Ethereum’s recent price movements have caught the attention of the crypto market, not just for their strength but for what they reveal beneath the surface. Over the past several weeks, major Ethereum holders known as whales have significantly increased their positions, indicating strong conviction in the asset’s future.

These whales, each holding between 10,000 and 100,000 ETH, have been aggressively accumulating since mid-April, just as Ethereum’s price began a steep climb. This pattern, alongside key technical signals, is raising expectations of a longer-term bullish phase.

Whale Accumulation Aligns with Price Breakouts

According to analyst Crypto Rover, large Ethereum wallets added over 1.4 million ETH between mid-April and mid-May. Their holdings grew from 15.8 million to more than 17.2 million ETH.

This accumulation period closely matches Ethereum’s price rally from around $1,600 to over $3,100. Notably, this surge allowed the token to break major resistance levels near $2,200 and $2,800.

BIG ETHEREUM WHALES (BALANCE: 10K-100K $ETH) ARE GOING ALL IN.

THEY CLEARLY KNOW SOMETHING WE DON’T! pic.twitter.com/VsHjXIqTaH

— Crypto Rover (@rovercrc) May 20, 2025

Significantly, these whales began buying before Ethereum’s price spike, suggesting informed confidence. Their entry at relatively low price levels likely contributed to the bullish breakout. Hence, their actions may reflect inside knowledge, or at least a deep belief in Ethereum’s long-term value.

Related: Ethereum (ETH) Shows “Golden Cross”; Analysts See $3,000 Price Target

Golden Cross on 12-Hour Chart Adds Momentum

Further supporting the bullish outlook, technical analyst Ted Pillows highlighted the emergence of a golden cross on Ethereum’s 12-hour chart. The 50-period moving average recently crossed above the 200-period moving average, a technical pattern historically associated with sustained upward momentum and renewed investor interest.

$ETH Golden Cross confirmed.

$3,000 Ethereum is coming next. 🚀 pic.twitter.com/zdC1AcCfcn

— Ted (@TedPillows) May 18, 2025

Moreover, the crossover indicates increased buying pressure, reinforcing the idea that Ethereum’s uptrend is gaining strength. However, Pillows noted that Ethereum must hold above $2,200 to keep the momentum intact. A drop below this level could weaken the bullish case.

Key Support and Resistance Levels Shape Market Outlook

Ali Martinez, another leading analyst, identified $3,100 as the next major resistance for Ethereum. Meanwhile, the $2,233 mark stands as a vital support.

Related: ETH Faces Resistance at $2,625 While Support at $2,500 Holds

If Ethereum stays above this level, a further rally toward $3,000 could be likely. Conversely, slipping below $2,200 may expose the token to a retest of the $1,900 zone.

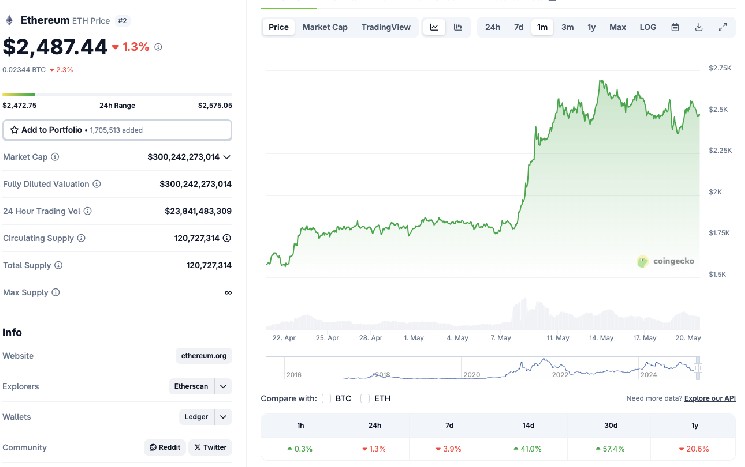

At the time of writing, Ethereum is priced at $2,478.66, reflecting a modest 1.29% daily gain. However, the past week shows a 2.74% decline, underlining short-term volatility.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Leave a Reply