Cardano (ADA) price is flashing mixed signals as bullish analyst forecasts clash with bearish whale activity.

The market is struggling for direction amid crypto volatility, with top altcoin rallying last 24 hours.

Despite optimism from top analysts, the recent sale of 180 million ADA by whales raises concerns about price strength and continuation.

Cardano price was trading at $0.6318 on April 18, slightly above its intraday low of $0.6200.

While some analysts point to historical and technical cues supporting a breakout, current price action remains capped by long-standing resistance near $0.65.

Historical Cycle Suggests $4 ADA Target

Crypto analyst ALLINCRYPTO shared a bullish Cardano forecast based on recurring price cycles from 2020 to mid-2021.

He explained how top meme coin prices previously consolidated before surging to $3 in a historic breakout.

According to his analysis, ADA’s current market setup mirrored that pre-breakout structure from the last cycle.

Source: ALLINCRYPTO, X

Notably, analyst revealed a clear pattern of accumulation and expansion repeating over time.

He argued that ADA price could rally toward $4 if the final phase of consolidation ends in a similar breakout.

While Cardano price is well below its all-time high, he believed that the historical roadmap remains valid.

However, market conditions have changed since ADA’s previous cycle. While the analysis is>Analyst Identified Triangle Consolidation

Furthermore, crypto analyst Ali Martinez offered a complementary technical view, identifying a symmetrical triangle pattern on ADA’s daily chart.

Triangle formations usually suggest a balance between buyers and sellers before a significant breakout.

Martinez noted this tightening range in an April 18 update, predicting a potential 30% move once ADA exits the pattern.

Source: Ali Martinez, X

Interestingly, the top altcoin position inside this triangle aligns with recent price action. The asset was holding above $0.61 at the time of analysis, gradually pushing toward the upper boundary of the triangle.

A clean breakout could push the ADA price to $0.82, assuming the 30% projection plays out.

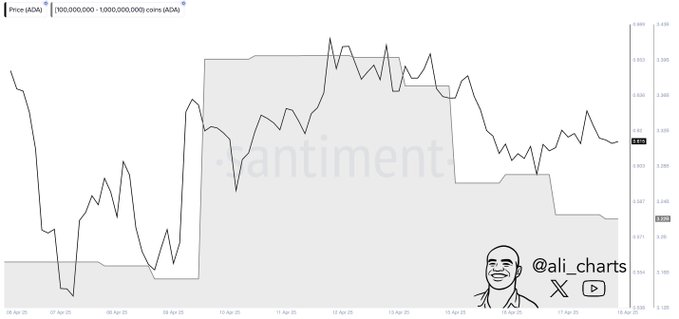

Whale Activity Highlights Growing Sell Pressure

Despite these bullish projections, on-chain data reveals a bearish trend. Recently, Ali Martinez reported that whales dumped 180 million ADA within five days, indicating a lack of long-term conviction from major holders.

These sales occurred even as Cadano price rose nearly 10% from earlier lows, reflecting a strategic exit by some whales.

Source: Ali Martinez, X

The on-chain chart showed declining whale balances during ADA’s recent bounce, which often signals distribution.

Such large transactions can suppress bullish momentum, especially in low-liquidity conditions. Historically, whale exits precede price corrections, creating headwinds for further gains.

If whale sell pressure continues, ADA price may struggle to attract enough retail volume to break resistance.

This dynamic complicates the bullish setup, especially with ADA still operating below key technical levels.

For the top altcoin price to maintain an upward trajectory, both whale sentiment and spot volume must improve.

Technical Resistance and Broader Market Bias

Cardano price has not been able to flip the macro levels into support, which explains why recent moves have been unable to give strong support.

The top altcoin price is in the overall bearish trend, supported by the crossover below the 200-day Exponential Moving Average.

This has limited several attempts at a breakout in the $0.65 to $0.67 range. On the technical analysis, there are signs of weakness as well.

The 50-day and 100-day EMAs are also situated below 200-day EMA, bearish and in line with the overall outlook.

Consequently, Cardano price may again be dragged lower and fail to get the bullish crossover or even experience volume above these moving averages.

Notably, there is also an overall decline in the sentiment on most altcoins. This makes overall buying pressure weaker and restricts ADA’s potential to rise.

By failing to rise and maintain upward momentum from overhead resistance, ADA price is likely to prolong its periods of stagnation.

Leave a Reply