Zcash (ZEC) price has started June with renewed momentum, climbing past the $50 psychological barrier and now aiming to reclaim higher resistance levels. Based on the current daily and hourly TradingView charts, the trend looks increasingly bullish, and technical indicators are supporting the possibility of further gains. Let’s dive deep into the charts and evaluate what lies ahead for ZEC.

Zcash Price Prediction: Is ZEC Price Gearing Up for a Strong Breakout?

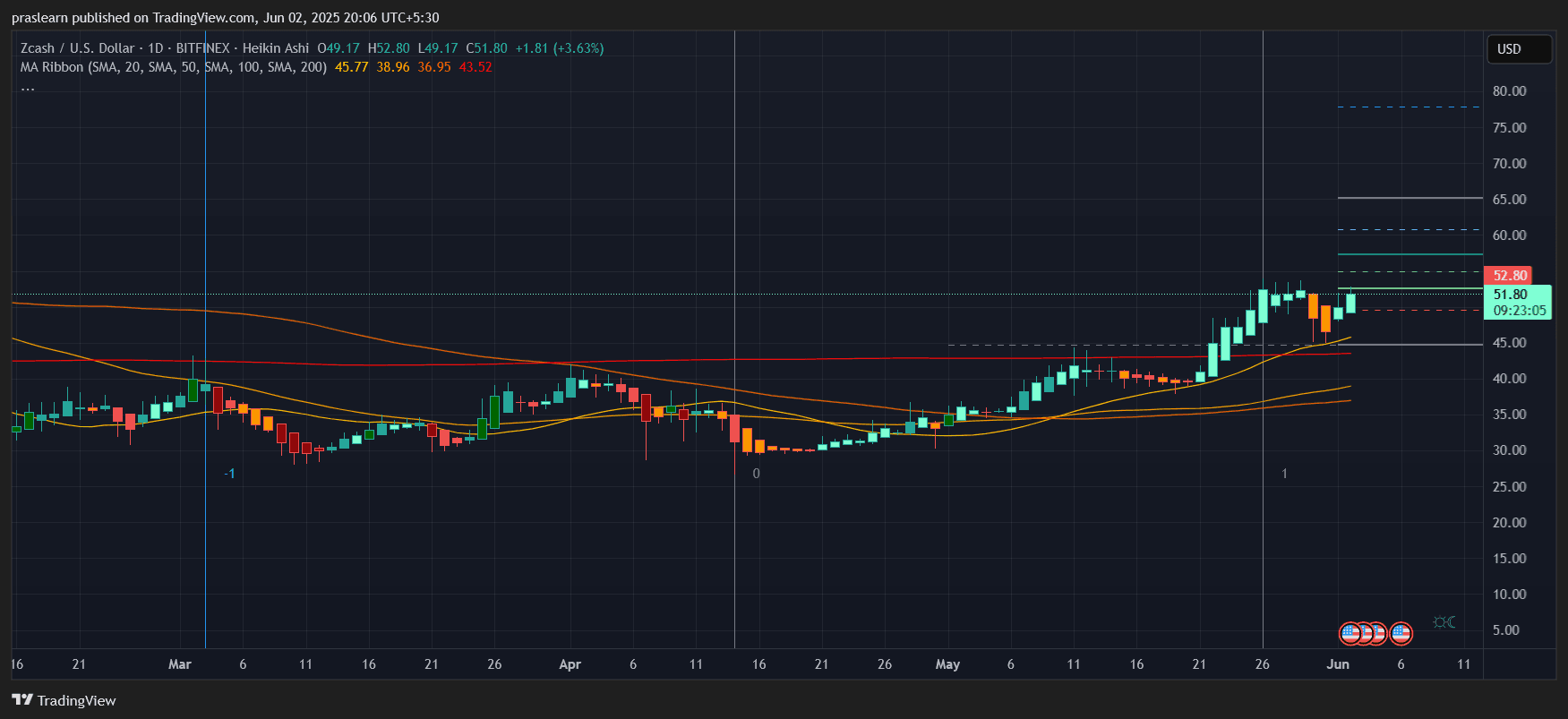

ZEC/USD Daily Chart- TradingView

Looking at the daily chart, ZEC price has clearly flipped into an uptrend after consolidating in the $30–$40 range for weeks. It broke above the 20, 50, and 100-day simple moving averages (SMAs), which are currently positioned at $45.77, $38.96, and $36.95 respectively. ZEC is now trading at $51.80, just shy of the immediate resistance at $52.80 — a level it needs to clear for the next breakout.

The Heikin Ashi candles have shown consistent bullish momentum since May 20, confirming strong buyer interest. The candle bodies are extending with little to no lower wick, a classic sign of strength.

If Zcash price closes above $52.80 on the daily timeframe, we could see it target the next Fibonacci resistance levels drawn on the chart — around $56.40, $60.10, and $65.00. That gives a potential upside of around 25% from current levels.

What Does the Hourly Chart Reveal?

