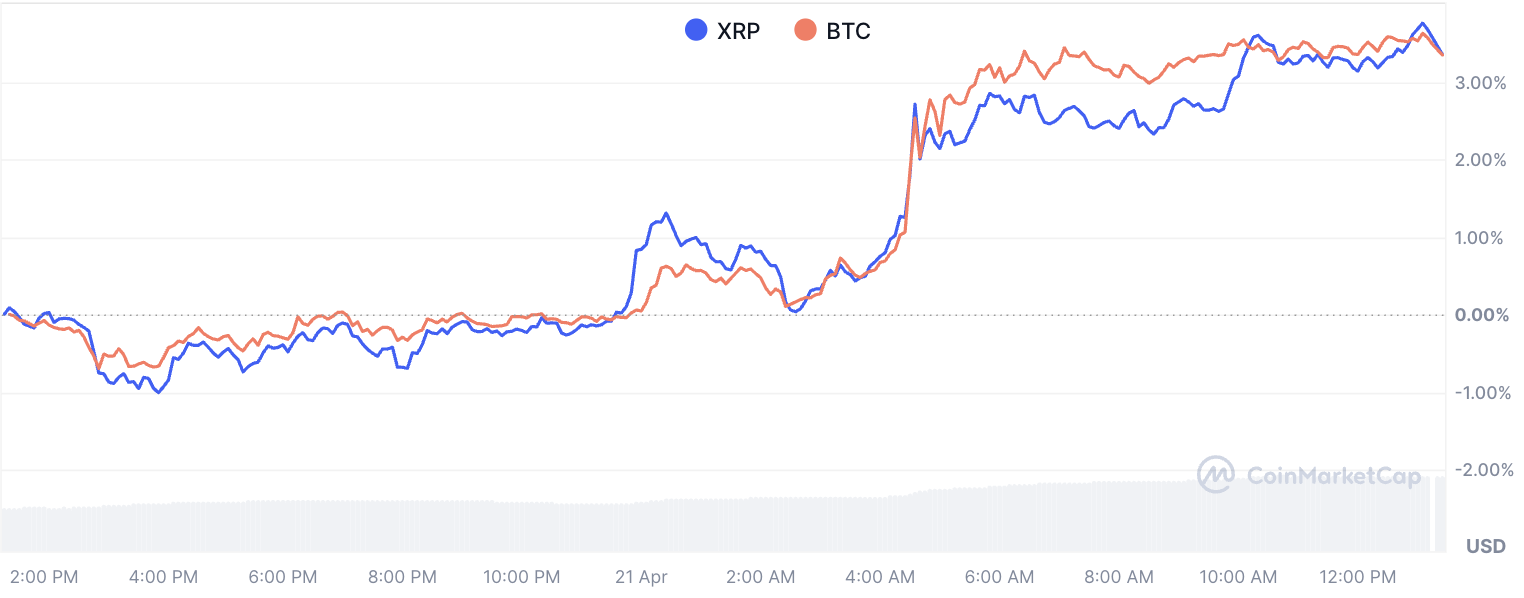

It was supposed to be another cautious Monday on the crypto market. What investors got instead was a double strike: Bitcoin (BTC) surged past $87,000 for the first time in weeks, and XRP’s trading volume spiked 73% in 24 hours, according to CoinMarketCap.

That kind of spike does not usually come out of nowhere. XRP’s price climbed to $2.13, up 3.39% on the day, while its market cap edged above $124 billion. But the real story is volume — now at $2.34 billion — suggesting a strong return of speculative energy into the asset.

The general market conjecture setup helps explain why, as reports of potential leadership changes at the Fed rattled confidence in U.S. monetary policy, sending the dollar to a three-year low and reviving interest in alternative assets.

Bitcoin responded first, breaking above $87,200. Gold was not far behind, hitting a new all time-high at $3,382. Both assets rising in tandem usually reflects deeper uncertainty.

For XRP, the surge in the volume-to-market cap ratio, now at 1.88%, is telling. It is not just price movement but engagement. It is not surprising that with the rise of Bitcoin, alternative cryptocurrencies also received a little price appreciation and liquidity kick.

So, what’s next? If pressure on the Fed continues and the dollar slide accelerates, crypto could be in for another leg higher. Bitcoin eyeing $90,000 might steal the spotlight, but XRP’s recent activity shows it is carving out its own path.

But the question now is whether this spike is the start of a bigger move or just a flash of interest on an increasingly unpredictable macro background. Anyway, the volume is back on the crypto market.

Leave a Reply