Strategy (formerly MicroStrategy), the poster child of corporate BTC accumulation, has just added another 3,459 BTC ($285.8 million) to its reserves, bringing its total now to a staggering 531,644 BTC, worth over $35.9 billion, noted blockchain analysis platform Lookonchain.

MicroStrategy(@Strategy) bought another 3,459 $BTC($285.8M) at an average price of $82,618 last week.#Strategy currently holds 531,644 $BTC($35.92B), with an average buying price of $67,556. pic.twitter.com/siFIoASRXk

— Lookonchain (@lookonchain) April 14, 2025

How Leveraged is Strategy Inc After the Latest Bitcoin Buy?

While the online rumor mill churns about Strategy being dangerously leveraged, data suggests otherwise.

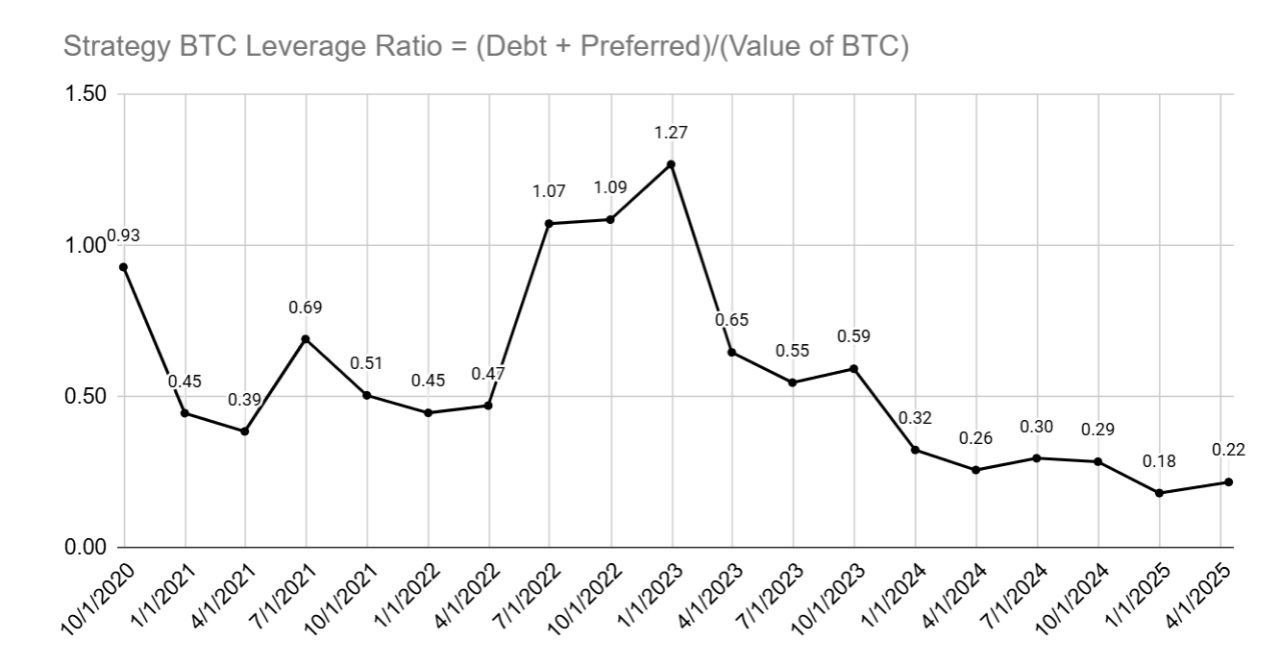

A breakdown of Strategy’s BTC Leverage Ratio–calculated as (Debt + Preferred Equity) ÷ Value of Held BTC–shows that the company’s current risk exposure is well below historical averages.

Looking at the chart spanning from late 2020 to early 2025, a few things are clear.

- At its peak in Q1 2023, Strategy’s leverage ratio touched 1.27, meaning the value of its debt obligations briefly surpassed the market value of its BTC holdings.

- Fast forward to April 2025, and the ratio has dropped sharply to 0.22 making it one of its lowest levels ever.

- This downtrend has been consistent since mid-2023, reflecting both Bitcoin’s rising price and a more measured borrowing strategy.

Even during bull runs like in late 2021 and 2022, Strategy operated at significantly higher leverage (e.g., 1.07 in mid-2022 and 1.09 in Q4 2022). So, by comparison, the current posture appears cautious, if not outright conservative.

Related: North Carolina’s ‘Digital Asset Freedom Act’ Looks More Like a Bitcoin Bill

What Does Strategy’s Low Leverage Signal?

This historically low leverage ratio signals financial control, not desperation. It shows Strategy isn’t aggressively borrowing to chase price pumps. Instead, the company uses a mix of equity, debt, and retained earnings to build its position without overexposing itself.

With BTC trading around the $85,000 price level, Strategy’s average purchase price of $67,556 gives it a 11.4% return year-to-date, despite market volatility.

Are Other Companies Buying Bitcoin for Treasury Reserves?

Strategy’s approach seems to be influencing other corporate players as well. Metaplanet, a Japanese firm, just added 319 BTC ($26.3 million) at an average price of $82,549, bringing its total holdings to 4,525 BTC (valued at $386.3 million).

*Metaplanet Purchases Additional 319 $BTC* pic.twitter.com/haBS1NjtwI

— Metaplanet Inc. (@Metaplanet_JP) April 14, 2025

Related: ‘Fed on the Clock’: Hayes Links Bond Market Stress to Coming Bitcoin Gains

Thanks to Bitcoin’s strong run, it has already locked in a 108.3% return in 2025 alone.HK Asia Holdings also upped its game, buying an additional 10 BTC, pushing its total to nearly 29 BTC. Though smaller in scale, the move is symbolically important, especially given China’s erratic regulatory stance on crypto.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Leave a Reply