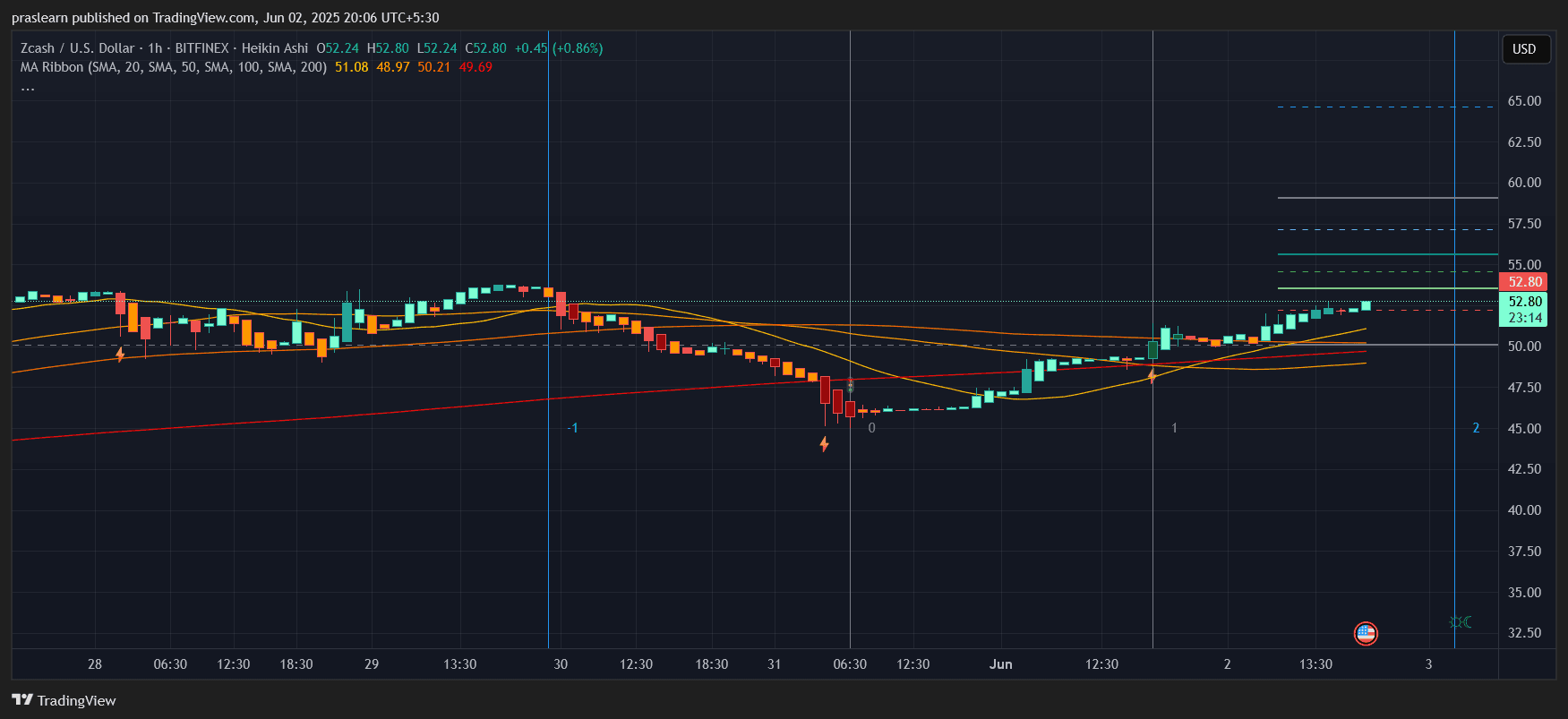

ZEC/USD 1 Hr Chart- TradingView

The hourly chart supports this bullish case with a clean and strong recovery from a dip below $48. It’s notable that ZEC price bounced strongly after hitting the 200-SMA (red line at $49.69) and quickly climbed back above the 20-SMA and 50-SMA, currently at $51.08 and $48.97 respectively.

In the short term, the price is consolidating near the upper range of its hourly resistance, hovering around $52.80. A candle close above this will be crucial to initiate a surge toward $55.50–$57.00. Volume is also picking up, suggesting increasing trading activity around these levels.

Here’s a simple price extension based on the most recent impulse:

- Previous swing low: $44.00

- Previous swing high: $52.80

- Projected move: $52.80 + ($52.80 – $44.00) = $61.60

That makes $61–$62 a potential measured move target if momentum sustains.

Are Moving Averages Signaling a Trend Continuation?

Yes. Both the daily and hourly charts show that ZEC price has flipped all major moving averages into support — a strong confirmation of an ongoing trend reversal. The golden crossover between the 20-SMA and 50-SMA recently took place on the daily chart, which traditionally signals a medium-term uptrend.

Currently, the 100-SMA sits at $36.95 and the 200-SMA at $43.52, far below current market price. This wide separation shows how far Zcash price has moved away from its longer-term average — usually an early sign of a rally in formation.

Zcash Price Prediction: Can ZEC Price Sustain the Momentum?

Momentum indicators such as the Heikin Ashi trend and moving average alignment suggest the path of least resistance is upward. However, ZEC price must break and hold above $52.80 on daily candle close. Any rejection from here might lead to a short-term pullback to $48.50, but that could serve as a healthy retest of support.

If Bitcoin remains above $70K and broader altcoin sentiment holds, Zcash price has a solid chance of rallying toward $60–$65 in the next 7–14 days.

Final Thoughts

Zcash price is showing promising signs of strength after months of accumulation. With bullish alignment in both short-term and long-term indicators, the breakout scenario remains valid — as long as $52.80 turns into support. Based on chart extensions and moving average structures, a rally toward $60–$65 is technically reasonable if bulls maintain control.

If you’re watching ZEC price, keep a close eye on volume around $52.80 and the reaction in the next 24 hours. A decisive move here could be the start of ZEC’s next bullish leg.

Leave a Reply