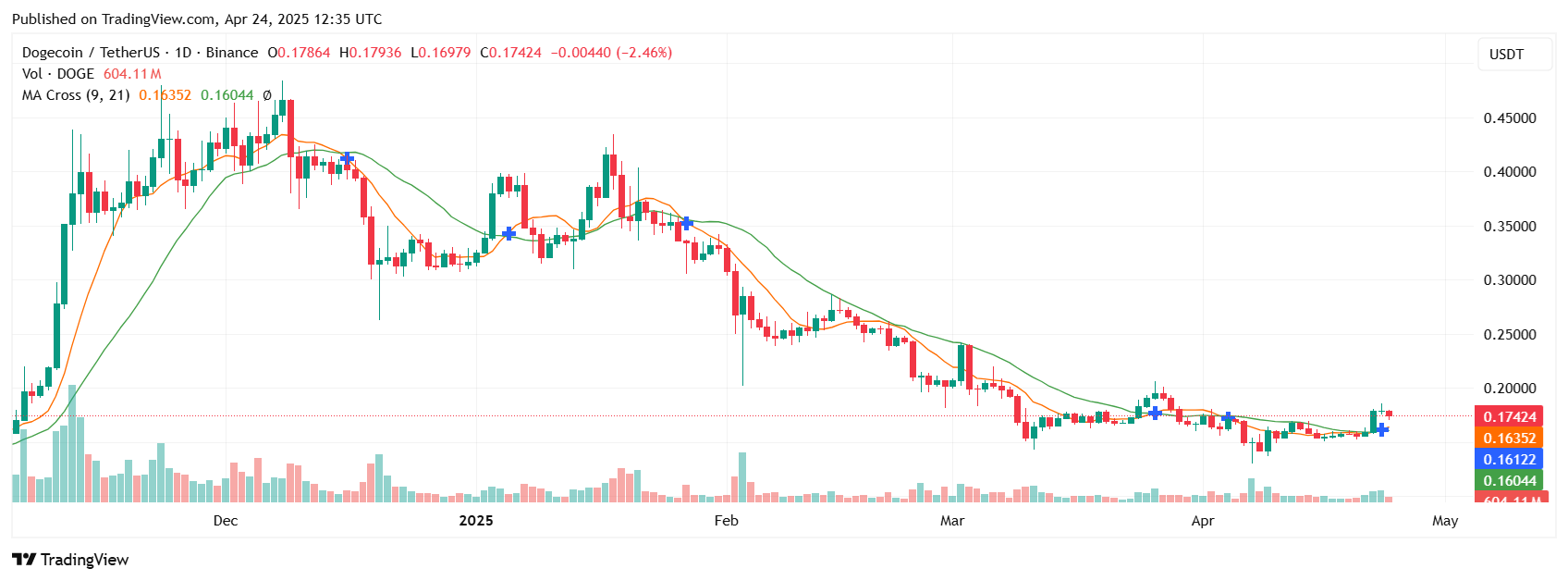

Dogecoin (DOGE), the leading meme coin on the cryptocurrency market, is facing strained price action. The current technical setup of DOGE shows that it is facing a death cross, which could impact its future outlook.

Dogecoin hourly death cross signals short-term weakness

According to data, DOGE’s hourly chart shows that the menacing death cross is fully formed, a trend that marks a bearish signal. The full formation of the death cross implies that short-term momentum is weakening compared to the long term.

This development could trigger traders to consider closing their long positions. Such a move could ignite selling pressure on the market and lead to a further decline in the price of DOGE.

As of press time, DOGE was changing hands at $0.1742, representing a 5.57% decline in the last 24 hours. The meme coin had dipped to a low of $0.1703 before posting a slight rebound in the day’s trading.

The slight recovery has sparked hope among coin holders. Notably, per DOGE’s daily chart, the death cross is not fully formed, implying that the trend could reverse despite its hourly chart indication.

Market activity could likely invalidate the hourly chart outlook and help the asset reset its upward journey.

A significant factor that could influence this is investor sentiment, which is currently low as the trading volume has dropped by 21.01% to $1.6 billion. If this metric witnesses an increase, it could fuel the anticipated reversal.

Open interest offers glimmer of hope

As reported by U.Today, DOGE recorded a 5% price gain after its trading volume skyrocketed by 80% recently. There is always a correlation between price and trading volume on the market, as an uptick in this metric catalyzes price increases.

Meanwhile, after an initial drop, DOGE’s four-hour open interest shows potential, increasing by 1.99%. If the meme coin sustains this trend, it could reverse the trend to a bullish one.

Leave a Reply