The Sui blockchain continues to witness growing adoption and position itself as a formidable Solana competitor.

The traction comes amid growing developer momentum, interest in Sui-based DeFi protocols, and successful integrations with real-world Web3 applications.

Sui TVL Surge: What Users Need to Know

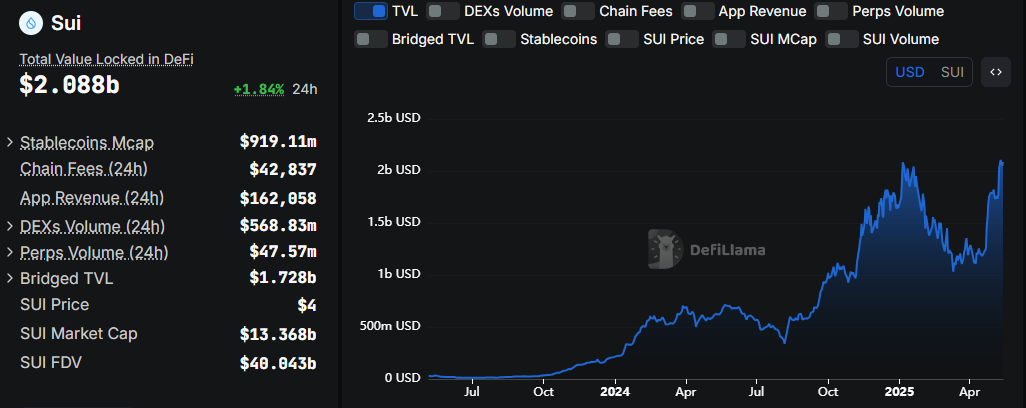

According to DefiLlama data, the total value locked (TVL) on the Sui blockchain recently soared to a new all-time high of $2.1 billion. Despite a modest drop to $2.088 billion as of this writing, the traction represents a 17% surge from early May lows.

Sui TVL. Source: DefiLlama

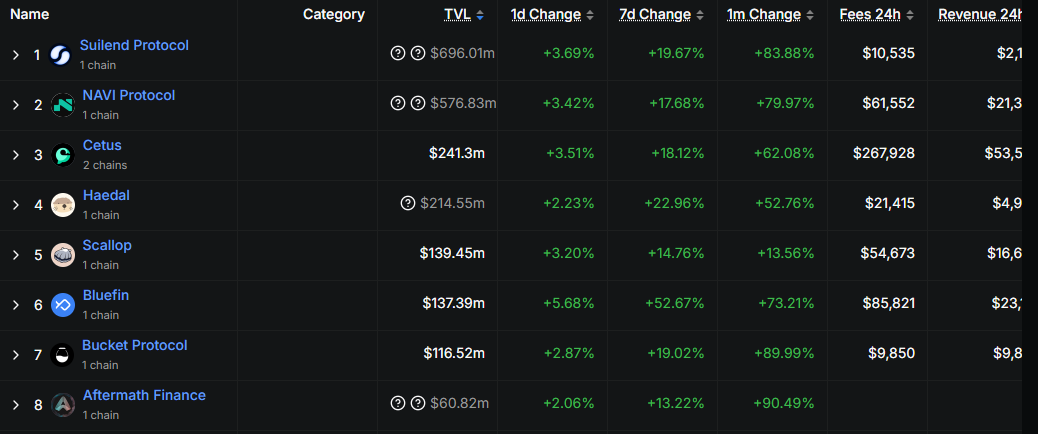

Meanwhile, Sui-based lending protocols have seen a 78.86% spike in TVL over the past month. Heightened liquidity incentives, strong yields, and rising attention from retail and institutional DeFi participants are drivers of this growth. One major driver is the NAVI Protocol, Sui’s flagship lending and borrowing platform.

Lending protocols on the Sui blockchain. Source: DefiLlama

The Navi Protocol recently hit another milestone. Its token, NAVX, secured listing on Binance Alpha, following a prior debut on the OKX exchange.

“NAVX listed on Binance Alpha! NAVX is picking up momentum. After the recent listing on OKX, the native token of the NAVI DeFi Ecosystem is getting its spotlight on Binance Alpha. NAVI brings groundbreaking DeFi on Sui to Binance Alpha users, with Lending/Borrowing, Liquid Staking, and Trading,” NAVI protocol shared on X (Twitter).

Binance echoed the development, committing to exclusive SUI ecosystem asset airdrops for active traders on the new SUI Chain.

“Low slippage on Binance makes NAVX a top choice for farming Alpha Points,” a Navi Protocol ambassador remarked.

These listings boost NAVX’s liquidity and elevate the visibility of the broader Sui DeFi ecosystem. This positions the chain as a formidable contender in the Layer-1 (L1) wars.

Real-World Applications On Sui Take Shape

Beyond DeFi, real-world applications on Sui are beginning to take shape, with notable traction in the loyalty and commerce space.

Mojito, a Web3 commerce infrastructure provider best known for powering NFT marketplaces for luxury brands like Sotheby’s and Mercedes-Benz, has launched Mojito Loyalty, a gamified loyalty platform built entirely on Sui.

The Sui-based Mojito Loyalty is designed for seamless integration with Web3 projects. It enables brands to embed on-chain missions, rewards, and engagement tools directly into their user interfaces. This eliminates the need for extra wallets or third-party dashboards.

By leveraging Sui’s fast and low-cost infrastructure, Mojito can offer real-time, scalable user engagement without compromising experience.

“Mojito Loyalty is a strong example of what’s possible when Web3 infrastructure is built with user experience at its core…We’re excited to see more projects building on Sui adopt Mojito Loyalty… and set a new bar for what on-chain engagement can look like,” Lola Oyelayo-Pearson, Product Director at Mysten Labs, the team behind Sui, said in an interview.

In the same tone, Mojito CEO Neil Mullins said the loyalty market, projected to reach $155 billion by 2029, is ripe for disruption. Its white-label, customizable solution offers Web3 brands a powerful alternative to legacy CRM tools.

Launch partners like Cur8 are already seeing results. Over 1,400 users have reportedly completed missions in just a few weeks and earned rewards.

The rise of DeFi protocols like Navi and real-world platforms like Mojito paints a bullish picture for the Sui ecosystem.

As its TVL grows, Sui is proving that scalability, low fees, and user-first design drive real adoption, from high-yield lending to gamified loyalty.

Sui (SUI) Price Performance. Source: BeInCrypto

However, despite the DeFi traction, the SUI price has only increased by a modest 0.86% in the last 24 hours. As of this writing, it was trading for $4.00.

Leave a Reply