After a bearish market in February and March, the global crypto outlook has shown considerable improvement over the course of April, with the Crypto Fear and Greed Index reaching a Neutral reading of 51/100 as of this writing – firmly above the 20-25 range seen in prior months.

The reasoning behind these gains can be seen in the recalibration of portfolios from traditional investment markets like stocks and bonds to cryptocurrencies, amid U.S. recession fears.

On the other hand, easing tariff tensions and a notable short-squeeze in the commodities market, have made way for crypto investors to take the stage in April.

The price of Bitcoin has also experienced considerable growth – up from as low as $75,000 on April 9, to over $95,000 towards the end of the month. However, declining consumer confidence and spending capacity could mean that this bullish push is a fluke before further declines.

The current market conditions are more favorable for swing traders, as the broader trend has shown some strength throughout April. You can learn more about trading strategies by using Axiory Trading Resources.

Top 5 Crypto Gainers of April

The month of April has seen a lot of meme coin activity, with the top 5 list of gainers predominantly consisting of meme projects. However, the likes of Bitcoin and Ethereum also delivered admirable returns, which has further enforced the bullish push over the course of April.

DeepBook Protocol (DEEP) +189.7%

DeepBook is a decentralized limit order book (LOB) built on the Sui blockchain and serves as the native liquidity layer for Sui DeFi protocols, enabling greater efficiency in trade matching.

It is worth noting that DeepBook only had its ICO in October 2024, which means that the overall performance history for the coin is relatively limited.

The month of April saw DeepBook surge in price, reaching as much as $0.25, with a total gain of almost 190% over the past 30 days of trading. Determining the long-term prospects of the project can be challenging due to short performance history, while the broader market conditions also show indecisiveness among investors, which could mean a short-lived bull run for DEEP investors.

On the other hand, DeepBook’s utility value is higher than several other entries on our list, as increased Sui adoption positions DeepBook as a foundational protocol for building DEXs and financial applications that require low latency and high throughput, giving it more flexibility in the eyes of crypto investors.

Virtuals Protocol (VIRTUAL) +176%

Virtuals Protocol is a blockchain-based infrastructure designed for prediction markets and event-driven trading. The protocol enables decentralized, verifiable betting on sports, politics, financial events, and more.

The coin has enjoyed a fruitful period over the course of April, as investors saw their holdings increase by a whopping 176%, which places VIRTUAL firmly among the top gaining cryptocurrencies of the month

When looking at the annual returns of the coin, Virtuals Protocol is among the most lucrative investments on the market, with returns reaching just under 1,500% over the past 12 months of trading.

Whether the coin is able to maintain its current bullish momentum remains to be seen, while overall improvements in market sentiment are likely to push VIRTUAL even higher in the coming months.

Fartcoin (FARTCOIN) +133%

April has proven to be a great month for meme coins and Fartcoin has emerged as the top-performing meme coin over the past 30 days of trading, with gains exceeding 130%.

The rise of such coins indicates a considerable shift in market sentiment and a push from fear towards greed on the market.

Fartcoin, much like other meme coins, is a highly speculative asset and assessing its future performance is largely dependent on the overall investor sentiment and broader market conditions. For this reason, investing in the coin at its current valuation is not advisable for beginner crypto traders.

Pudgy Penguins (PENGU) +108%

Pudgy Penguins is an Ethereum-based NFT collection featuring 8,888 unique cartoon penguins. While it began as a PFP (profile-picture) project, Pudgy Penguins has evolved into a brand ecosystem that includes merchandise, storytelling, licensing deals, and Web3-native experiences.

The coin’s price exploded towards the end of April, netting investors a gain of over 100% in the process. It is also worth noting that Fudgy Penguins only had its ICO in December 2024, which limits the ability of investors and analysts to scrutinize its past performance to highlight certain trends in its limited performance track record.

Therefore, similarly to meme coins, Fudgy Penguins can also be classified as a highly speculative investment with limited utility on the blockchain.

Brett (BRETT) +103.4%

Another meme coin among the list of gainers, Brett is a meme coin launched on the Base chain, inspired by the Brett character from the “Boy’s Club” comics—the same roots as Pepe the Frog.

