eToro (NASDAQ: ETOR) filed a registration statement with the U.S. Securities and Exchange Commission (SEC) on Tuesday to register shares for its newly established employee share purchase plan, following its recent public listing earlier this month.

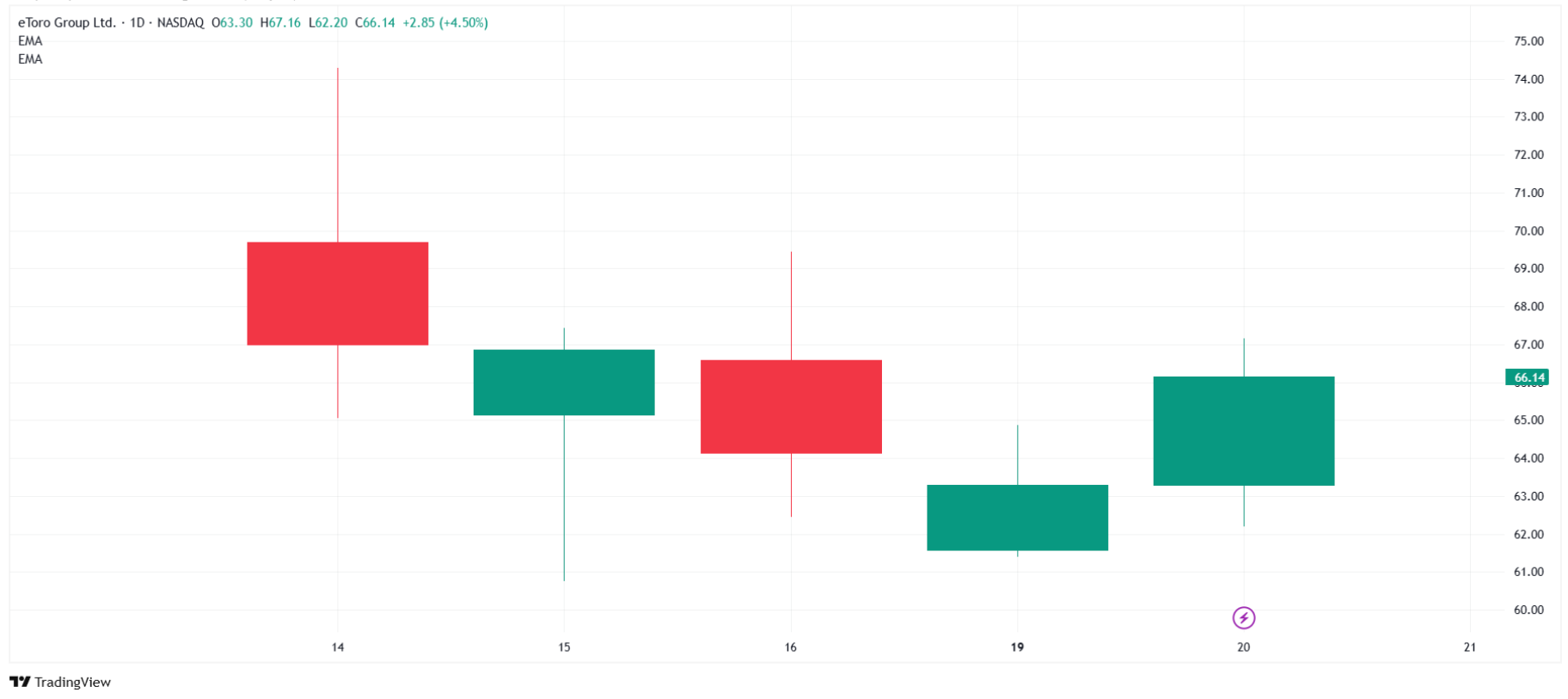

At the same time, the fintech’s share price rebounded by 4.5% on Wall Street during yesterday’s session, closing at $66.14. It marked the largest single-day gain since last week’s IPO.

The British Virgin Islands-incorporated eToro Group Ltd., which operates a social trading and investment platform, submitted an S-8 registration statement dated May 20 to register shares under three employee benefit plans, including its 2025 Employee Share Purchase Plan (ESPP).

The filing comes just days after eToro completed its initial public offering, with its prospectus having been filed with the SEC on May 13, 2025, and its shares beginning trading on May 15.

The 2025 ESPP authorizes the issuance of 2,201,301 Class A common shares, with provisions for potential annual increases through January 2035. Each January 1 beginning in 2026, the plan allows for additional shares equal to the lesser of 1% of outstanding shares or a smaller number determined by the board.

“The purpose of this Plan is to assist Eligible Employees of the Company and its Designated Subsidiaries in acquiring a share ownership interest in the Company,” the filing states.

eToro’s Employee Share Purchase Plan Details

The plan consists of two components: a Section 423 Component intended to qualify under U.S. tax code, and a Non-Section 423 Component for international employees. Eligible employees can contribute up to 20% of their compensation through payroll deductions to purchase company shares at a discount.

According to the plan documents, the purchase price will be at least 85% of the fair market value of a share on either the enrollment date or purchase date, whichever is lower.

The company’s Chairman and CEO Jonathan Alexander Assia signed the registration statement along with CFO Meron Shani and other board members.

The company’s dual-class share structure grants Class B shares ten votes per share compared to one vote for Class A shares, according to its corporate documents. This structure allows founders and early investors to maintain control while raising capital from public markets.

eToro Shares Rise 4.5%

During Tuesday’s session, eToro’s share price rose by 4.5%, closing the day at $66.14, despite modest declines in the Nasdaq 100 and S&P 500 indices. The stock is rebounding after a higher-than-expected IPO valuation triggered quick profit-taking last week, pushing the price down to $61.40 on Monday.

eToro shares chart. Source: Tradingview.com

eToro, however, is actively working to keep investors engaged. This week alone, the platform launched a recurring buy feature for stocks, ETFs, and crypto. A day earlier, it introduced a new savings service for clients in France. To support this offering, the company opened a local branch and partnered with Generali.

eToro’s Wall Street debut also caught the attention of well-known investors. Cathie Wood’s Ark Invest purchased nearly $10 million worth of shares during the IPO, which raised close to $620 million in total.

Leave a Reply