Dogecoin price is climbing toward $0.20, with 71% of traders holding long positions. Will a breakout rally propel DOGE to $0.30?

With Bitcoin momentarily reaching the $104,000 mark, meme coins are turning extremely bullish. The meme coin segment has surged by 11%, reaching a total valuation of $62.20 billion.

Amid the growing bullish sentiment, Dogecoin has risen by nearly 10%, pushing its market cap to $29.26 billion. As DOGE approaches the key $0.20 breakout level, it appears poised for its next major move. Could this breakout rally drive Dogecoin’s price up by 85%?

Dogecoin Price Nears $0.20 Breakout

On the daily chart, Dogecoin has staged a strong recovery after establishing support around $0.14, making several bullish attempts to break through the $0.20 resistance zone. This ongoing struggle, paired with increasing bullish momentum, has led to the formation of an inverted head-and-shoulders pattern.

The pattern’s neckline aligns with the psychologically significant $0.20 mark. Moreover, a 15% jump on May 8 formed a large bullish candle on the chart, surpassing the 50-day exponential moving average (EMA) at $0.1795 and the 23.60% Fibonacci retracement level at $0.1869.

Currently, Dogecoin is testing both the neckline resistance and the 100-day EMA at $0.20. A breakout appears imminent. Supported by broader market recovery, a successful breakout could spark a major trend reversal and initiate a fresh bullish phase.

The 38.20% Fibonacci level sets an immediate price target at $0.2227. Optimistically, a breakout from the inverted head-and-shoulders pattern could propel DOGE to the 61.80% Fibonacci level at $0.2957, suggesting a potential 45% rally and a possible retest of the $0.30 mark.

On the downside, the 50-day EMA at $0.1795 remains a crucial support level.

71% of Binance Traders Anticipate DOGE Breakout Rally

As Dogecoin gains momentum, sentiment in the derivatives market remains highly bullish. Open interest has surged nearly 17% to $2.11 billion, while a funding rate of 0.0102% reflects aggressive bullish positioning.

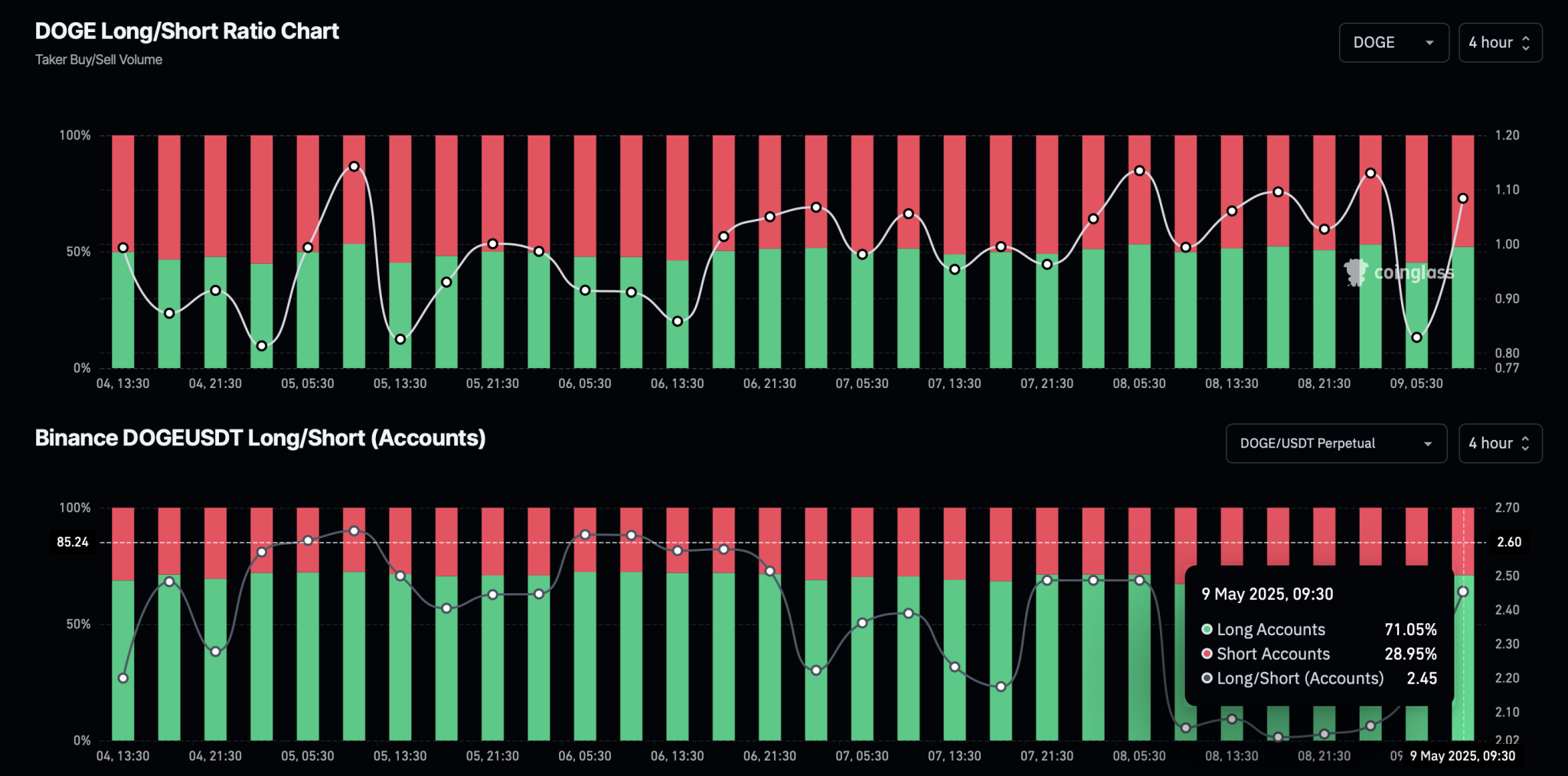

According to Coinglass, the long-to-short ratio has seen significant fluctuations over the past 12 hours. However, the bullish narrative currently dominates, with long positions comprising 52.02% of trades, bringing the long-to-short ratio to 1.0842. This indicates increased odds of a bullish continuation.

Dogecoin LongShort Ratio Chart

On Binance, the bullish narrative peaks with long accounts rising to 71.05%. Hence, traders anticipate a breakout rally in Dogecoin for an extended rally.

Leave a Reply