With limited utility, Brett has also followed the trend of high gains over the course of April, more than doubling in market value towards the tail end of the month, which saw many cryptocurrencies suddenly jump after a lackluster performance throughout the first half of April.

If the market corrects in the near future, Brett is one of the top contenders for a correction, due to its massive gains and meme coin status, which are generally very reactive to market sentiment changes.

Top 5 Crypto Losers of April

On the list of this month’s losers we can see some familiar names, such as Mantra, Toncoin, Pi, and Uniswap, which have all posted double-digit declines over the past 30 days of trading.

However, considering the fact that the Fear and Greed index is still showing a modest 51/100, the marker could continue to climb in May as well, increasing the chances for these coins to regain lost ground.

Mantra (OM) -94%

The crash of Mantra’s OM token was the main story of April’s crypto market, which saw the coin nosedive by as much as 94% on April 13. Liquidity issues caused by a large number of liquidations meant that routine sell-offs quickly spiraled out of control for Mantra, causing the coin to crash.

This makes Mantra one of the latest cases that highlight systemic risks with crypto liquidity and lack of transparency, which has put the entire Mantra project into jeopardy. Remedying the situation also looks unlikely in the short-term, as the token has flatlined since dropping to below $0.50.

With Mantra’s reputation on the line, investors can only be hopeful of some speculative activity on the OM token, as the long-term prospects of the project seem bleak.

Toncoin (TON) -20.9%

Toncoin is the native cryptocurrency of The Open Network (TON), originally developed by Telegram. Now community-led, TON is a high-speed, scalable blockchain designed for mass adoption. It supports smart contracts, decentralized applications (dApps), and payment features integrated into Telegram, offering real-world accessibility to crypto.

While the utility of the coin is solid, the month of April has not been kind to TON investors, as the coin declined by more than 20%, which deepens its annual losses to 35%.

While the short-term market conditions do not provide much room for optimism for TON holders, the long-term prospects could look like a bargain for those buying the coin today. However, much of this will depend on the improvements of market sentiment from indecisive to firmly bullish in the coming months.

