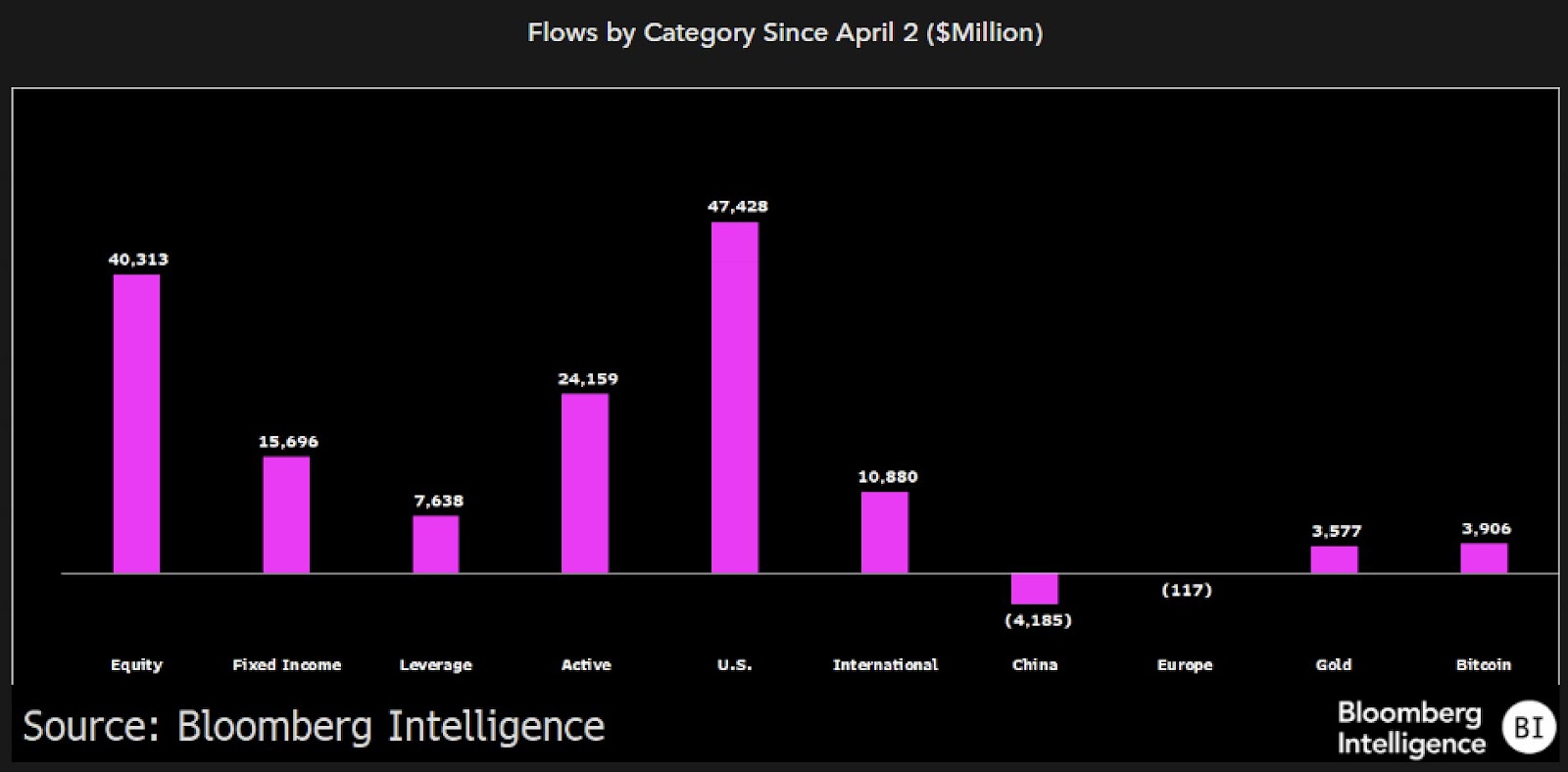

Since April 2025, investors have poured $47.4 billion into U.S.-focused ETFs, making them the leading category by inflows. This makes U.S. ETFs the leader by inflows, according to the latest market data.

