Cryptocurrencies, precious metals, and equities all slipped today after an energetic rally that carried markets higher over the past week and a half. Signs of fatigue are emerging, with momentum stalling across several asset classes. Meanwhile, bitcoin dropped to a mid-day low of $102,622.

Markets Begin to Lose Steam

BTC touched $102,622 during Wednesday’s mid-day session (Eastern time), retracing from its intraday peak of $104,836. Technical gauges such as the daily relative strength index (RSI) suggest overbought territory has given way to persistent sell pressure. This followed two failed attempts to break through the $105,000 ceiling. Both BTC and ETH have shed around 1%, while losses ran deeper across a range of other top tokens.

BTC/USD via Bitstamp on May 14, 2025.

The broader crypto market declined by 1.12% in the past 24 hours. Trade volume hovered near $146.31 billion, mirroring Tuesday’s figures. A handful of tokens—WAL, RAY, PENGU, and FORM—swam against the current, posting gains between 5% and 10%. In contrast, EOS, BRETT, WIF, and PI saw losses ranging from 9.2% to 10%.

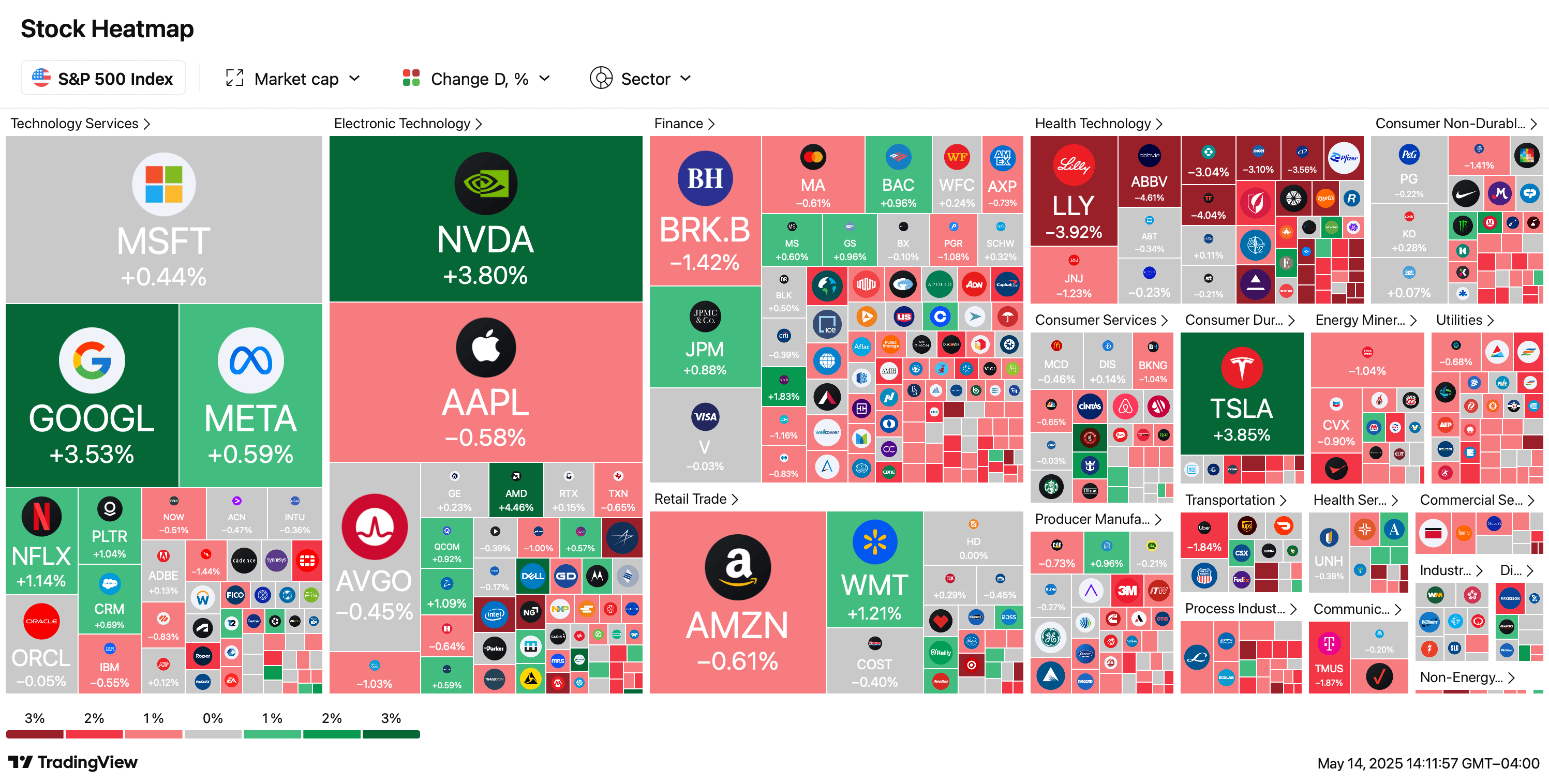

S&P 500 heat map on May 14, 2025.

Major U.S. stock indices were also lower and mixed, though the Nasdaq held a touch firmer amid climbing bond yields. The NYSE Composite slipped 0.55% to 19,614.91. The Dow Jones Industrial Average dipped 0.28% to 42,022.91, while the S&P 500 inched down 0.02% to 5,885.17 as of 1:45 p.m. Eastern. Persistent recession forecasts and a tightening stance by the Federal Reserve continue to weigh heavily on investor sentiment.

Precious metals weren’t spared either. Gold declined more than 2% on the day, while silver fell 1.96%. As of press time, silver trades at $32.45 per ounce, with gold priced at $3,182. Platinum slipped 0.85%, and palladium recorded a more modest loss of 0.24%, according to recent market data. The recent wave of optimism tied to trade negotiations appears to be tapering off. By 2:30 p.m. (ET), bitcoin managed to claw its way back just above the $103,000 range.

Leave a Reply