Bitcoin is nearing $85K amid rising long positions and MetaPlanet’s $26M BTC acquisition. Will this push the BTC price to $92K?

Bitcoin is trading at $84,949, recovering from a 1.83% pullback on Sunday. At the time of writing, it had started the week with an intraday gain of 1.49%.

With a 24-hour high of $85,496, Bitcoin is testing key resistance. A successful breakout could fuel momentum toward $92,000.

Bitcoin Nears Critical Resistance at $85K

On the daily chart, Bitcoin shows a strong rebound from the 50% Fibonacci retracement near $75,500, breaking through a long-standing descending resistance trendline. This movement ends the recent short-term pullback and the start of a potential bullish reversal.

After surpassing the 61.8% Fibonacci level around $82,000, Bitcoin is now testing the 200-day Exponential Moving Average (EMA), a key technical barrier. Reclaiming $85,000 convincingly would confirm bullish intent.

However, the 50-day EMA is still trending downward due to the recent correction, hinting at a potential “death cross” if it converges with the 200-day EMA. Despite this, the breakout has triggered a bullish crossover in the MACD and signal lines, supported by growing bullish histogram bars — signaling potential trend reversal.

The ongoing V-shaped recovery may face a retest of the broken resistance trendline near the 61.8% Fib level. A decisive 24-hour candle close above the 200-day EMA would significantly improve the chances of a continued rally.

Rising Long Positions Hint at Breakout Rally

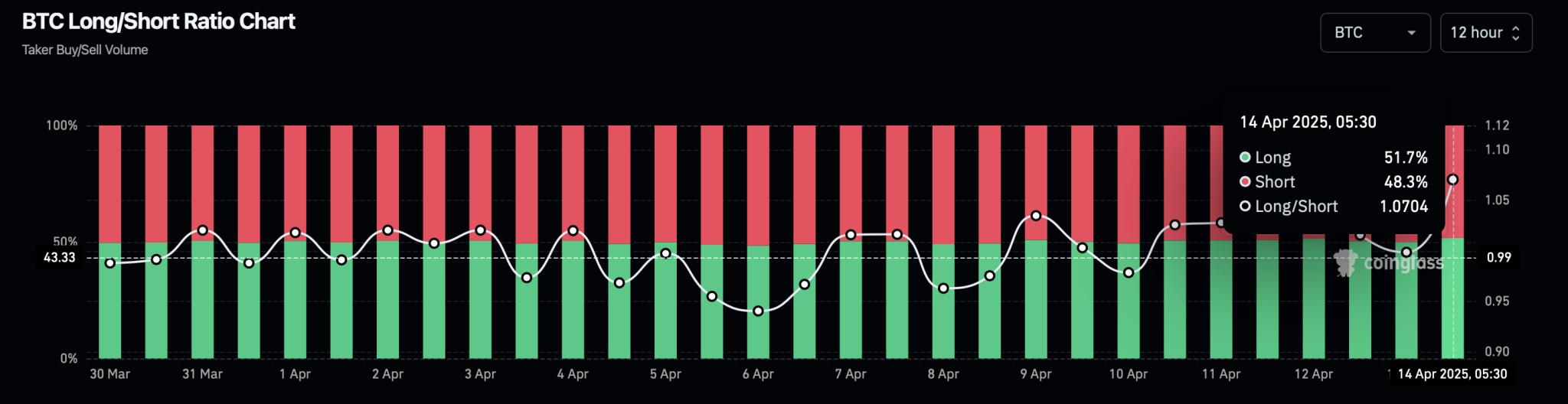

As BTC tests crucial resistance, the derivatives market is seeing a notable rise in long positions. According to Coinglass, the Bitcoin long/short ratio has increased to 1.0704, with long positions accounting for 51.7% in the last 12 hours.

BTC LongShort Ratio Chart

This uptick in long positioning has pushed Bitcoin’s open interest to $55.73 billion, indicating strong participation and anticipation of a bullish breakout.

According to the Binance Bitcoin liquidation map, a price surge to $85,565 will liquidate $91.5 million of short positions. Meanwhile, a pullback to $83,825 could potentially lead to a steeper correction, with $104.64 million worth of long liquidations.

The next key support lies at $82,925, protecting $286.10 million in long positions.

Long-Term Holders Buy the Dip

Confidence among long-term holders is growing. On April 13, the long-term holder (LTH) net position change was positive for the eighth consecutive day, rising by 266.57K BTC.

