US President Donald Trump is adamant about a national Bitcoin reserve. While he signed an executive order to implement the BTC reserve in March, disagreements over the reserve continue.

While some industry figures oppose the idea of a BTC reserve, others support it. The latest statement on this issue came from Morgan Stanley.

US financial giant Morgan Stanley said that Bitcoin now has enough market value to be considered a national reserve asset of the US government.

On this point, Morgan Stanley argued in a recent report that Bitcoin’s $1.87 trillion market cap makes it significant enough to be considered a U.S. reserve asset.

Although the giant bank accepts BTC as a reserve asset, its volatility is still a risk, he said.

The bank suggests that holding 12-17% of Bitcoin’s total supply in the US would be consistent with traditional reserve standards.

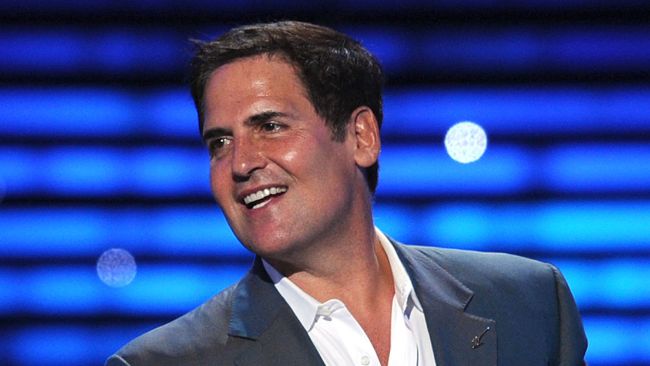

While the idea of a Bitcoin reserve has generally gained support, American billionaire investor Kevin O’Leary claimed that the reserve idea will never come true.

O’Leary also criticized Bitcoin bull Michael Saylor, one of the biggest proponents of the Bitcoin reserve bill, claiming that his company’s Bitcoin accumulation strategy was motivated by self-interest. O’Leary claimed that Saylor’s company raised capital through stock and debt sales to fund Bitcoin purchases and lacked long-term sustainability.

In contrast, prominent figures like Anthony Scaramucci argue that the Bitcoin reserve measure would put the US at the forefront of digital asset integration and help address the US national debt.

*This is not investment advice.

Leave a Reply