Cryptocurrency analyst and trader Jason Pizzino is leaning bullish on Bitcoin (BTC) over the short to medium term.

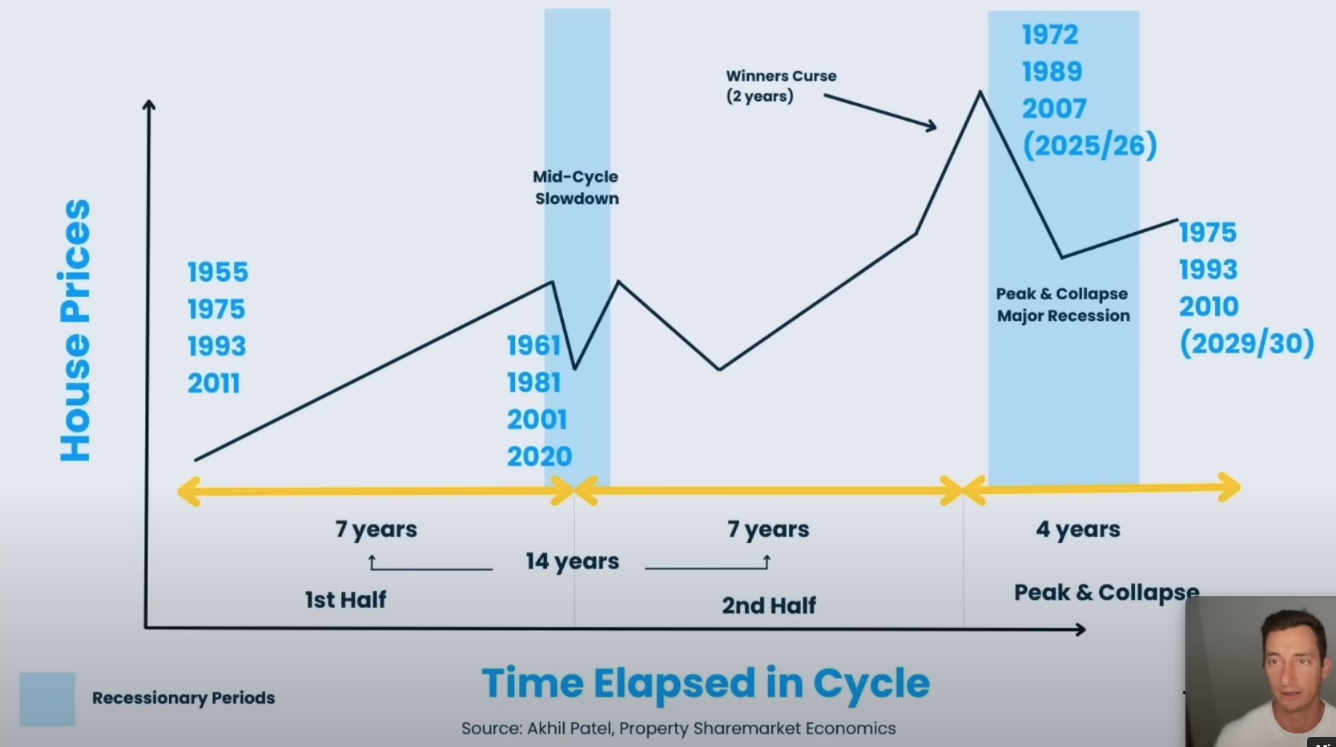

In a new strategy session, Pizzino tells his 351,000 YouTube subscribers that traditional assets such as stocks and real estate are in the correction phase of the 18-year property cycle theory popularized by land economist Fred Harrison.

The theory states that the property market rotates between a boom phase that lasts for 14 years and a bust period that lasts four years.

According to Pizzino, Bitcoin could precede the traditional assets in undergoing a major market correction.

“I wouldn’t expect Bitcoin to peak at the same time that the stock market does or even at the same time that the real estate and the economy peaks. And if that peak is due sometime around 2026… let’s call it the first half of 2026…

…so being conservative, I would look for a peak in Bitcoin before that happens. So before the peak sometime in the first half of 2026. If we’re lucky, maybe this thing peaks in the first half, maybe quarter one.”

