- VeChain’s bullish pressure is focused on breaking crucial resistance at $0.025.

- VET exhibits strong purchasing pressure, driven by demand from the market and investor interest.

- Technicals are good, but $0.0220 is still highly significant support.

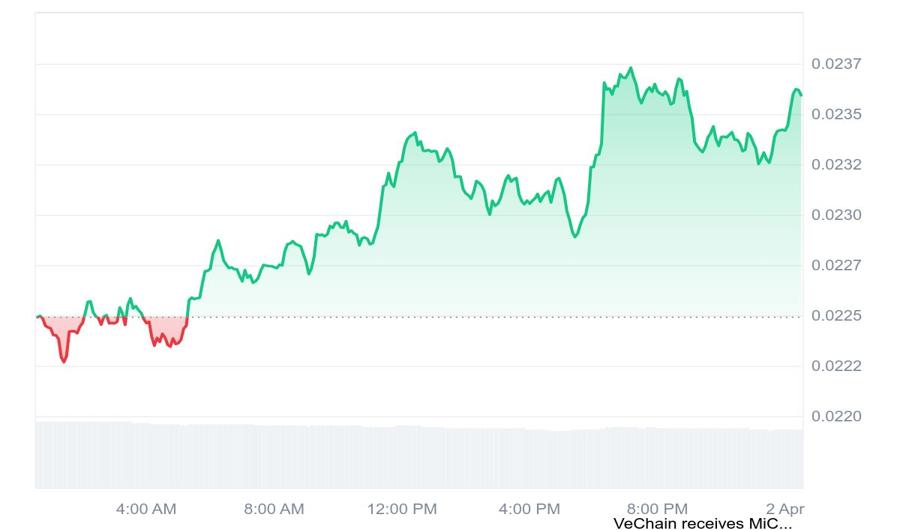

VeChain (VET) price chart on CoinMarketCap shows good performance with a 4.86% rise over the last 24 hours. The token is resting at $0.02359, showing bullish pressure backed by good technical readings.

Price Action Summary

VET’s 24-hour price action on CoinMarketCap indicates extremely high volatility with a clear upward trend. The price began at approximately $0.0225 and fell as low as $0.0220 by 4:00 AM before recovering and shooting up above $0.0227 by 8:00 AM. Such extreme upward momentum was a breakaway in an upward direction, indicating demand in the market.

Source: CoinMarketCap

The price ranged between $0.0227 and $0.0230, recording higher highs, before breaching $0.0230 at noon. Persistent high volatility between noon and 4:00 PM drove the price to $0.0237, attesting to vigorous buying pressure. VET withstood small corrections and remained on a bullish trend.

Technical Indicators Analysis

The CoinMarketCap timeline illustrates a bearish setup of fundamental technical indicators. The 50-day Simple Moving Average (SMA) and the 20-day Exponential Moving Average (EMA) both incline upwards, indicating an uptrend. The Relative Strength Index (RSI) is far above 60 and yet to reach the overbought zone.

The MACD indicator is also depicting a bullish crossover, i.e., momentum is positive. Volume strength remains consistent during bullish periods, which indicates strong market interest. Fibonacci retracement levels indicate support at $0.0220 and resistance at $0.0237.

Market Insights from Michaël van de Poppe

According to Michaël van de Poppe, VeChain’s ongoing developments drive investor appetite. MiCAR license enables European business services, governance updates, and improved staking rewards to bolster tokenomics. Van de Poppe emphasizes the importance of breaking above $0.0237 for sustained bull runs.

Source: Michael van de Poppe

He views $0.020 as a strong support level and $0.025 as strong resistance. Failing to penetrate above $0.025 may trigger a pullback towards $0.020, but a breakout would send VET through the roof. Van de Poppe’s reading is corroborated by technical markers, highlighting the significance of current price levels.

Future Price Outlook

VeChain’s price action suggests a strong bullish image if $0.0237 is broken firmly. The next target is $0.025, backed by sound market sentiment and bullish technical signals. Breaking above $0.025 can lead to a rally towards $0.030.

But a breakdown below $0.0237 could lead to a retest of $0.0220. Investors should wait for confirmation of volume, RSI, and MACD. VeChain’s long-term path depends on breaking through key resistance levels and maintaining market confidence.

Leave a Reply