Following a notable surge, Ethereum has approached a critical resistance zone around $1.8K and has begun losing momentum. Nevertheless, the emergence of a bearish divergence suggests a potential short-term corrective consolidation before the next bullish continuation.

Technical Analysis

The Daily Chart

Following the substantial price increase as of late initiated by strong buying pressure at the critical $1.5K support level, ETH has reached a significant resistance zone near $1.8K. This upward displacement has resulted in the formation of a fair value gap, highlighting the presence of smart money on the buyers’ side. However, the $1.8K region coincides with a prior order block, likely filled with supply, making it a formidable barrier.

Consequently, Ethereum is expected to enter a temporary consolidation phase, potentially followed by a minor correction before the next major move. Should buyers manage to breach this resistance, the next target would be the crucial $2.2K level.

The 4-Hour Chart

On the lower timeframe, ETH’s bullish market structure shift was confirmed after a breakout above a multi-month descending channel, leading to a strong surge toward the $1.8K resistance zone. This level aligns with previous significant swing lows, reinforcing its importance. However, momentum has stalled upon reaching this critical threshold, with the price entering a low-volatility consolidation phase.

Simultaneously, a bearish divergence between the price and the RSI indicator has emerged, suggesting the likelihood of a short-term corrective move. As a result, extended consolidation or a minor pullback is anticipated before any further bullish breakout attempt.

Onchain Analysis

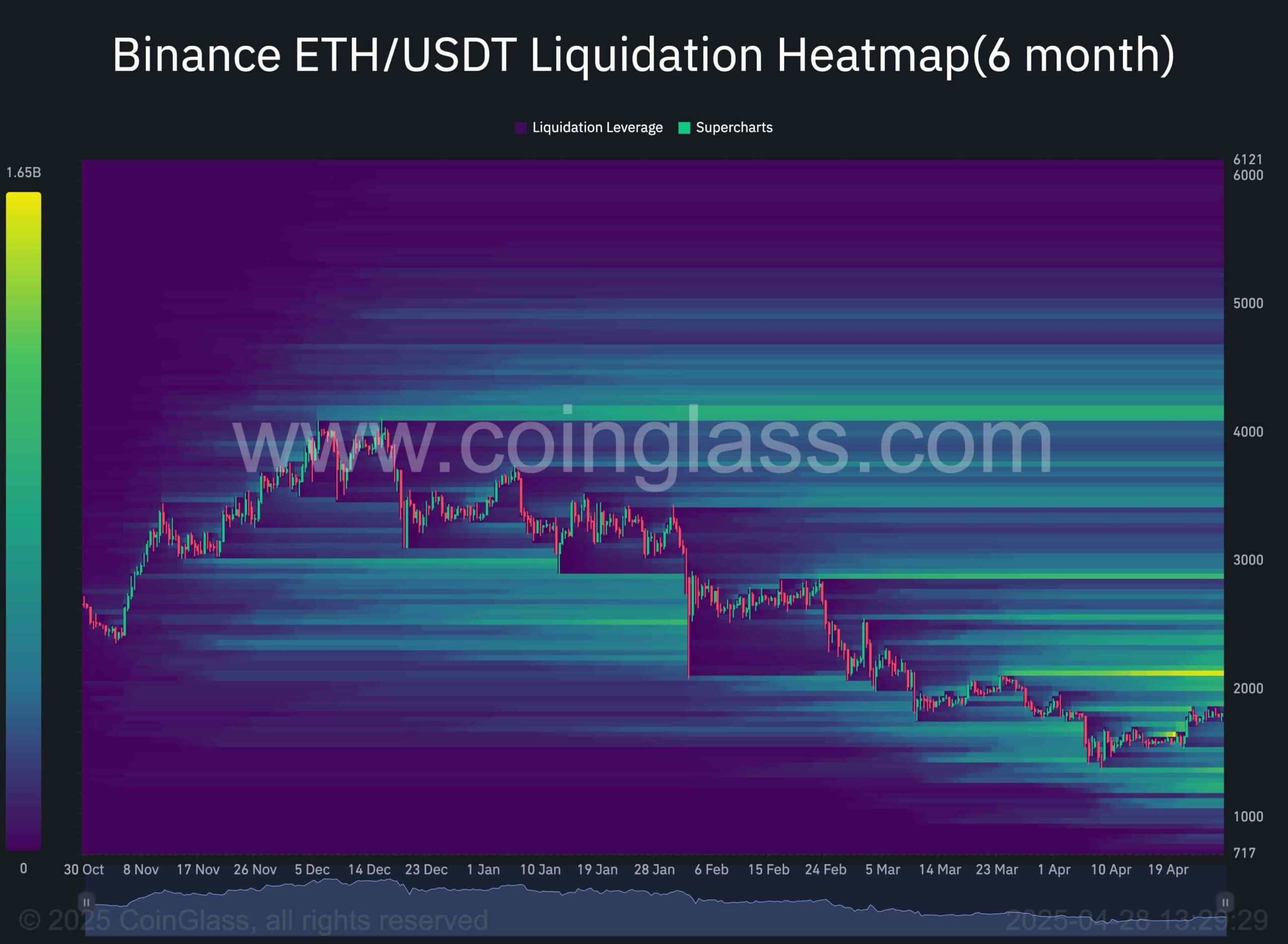

The Binance liquidation heatmap continues to offer valuable insights into Ethereum’s current market structure and potential future price movements. Liquidity zones, often clustered around key psychological levels, tend to act as magnets, attracting the price as market participants seek to trigger stop-losses and liquidations.

Following the recent significant downtrend, a sizable concentration of liquidation levels has formed just above Ethereum’s previous swing high around the critical $2K mark. Historically, during periods of recovery or bullish sentiment, markets are drawn toward such liquidity pockets, as institutional players and smart money participants look to exploit trapped sellers by triggering forced liquidations.

Currently, Ethereum’s price action indicates growing strength, having successfully rebounded from the key $1.5K support area and reclaimed important technical levels. Should the asset continue its upward momentum and enter the $2K liquidity cluster, a cascade of short liquidations could be unleashed. This would likely inject additional volatility and amplify buying pressure, pushing Ethereum rapidly toward the next critical resistance zone near $2.5K.

Leave a Reply