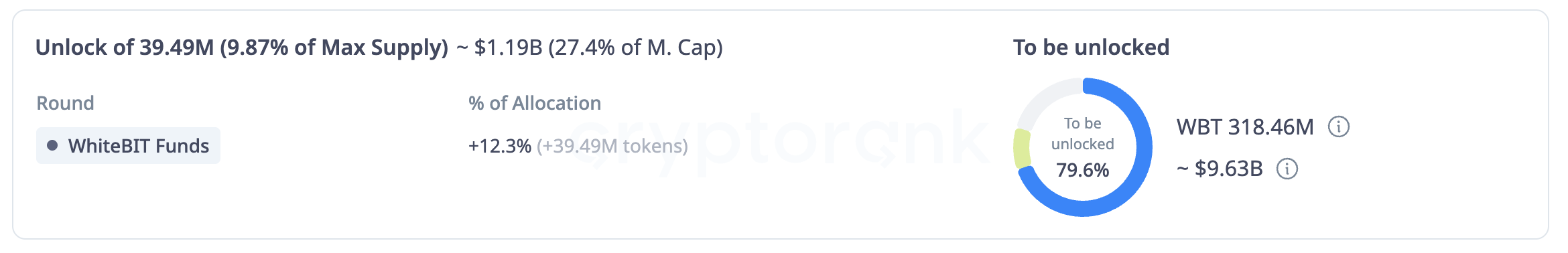

WhiteBIT (WBT) enters a critical phase today as it unlocks over 39 million tokens valued at approximately $1.19 billion. The unlocked tokens will go to WhiteBIT Funds, and traders are watching closely for any signs of market reaction.

Despite the scale of the event, WBT’s price performance has lagged behind other exchange tokens over the past week. With key support holding and technical indicators showing consolidation, the coming days will determine whether WBT breaks higher or faces renewed selling pressure.

WhiteBIT Awaits $1.19 Billion Token Unlock as Performance Lags Behind Peers

WhiteBIT (WBT) faces a pivotal moment today as it unlocks over 39 million tokens worth approximately $1.19 billion.

The team will allocate the unlocked tokens to WhiteBIT Funds, while traders closely monitor the market for potential price impact or distribution activity.

WBT Unlock Info. Source: CryptoRank.

While WBT has posted a 6.5% gain over the past seven days, that performance trails broader market trends and is notably weaker than key exchange-related tokens. The community remains cautious, as large unlocks often bring increased volatility and potential sell pressure.

When compared with its peers, WBT is clearly underperforming. Binance Coin (BNB) is up 10%, Bitget Token (BGB) gained 9.4%, Cronos (CRO) rose 15%, and Uniswap (UNI) surged an impressive 40% in the same period. This relative lag suggests a lack of strong momentum or investor conviction ahead of the unlock.

WBT Indicators Signal Consolidation Ahead

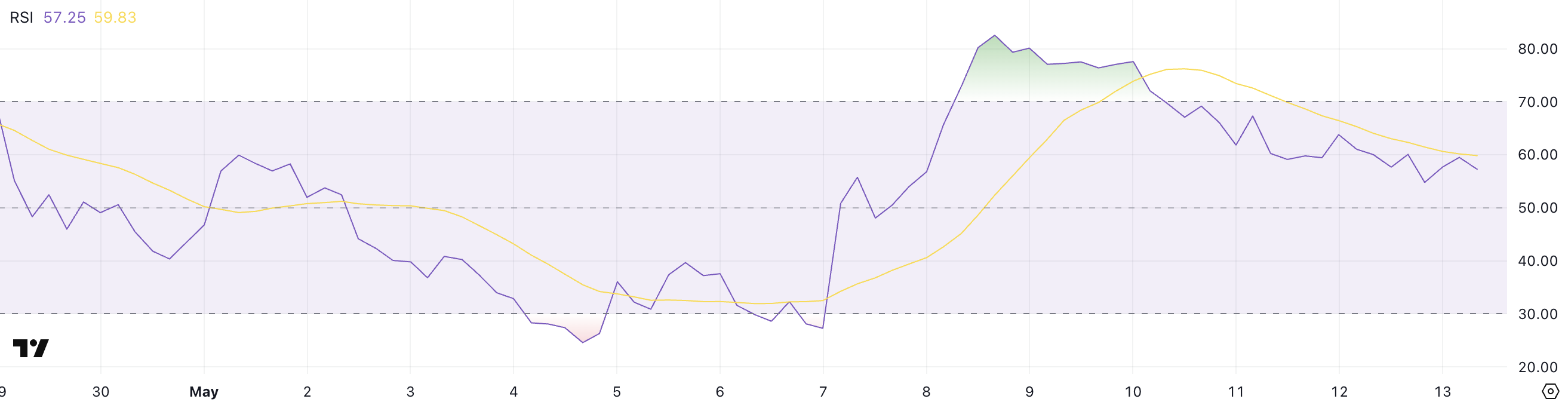

WhiteBIT’s RSI has dropped to 57.25 from a recent high of 77.57, after staying above 70 between May 8 and May 10. This signals a cooling of momentum just ahead of the token unlock.

RSI (Relative Strength Index) is a momentum indicator that ranges from 0 to 100. Values above 70 suggest an asset is overbought, while below 30 signals it may be oversold.

WBT RSI. Source: TradingView.

At 57.25, WBT is now in neutral territory. This could mean the recent rally is losing strength, but it still leaves room for another move up if sentiment improves post-unlock.