Equity ETFs followed with $40.3 billion, while active strategies brought in $24.2 billion. Meanwhile, fixed income ETFs attracted $15.7 billion, and leveraged funds gained $7.6 billion.

U.S. ETF Flows Surge Past $47B Since April. Source: Bloomberg Intelligence

US and Tech ETFs Dominate Recent Capital Flows

While U.S.-focused funds surged, international ETFs (excluding the U.S.) pulled in $10.9 billion. China-focused ETFs saw $4.2 billion in outflows, and Europe-focused funds lost $117 million. Technology ETFs led sector flows.

Bloomberg’s Eric Balchunas reported that tech funds topped all categories in inflows since early April, calling it a “semi-shock” surge.

Bloomberg Intelligence data shows that since “Liberation Day,” U.S. investors have favored domestic and tech-focused ETFs, pushing U.S.-centric funds to the front of the market flow rankings.

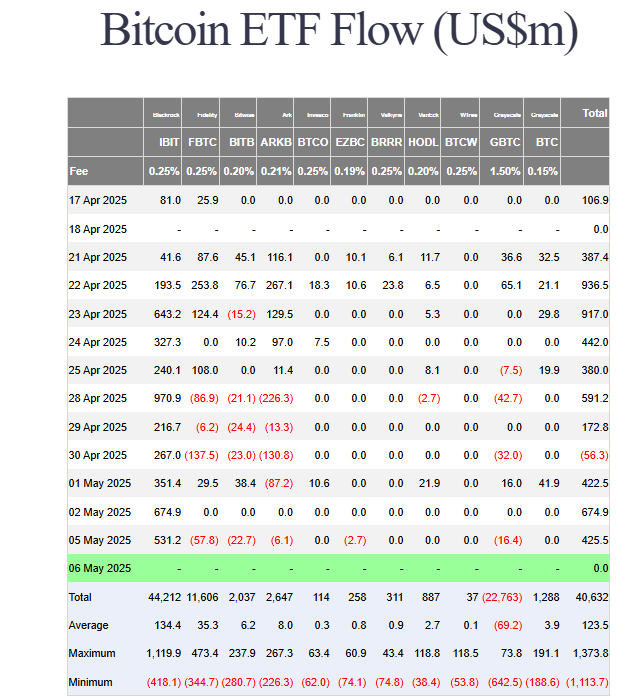

Bitcoin ETF IBIT Hits $5.58B in 15-Day Streak as Crypto ETF Flows Accelerate

In early May 2025, investors kept shifting capital into technology and crypto-related ETFs. On May 5, BlackRock’s iShares Bitcoin Trust ETF (IBIT) recorded its 15th consecutive day of inflows, adding $531.2 million. The fund began this streak on April 17, bringing total inflows over the period to $5.58 billion.

IBIT Leads Bitcoin ETF Inflows With $531M on May 5. Source: Farside Investors

While IBIT’s assets under management (AUM) rose to $34.3 billion, surpassing BlackRock’s iShares Gold Trust (IAU). However, it remains behind the SPDR Gold Shares ETF (GLD), which holds $98.1 billion as of May 6, 2025.

Meanwhile, Bitcoin’s 24-hour trading volume increased by 12% on May 6, reaching $22 billion across major exchanges. This volume spike aligned with the continued rise in institutional ETF activity.

U.S. Inflows Into European ETFs Cross $10 Billion

In Q1 2025, U.S. investors allocated $10 billion to European equity ETFs, a sevenfold increase from Q1 2024, according to Funds Society. The trend continued into May, with consistent capital flowing into Europe-focused funds.

This growth followed Germany’s €500 billion infrastructure plan and EU support for defense and renewable sectors. The iShares MSCI Germany ETF (EWG) and the Select STOXX Europe Aerospace & Defence ETF (EUAD) recorded the largest inflows. EUAD raised $469 million since launching in October 2024.

Bloomberg Intelligence confirmed that inflows increased after regional policy shifts and sector developments. U.S. investors maintained steady engagement with European markets as defense and energy investments gained traction.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Leave a Reply