Litecoin (LTC)’s recent price recovery continues to display multiple twists and turns triggered by an extremely volatile market. Today, crypto analyst, the IntoTheBlock, disclosed that the recent price jump is driven by long-term holders’ accumulation based on UTXOs (Unspent Transaction Outputs) metrics.

This chart shows $LTC belonging to long-term holders based on UTXOs.

These long-term Litecoin holders display distinct patterns across market cycles.

The red boxes mark wallets that accumulated in the previous bull run and have been holding for 3 to 5 years. They tend to sell… pic.twitter.com/KTU64nZPA7

— IntoTheBlock (@intotheblock) April 24, 2025

UTXOs show rising LTC market activity

In a post shared on X, the market analyst disclosed that Litecoin is experiencing token re-accumulation mainly driven by whales, reflecting a similar trend that occurred 3 to 5 years ago.

The term “UTXOs” means the remaining balance of a digital asset transaction that has not been spent by investor. This tool can be utilized to understand the market sentiment, investors’ behaviors, and price cycle mechanisms.

Normally, UTXOs older than five months (155 days) indicate long-term holders. On the other hand, those who hold crypto for less than five months (less than 155 days) are short-term holders, typically considered as “weak” hands.

The above metrics shows the percentage of Litecoin tokens held for the last 5 months has been increasing, similar to the accumulation patterns seen three to five years ago. This trend shows a holding behaviour, whereby holders currently avoid selling their tokens despite ongoing heightened volatility.

Historically, this form of resilience among Litecoin investors has contributed a significant role in creating market declines and triggering new upturns. As long-term holders keep buying, the available circulating supply declines, making Litecoin scarcer.

Based on this behavior, the metrics show that Litecoin’s current market situation is more of a healthy consolidation. The data suggests that many traders and investors still see Litecoin as a valuable long-term investment, strengthening the prospects for a bullish continuation.

LTC price correction appears ending

Of late, Litecoin has been under an impressive buy pressure, as traders and whales appear purchasing, resulting to a noticeable increase in the asset’s price. However, today, the token’s value dropped by 3.1% over the past 24 hours, currently placing its price at $81.62.

The current price of Litecoin is $81.62.

Despite today’s price downturn, LTC has displayed resilience, signifying a possible future price rebound. Its price has been up 9.0% and 9.9% over the past weeks and two weeks ago, respectively. The recent surge in LTC’s price happens after substantial accumulations by whales and traders. The sustained acquisitions have helped reverse a prolonged downtrend noticed several months ago. The recent buying activity shows that the correction phase is coming to an end, as savvy investors appear capitalizing on current market dips to accumulate more tokens.

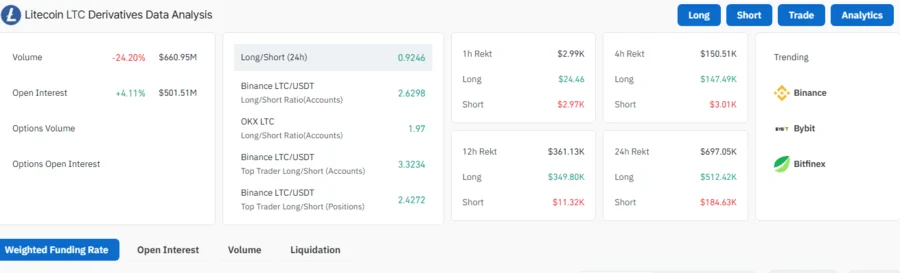

Today, Litecoin Open Interest rose by 4.11%.

Another crucial tool used to assess market sentiment is the Open Interest (OI) indicator. Today, metrics from Coinglass show that Open Interest for LTC rose by 4.11% from yesterday, indicating that traders are paying premiums to maintain their future positions. This shows that derivatives traders are enthusiastic about LTC’s future price actions.

Leave a Reply