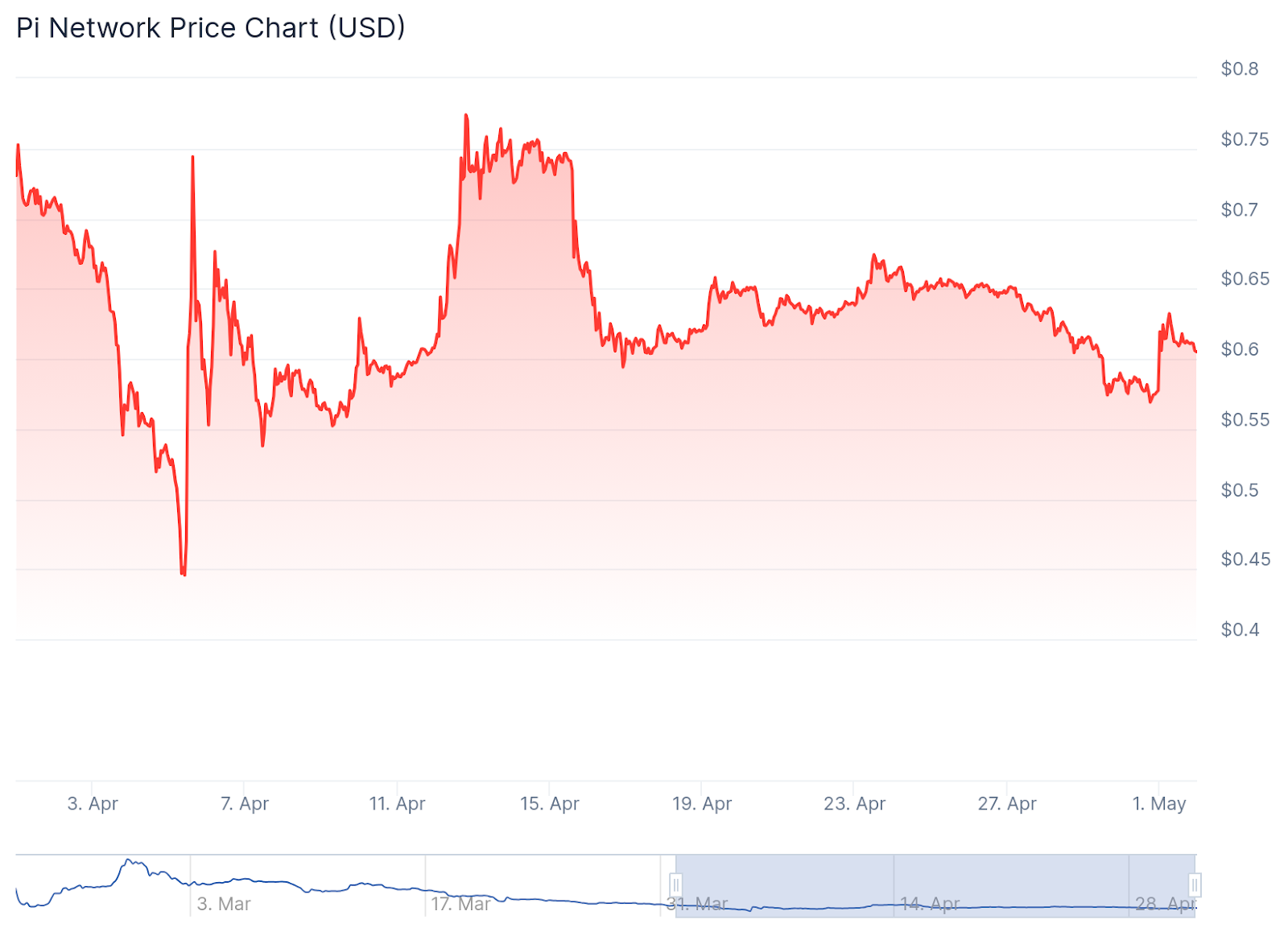

Pi (PI) -15.3%

The mobile-first cryptocurrency project that allows users to “mine” Pi coins through a smartphone app, Pi, has been one of the favorites of regular users less engaged in crypto trading and more in mobile mining.

While Pi does not require any advanced hardware to mine, the overall mining returns have been in decline for several years, as the coin keeps falling in price. In fact, April saw Pi drop by another 15%.

It is worth noting that Pi is relatively new to the crypto market, having gone through its ICO on 20 February, 2025.

This also limits the ability for investors to analyze the price action on the Pi performance chart, as there are only 2 months of data available for scrutiny.

Uniswap (UNI) -15%

A familiar name on our list, Uniswap is one of the largest decentralized exchanges (DEXs) on the Ethereum blockchain, facilitating automated token swaps using liquidity pools instead of traditional order books. Powered by smart contracts, it allows anyone to provide liquidity and earn fees, or swap tokens without intermediaries. While Uniswap has more utility than most entries on our list, the coin has seen double-digit declines in price over the course of April, dropping 15% in market value over this period.

Declining activity on pre-ICO coins can be attributed to this slowdown, as well as the broader indecision across the global crypto market.

Conversely, solid fundamentals mean that Uniswap could easily bounce back as soon as volatility decreases on the crypto market.

Cronos (CRO) -14.2%

Cronos is the blockchain network developed by Crypto.com, aimed at delivering scalable, low-cost DeFi, NFT, and Web3 applications. Built with Cosmos SDK and compatible with Ethereum Virtual Machine (EVM), Cronos enables seamless dApp deployment and cross-chain interoperability.

While Cronos declined by over 14% throughout April, the overwhelming activity across meme coins means that the market has not finalized its recovery from the bearish trend of February and March. Investors can be hopeful of a comeback in the coming months, as the broader market sentiment seems to be growing, which can boost the returns of Cronos in the process as well.

Conclusion

After a difficult period in February and March, the global crypto market has shown some signs of recovery in April, with Bitcoin reaching above $95,000, as meme coins drive the bulk of the growth throughout the month.

The last week of April was particularly fruitful and saw several projects jump by a double digit percentage. However, the broader crypto market is still quite volatile and showing signs of indecisiveness. Therefore, investors seeking more stable growth need to be more patient in the coming months, as more difficulties may be ahead. The uncertainties surrounding tariffs and the high probability of a U.S. recession loom heavily over the crypto market, making it challenging for sentiment to show drastic improvements.

Leave a Reply