Data shows that Bitcoin whales with 1,000-10,000 BTC have been accumulating despite price dips.

Bitcoin has shown minimal changes in price this new week, with a slight 0.9% increase, bringing the asset’s value just under $85,000. Despite the subtle daily fluctuations, Bitcoin has surged by 12.7% over the past week.

As of now, its market capitalization has crossed $1.68 trillion, and its dominance in the crypto space continues to rise. Amid this, analysts are focusing on whale behavior, specifically the activities of large Bitcoin holders, to understand market dynamics.

Whale Accumulation is Surging

One key aspect to observe is the accumulation patterns of Bitcoin whales—addresses holding between 1,000 and 10,000 BTC. Market analyst Miles Deutscher’s chart reveals that this group has steadily increased its Bitcoin holdings since 2024, even as the price fluctuated.

Very interesting $BTC stat:

Whales (1k-10k balance) have been accumulating hard since March, even as price slid.

Every time prices drop, whales accumulate into retail panic selling. pic.twitter.com/PaogZ7WxWT

— Miles Deutscher (@milesdeutscher) April 14, 2025

This trend, seen in periods of both price surges and declines, suggests that whales are taking advantage of price dips to acquire more Bitcoin.

For example, as Bitcoin’s price fell to $60,000 in October 2024, the total whale balance surged toward 3.37 million BTC. However, this balance saw a rapid drop as Bitcoin’s price recovered above $60,000, suggesting that these investors were cashing in on their gains.

They resumed accumulation in November 2024 amid the U.S. elections. However, as BTC crossed $100K in December, these whales sold. More recently, in April 2025, as the price dipped below $80,000, the accumulation has resumed, with their balance reaching 3.475 million BTC.

Despite market pullbacks, these large holders appear to be consistently accumulating, suggesting a long-term strategy. If past patterns are any guide, they are likely to continue accumulating until Bitcoin recovers, looking to reduce their holdings when prices hit new heights in a profit-taking scheme.

Retail Investors Pull Back During Uncertainty

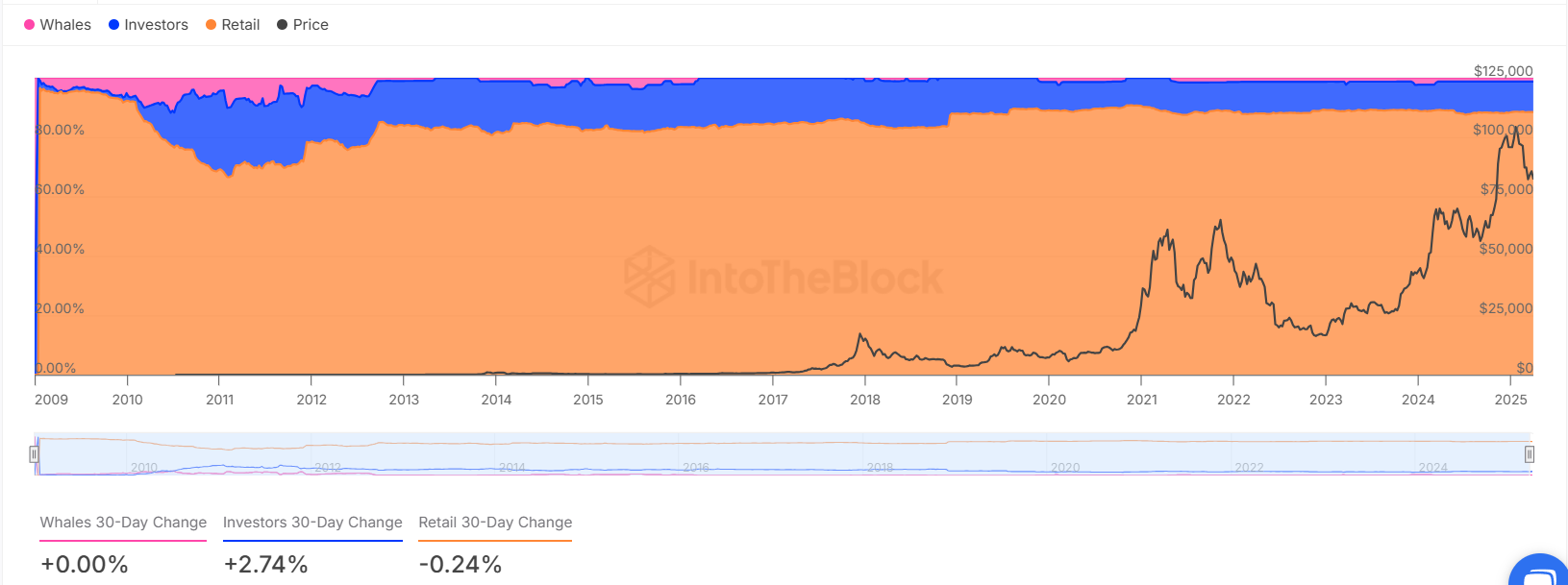

Amid the price consolidation, the behavior of smaller investors also provides important insights. Data from IntoTheBlock’s Historical Concentration chart reveals a shift in ownership dynamics during the recent consolidation in the market. Over the past 30 days, whale ownership has remained stable, with no significant changes in holdings.