Source: Jason Pizzino/ YouTube

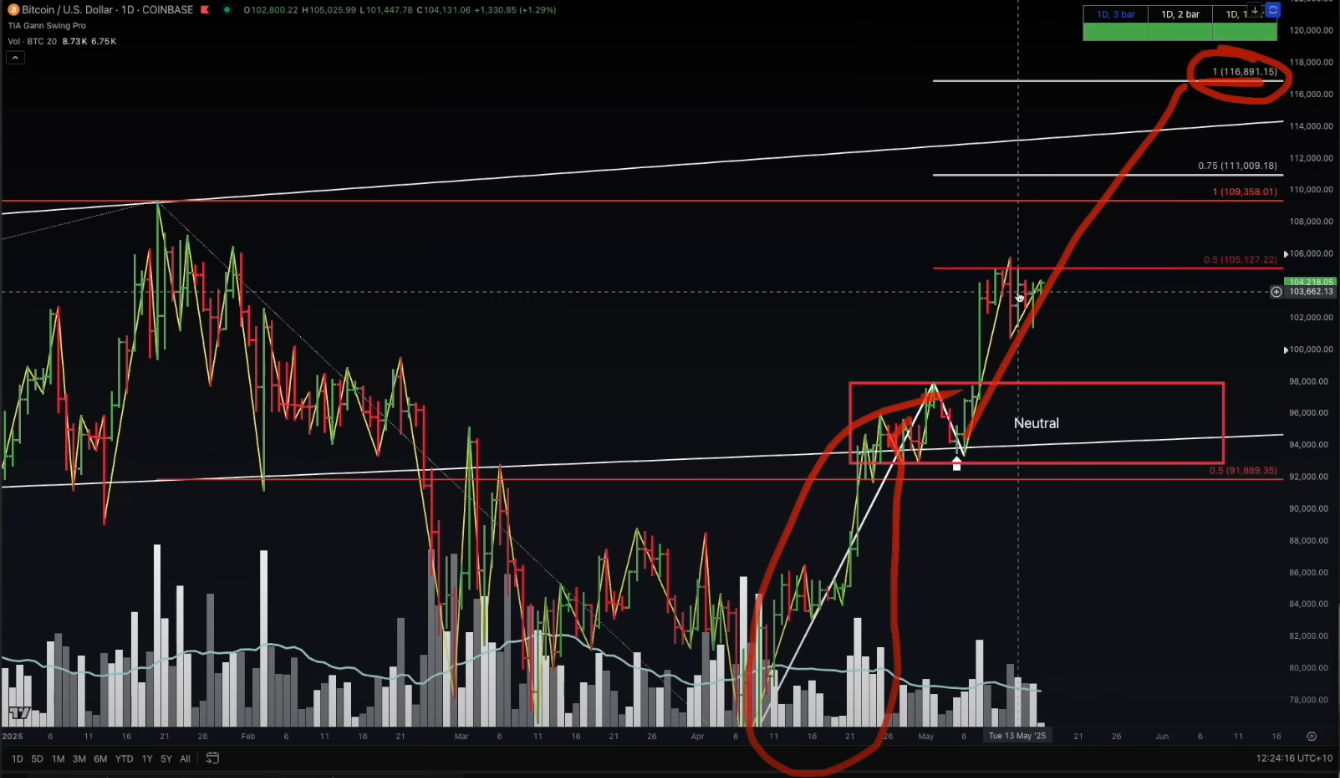

According to the crypto analyst, Bitcoin is, however, primed to reach a new all-time high before the major market correction occurs.

“If BTC is able to break through this level [around $106,000], then my next target of course, you’ve got the highs here around $108,000 to $109,000… but the 75% of our swing move [from around $74,000] here takes us out to $111,000.

Now if this is going to do a repeat of this 100%, that’ll take you to $117,000…”

Source: Jason Pizzino/ YouTube

Bitcoin is trading at $103,912 at time of writing, down by nearly 5% from the all-time high of just under $109,000 reached in January.

?

Generated Image: Midjourney

Leave a Reply