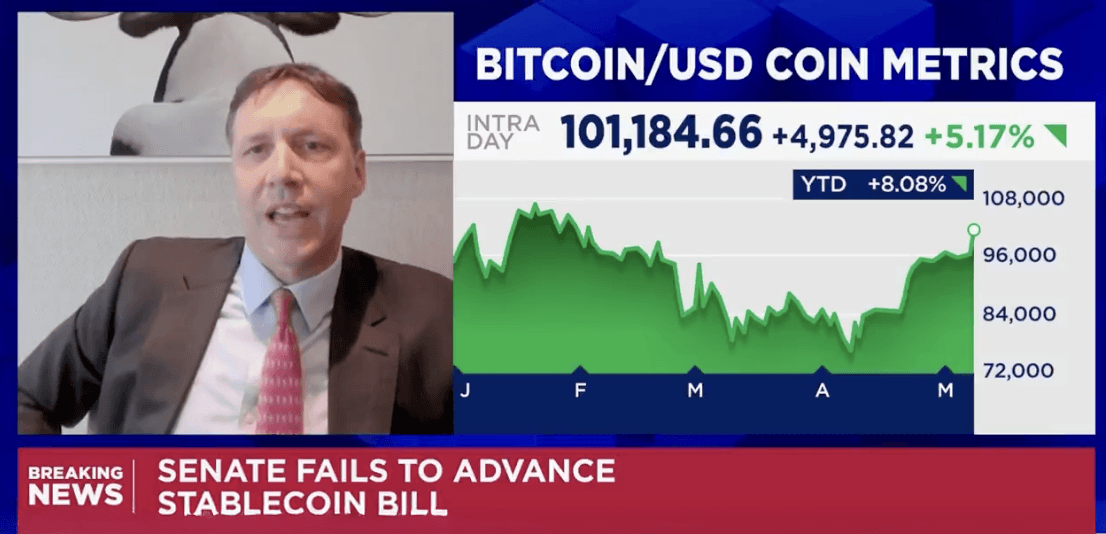

Bill Miller IV, chief investment officer at Miller Value Partners, told CNBC that cryptocurrency governance is rapidly evolving. He added that bitcoin has once again crossed the six-figure threshold and, in his view, still “has a lot of room to go.”

Miller Calls Bitcoin a Check on Fiat Abuse, Hints at $20T Potential

During the exchange with CNBC, Miller observed that U.S. supervision of digital assets—stablecoins most of all—remains in its early chapters. He cited the Senate’s inability to advance a stablecoin measure as evidence of regulatory ambiguity yet portrayed the setback as a moment that could steer policymakers toward clearer rules.

Miller’s credibility stems from his value-investing pedigree and his early, vocal embrace of bitcoin, which he began buying personally in 2013 and later championed publicly in 2015 as a logical holding for patient capital.

He noted that federal agencies, including the Federal Reserve, have relaxed certain earlier constraints—for instance, dropping guidance that forced banks to alert regulators before providing crypto custody. Despite ongoing delays in rulemaking, Miller said bitcoin continues to prove its mettle and even surpasses gold as a store of value.

“It’s back in the six figures with a lot of room to go,” Miller remarked. “If you compare its primary functional use case, which is actually a check in a balance on the lack of accountability in fiat unit creation, we still have a long way to go.”

Miller added:

So gold is a $20 trillion market gap. Bitcoin is still $2 trillion, despite functional superiority to gold. It’s much harder to steal, much easier to store, much easier to instantly transport. And more importantly, you can actually audit it.

Miller noted that auditing Fort Knox’s gold would demand 44,000 labor hours and 18 months, whereas a government reserve held in a handful of auditable bitcoin addresses could be verified by anyone, instantly, on a blockchain explorer.

“I think it would be a lot nicer for the American people if they could just go to a handful of auditable bitcoin addresses on a blockchain explorer and see exactly where the American people’s bitcoin is,” he added.

Leave a Reply