Bitcoin Historical Concentration | IntoTheBlock

Investor ownership has risen by 2.74%, indicating increased accumulation by institutional or large investors. On the other hand, retail investors have shown a slight decrease, with retail ownership falling by 0.24%.

This suggests that while large holders and investors remain stable, retail investors may be retreating from the market or selling off their positions during periods of price uncertainty. Deutscher confirmed that large whales tend to cop these tokens sold by retail investors during the panic season.

Hodler Activity and Market Sentiment

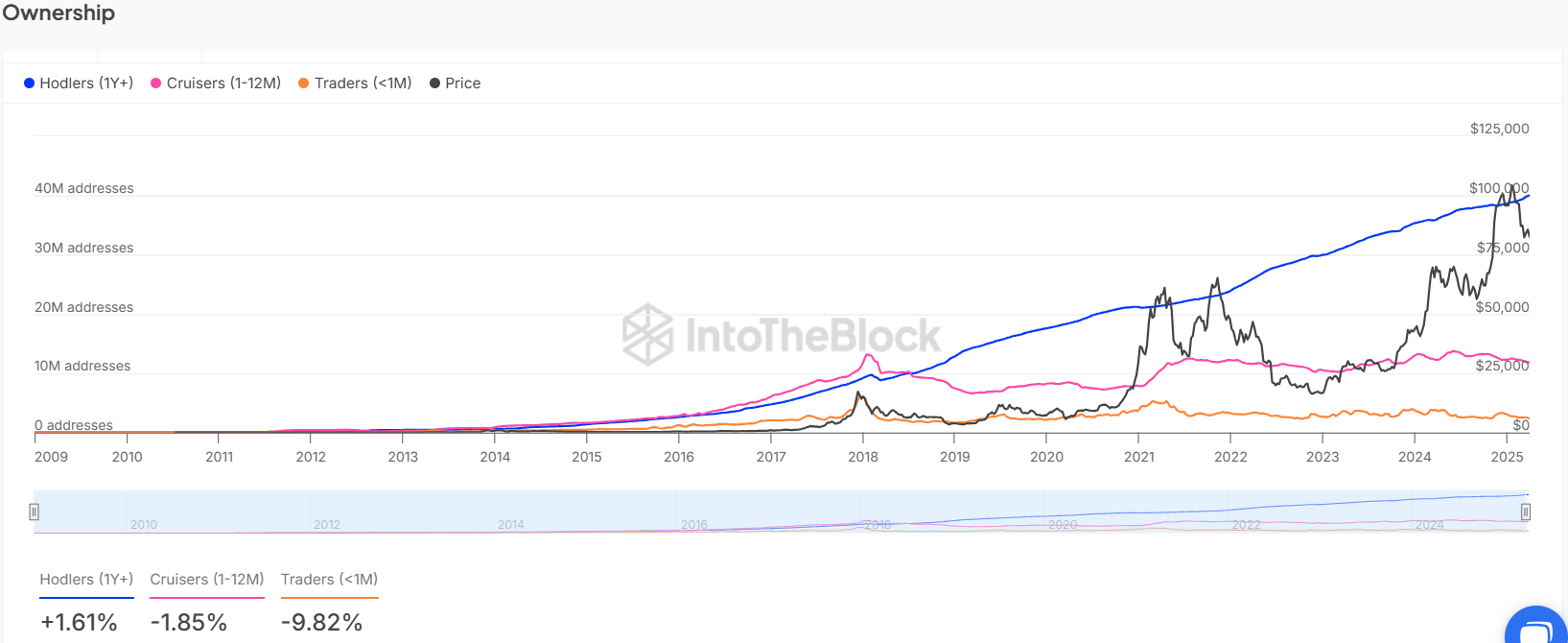

Further evidence of shifting investor behavior comes from the Addresses by Time Held data from IntoTheBlock. The data indicates that Bitcoin holders who have maintained their positions for over a year (Hodlers) have increased their ownership by 1.61%.

Bitcoin Addresses by Time Held | IntoTheBlock

Conversely, holders who have held Bitcoin for less than a year (Cruisers) saw a 1.85% decline in ownership, and traders with holdings for less than 1 month decreased their positions by 9.82%.

In tandem with these trends, Bitcoin’s derivatives market has seen increased activity. According to Coinglass, long positions in Bitcoin have risen, with the long/short ratio hitting 1.0338, indicating more market participants are betting on a price increase.

Further, open interest has surged to $57.91 billion, signaling strong participation in anticipation of a potential breakout.

Leave a Reply