The price of Bitcoin has surpassed $93K, fueled by key resistance breakouts and soaring ETF inflows. Will it break the $106K barrier next?

With a sudden turnaround in the crypto market, Bitcoin has surged past the $93,000 mark. This bullish rally is accompanied by a massive spike in open interest and substantial inflows into Bitcoin ETFs.

At present, the recovery marks multiple key resistance-level breakouts, hinting at a potential bullish extension. Will this upward momentum result in a breakout to $106,000? Let’s dive in.

Bitcoin Price Analysis

As highlighted in our previous articles, the breakout rally from Bitcoin’s falling wedge pattern continues to gain momentum. Furthermore, yesterday’s 6.83% surge marks a bullish breakout of a double-bottom pattern.

Over the past four days, consecutive bullish candles have led to an 11% price surge. Additionally, the sharp increase in bullish momentum has reversed the trend in the 50-day EMA, reducing the likelihood of a death cross with the 200-day EMA.

Currently, Bitcoin is trading at $93,681 — significantly higher than its exponential moving averages. Moreover, the uptick in the Chaikin Money Flow Index, from 0.04 to 0.17, signals strong capital inflow.

However, this inflow trend has struggled to surpass the 0.16 level since late January. A sustained move above this level could potentially drive Bitcoin to a new swing high.

The recent double-bottom breakout has pushed the price past the 78.60% Fibonacci level at $91,780, increasing the likelihood of an extended bull run toward the $106K supply zone.

If the broader market continues to build momentum, a breakout above $106,000 could propel Bitcoin toward the $127,800 target, which aligns with the 1.272 Fibonacci extension level.

Bitcoin Open Interest Nears All-Time High

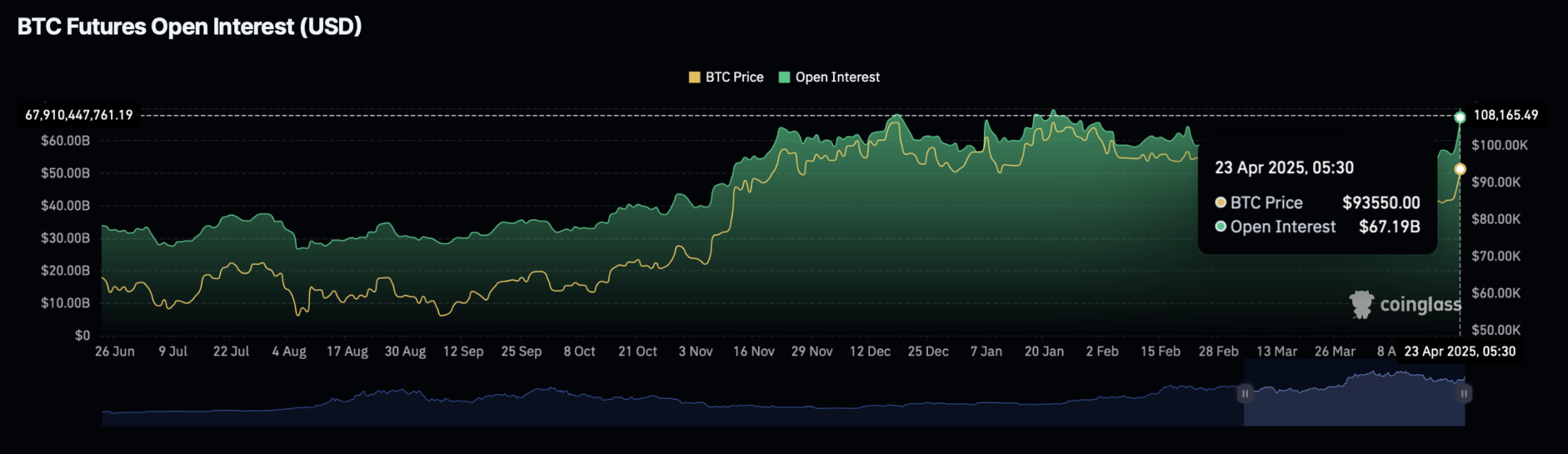

Interest in the derivatives market continues to climb as Bitcoin’s rally gains traction. According to Coinglass, open interest in Bitcoin has reached $67.19 billion.

This marks a $9 billion increase in just the past 24 hours, bringing open interest to levels last seen in late January.

As Bitcoin open interest approaches a potential new all-time high, the ongoing trend will likely continue building momentum.

Bitcoin Open Interest

Veteran Analyst Aims to Advance Bitcoin Stops ASAP

Amid the bullish trend, veteran market technician Peter Brandt has shared a slightly different perspective. He emphasized that he is a risk-averse trader who often aims to move his stop-loss orders toward breakeven as quickly as possible.

After previously holding a bearish outlook, Brandt has now disclosed that he is long on Bitcoin, anticipating a continued uptrend.

Based on his chart, the breakout rally from a trendline and consolidation range continues to gain strength. The next key resistance level lies near $99,416.

Bitcoin ETFs Hit Highest Inflow Since January 17

Notably, a major driver of the bullish momentum is the renewed surge in Bitcoin ETF inflows. On April 21, ETF inflows totaled $381 million, spiking to $936 million on April 22.

ARK and 21Shares recorded $267.10 million in inflows, while Fidelity brought in $253.82 million. This marks the third consecutive day of institutional inflows, a strong indicator of growing investor confidence. Notably, the $936 million inflow is the highest recorded since January 17.

Bitcoin ETFs

Leave a Reply