- TRON is closing in on Ethereum’s USDT dominance thanks to low fees and strong support from major exchanges.

- Ethereum still attracts institutional interest, with rising daily active addresses and profitable whale activity.

A few years ago, Ethereum might have been the main home for USDT. But now, the story is different. The battle has been heating up since 2021, and TRON, without much fuss, is slowly catching up.

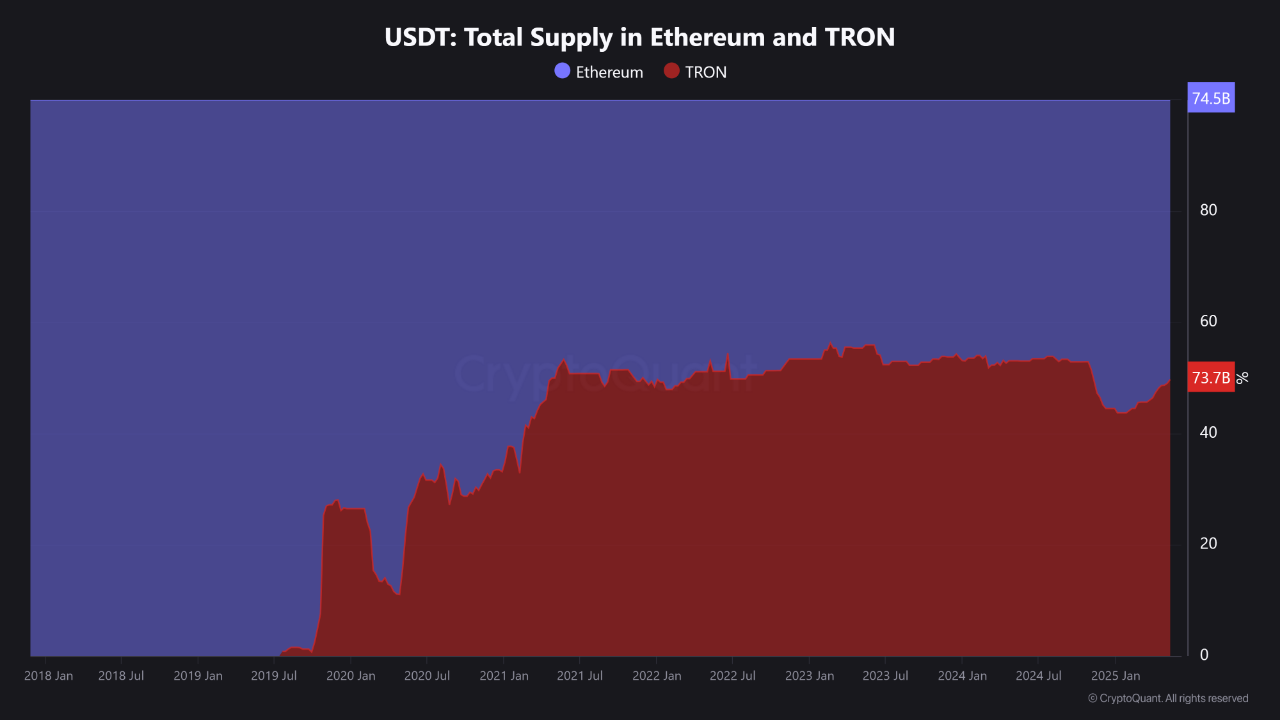

Currently, according to CryptoQuant, Ethereum is still slightly ahead with a total USDT supply of around $74.5 billion. But TRON is closely following at $73.7 billion. These numbers reflect how industry players are increasingly concerned about efficiency and speed.

Source: CryptoQuant

Behind this shift, there are several things that make TRON a new choice for many people. Ethereum’s gas fees that can make your pocket scream are one of the triggers. But not only that, big exchanges like Binance, OKX, and Bybit are also pushing for the use of the TRC20 standard.

Even in the Asian market, TRON is increasingly being used for over-the-counter transactions. All these factors make TRON no longer underestimated.

TRON is Getting More Mature, Ethereum is Still Captivating

If we look further, Ethereum once held almost all control over USDT, especially in 2019. But now? The proportions are almost even—Ethereum is around 50.26% and TRON is 49.73%. It’s not just about who’s bigger, but who’s more agile and efficient. Just imagine if you had to transfer a large amount of stablecoins, and the gas fee was equivalent to a fancy dinner. You’d think twice, right?

Furthermore, TRON is not just about low costs. CNF previously reported that TRON has maintained a daily block production efficiency of 99.7%. This stability is important, especially for a network that is the backbone of stablecoin transactions. Plus, their Super Representative (SR) system shows healthy rotation, reflecting fairly competitive governance.

On the other hand, Ethereum is not standing still. The latest data shows a 15% increase in daily active addresses, breaking through 450,000. There was even one ETH whale that managed to turn a $21 million loss into a $21.7 million gain. His total asset value now? $104.5 million. This kind of activity signals that institutional interest in Ethereum has not died down—in fact, it is even burning hotter.

Interestingly, as we previously reported, Ethereum is currently trading above its realized price. This means that many long-term holders—especially Binance users—are in a comfortable position, aka profitable. Binance itself remains a major liquidity hub for ETH, even during major portfolio shifts.

However, TRON is also showing an interesting pattern. Despite the recent decline in new wallets and transactions, many analysts see it as an accumulation phase. Slowing activity does not mean weakening, but rather preparing for the next surge.

Leave a Reply