, despite that increase in instability and the explicit and vocal support for BTC from the Oval Office, only the gold trust has continued to see its value increase.