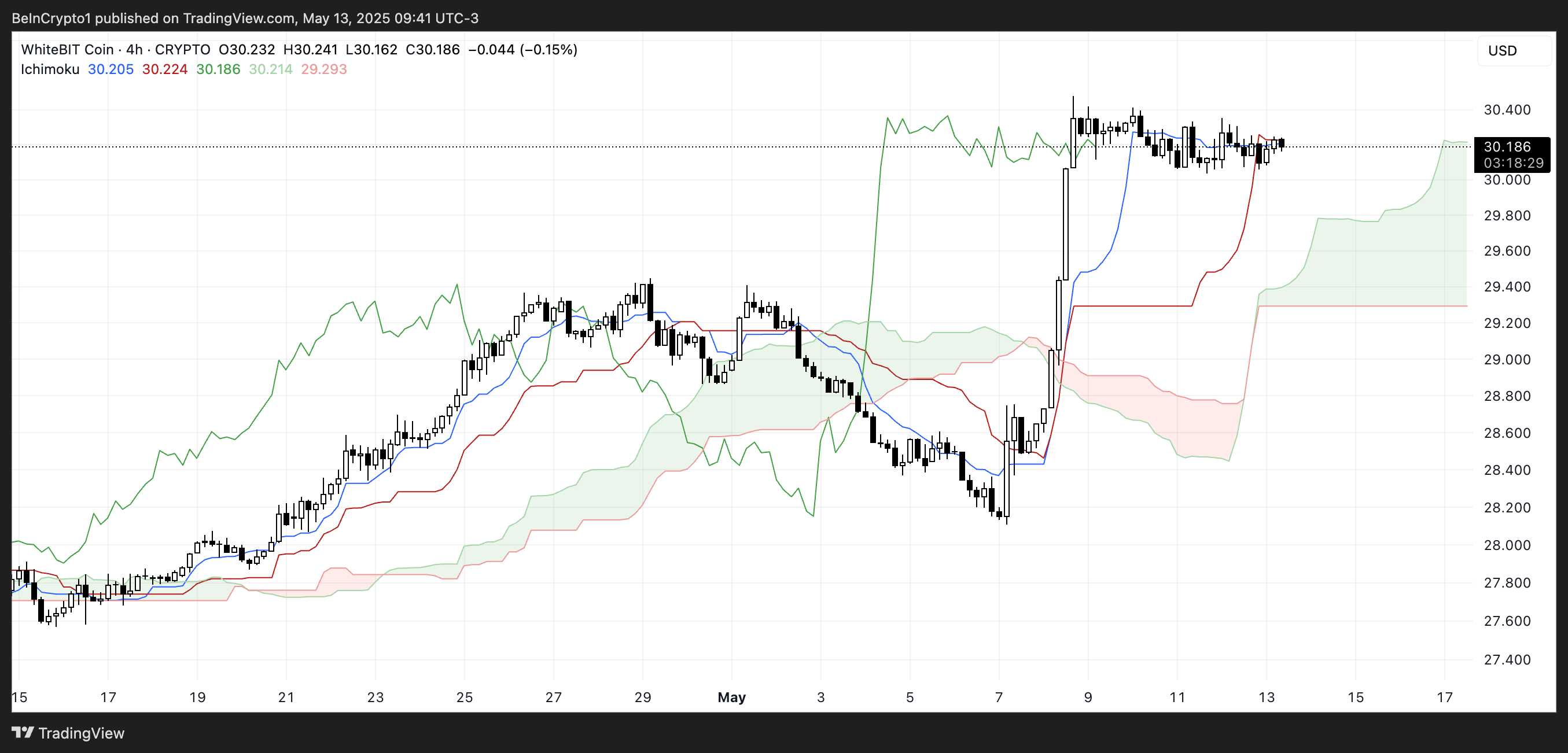

The Ichimoku Cloud for WhiteBIT shows a neutral-to-bullish structure. Price action is currently above the cloud, which is typically a bullish sign.

WBT Ichimoku Cloud. Source: TradingView.

The blue line (Tenkan-sen) and red line (Kijun-sen) are flat and tightly aligned, suggesting consolidation and a lack of short-term momentum.

If price remains above the cloud, the trend remains intact, but a drop into the cloud could shift the short-term outlook to neutral.

WhiteBIT Holds Key Support Near ATHs — Breakout or Breakdown Ahead?

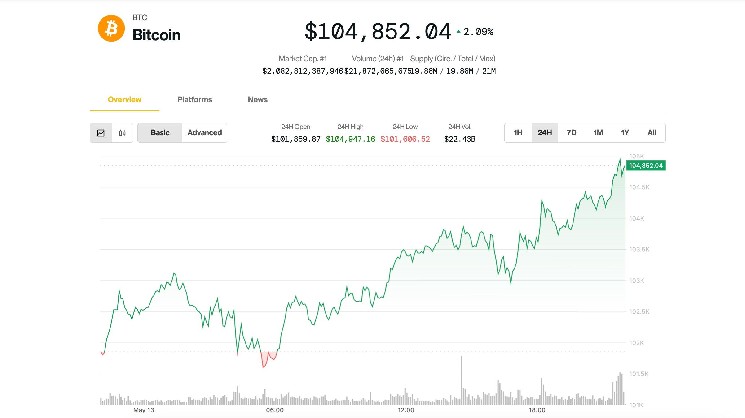

WhiteBIT is trading near its all-time highs, holding steady despite four days of price consolidation. The $30.06 level has been a key support so far, successfully holding back downward pressure.

WBT Price Analysis. Source: TradingView.

If that support is tested again and fails, downside targets include $29.40 and $28.86, with deeper levels at $28.10 and $27.56 if selling momentum increases.

On the upside, a break above the current consolidation range could trigger a fresh rally. If bullish momentum builds, WBT could push past $31 and potentially test the $32 level.

Leave a Reply