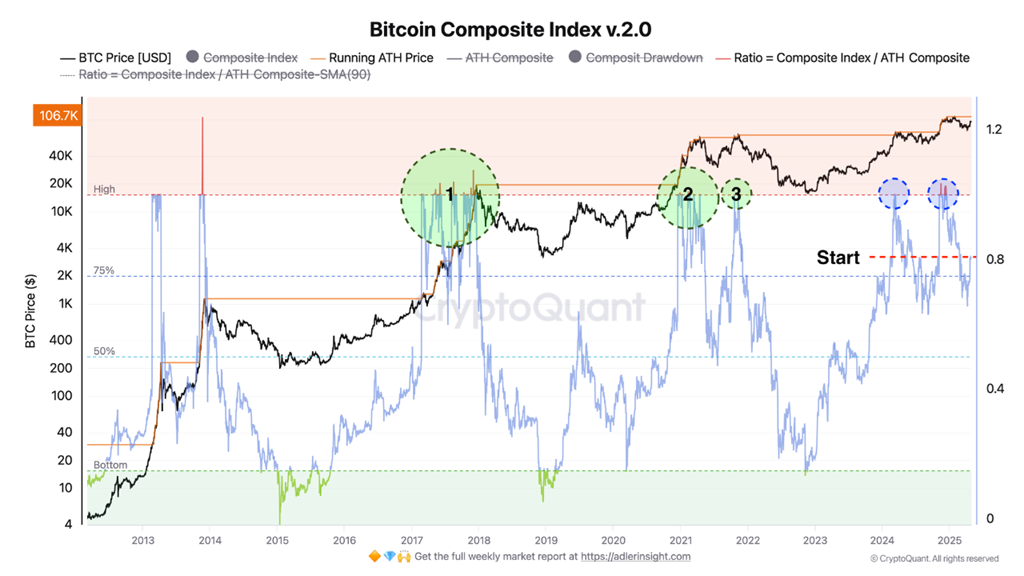

Cryptocurrency analytics firm CryptoQuant has published a new analysis of Bitcoin’s potential price movements over the next six months.

The report, prepared in line with on-chain data, states that the current momentum is in the “initial rally” region. According to CryptoQuant, this situation may be the harbinger of a new upward wave in Bitcoin.

The analysis highlights three different scenarios for Bitcoin:

Optimistic Scenario (Bull Market)

According to the analytics firm, if the on-chain ratio breaks and sustains above the 1.0 level, on-chain metrics such as NUPL and MVRV will signal a new bullish momentum, in which case Bitcoin could reach the $150,000 to $175,000 range, a move similar to the 2017 and 2021 cycles.

Basic Scenario (Consolidation Period)

If the ratio remains between 0.8 and 1.0, the market is expected to enter a broad consolidation process in the $90,000 to $110,000 band. In this scenario, investors will maintain their current positions but be cautious about new purchases.

Pessimistic Scenario (Correction Action)

A decline in the ratio to 0.75 levels could lead to short-term investors turning to profit taking, which could cause the price to drop to the $70,000 to $85,000 range. However, CryptoQuant believes that this scenario is less likely, noting that a correction has already occurred recently.

CryptoQuant’ın paylaştığı, onchain oranını gösteren grafik.

*This is not investment advice.

Leave a Reply