Long Term Holders Net Position Change

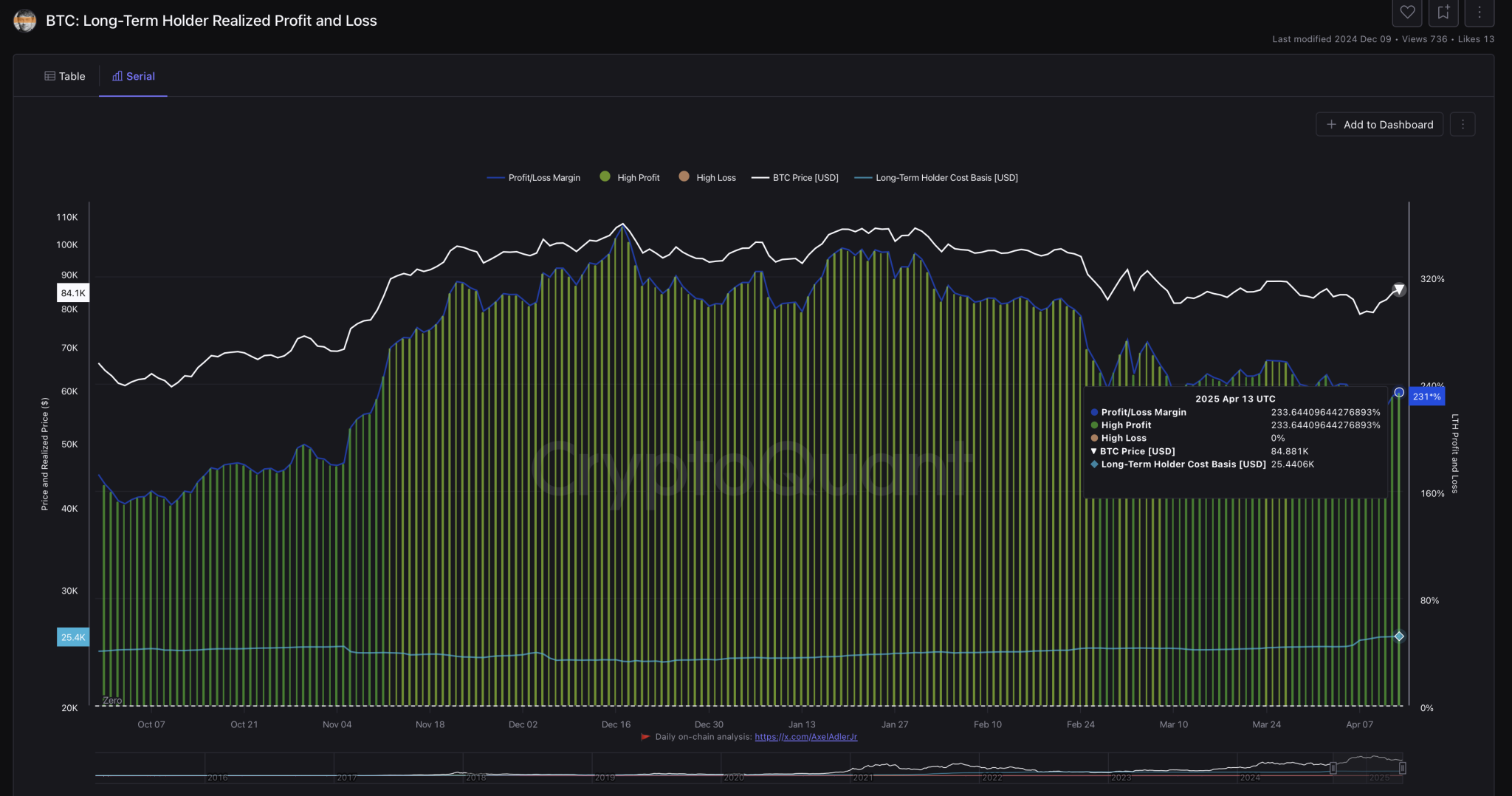

While realized profits among LTHs have dropped from a Q1 peak of 341% to 231%, their average cost basis has increased to $25.44K. This suggests strong conviction and continued accumulation, which could support further upside in BTC.

Long term Holder Profit

MetaPlanet Adds 319 BTC, Total Holdings Exceed 4,500 BTC

Amid market uncertainty, Japan-based MetaPlanet has doubled down on Bitcoin. The firm recently acquired 319 BTC for $26 million at an average price of $82,549, bringing its total holdings to over 4,525 BTC.

MetaPlanet has set a goal to accumulate 10,000 BTC by the end of 2025, reinforcing its long-term bullish stance.

Conclusion

Bitcoin is currently at a critical juncture, facing resistance at the $85,000 level — which aligns with the 200-day EMA. A bullish close above this zone could open the door to a rally toward $92,000, near the 78.6% Fibonacci retracement level.

On the downside, key support rests around $82,000, close to the 61.8% Fibonacci level. As long as this support holds and long positions keep building, Bitcoin remains poised for a bullish continuation.

Leave a Reply