Token unlock schedules are threatening to shake up the market, making the coming week crucial for a number of significant cryptocurrencies. Between May 19 and May 26, Dogecoin, one of the most prominent cryptocurrencies, is scheduled to put 96.52 million tokens into circulation. Although only 0.06% of DOGE’s circulating supply is represented by this unlock, which has a value of about $21.9 million, the timing and market structure raise concerns about its possible impact.

Technically speaking, DOGE recently displayed indications of a bullish breakout, with price momentum increasing toward the $0.25 mark. The asset, however, has since retreated after failing to sustain its upward trajectory and is having difficulty breaking through the black 200 EMA line. The chart’s descending triangle could indicate a bearish continuation unless the asset is pushed upward by high volume.

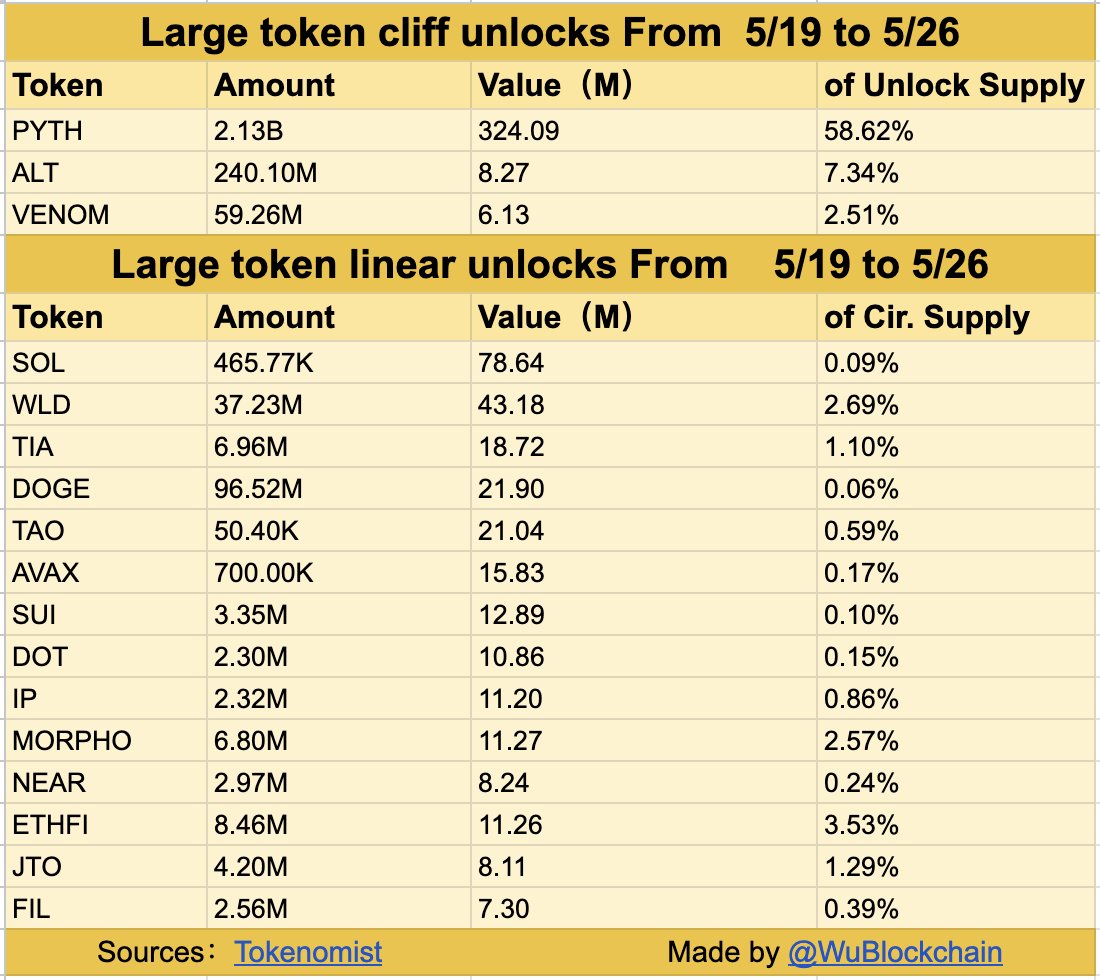

The unlock this week may serve as a catalyst for either bullish expansion by providing liquidity or, more likely, a short-term sell-off because of market saturation. Other noteworthy unlocks this week include the release of $8.24 million in tokens by Near Protocol (NEAR), $43.18 million by Worldcoin and $12.89 million by Sui.

Even though these represent larger proportions of the circulating supply than DOGE, none of them have the same psychological impact as the roughly 100 million DOGE that hits the market within a narrow range. The actual risk for traders and investors is the overall liquidity of the market.

These unlocks — DOGE’s in particular — are coming into a market that is beginning to show signs of weariness. Following the breakout, volume has been declining and since there has not been any follow-through, purchasing these unlocks may drive down prices generally.

Even though the DOGE unlock may not seem like much in terms of percentage, its symbolic volume and timing during a period of diminishing momentum make it a significant short-term event. When coupled with other mid-tier unlocks such as WLD, TIA and NEAR, the upcoming week may bring more volatility than most anticipate.

Leave a Reply