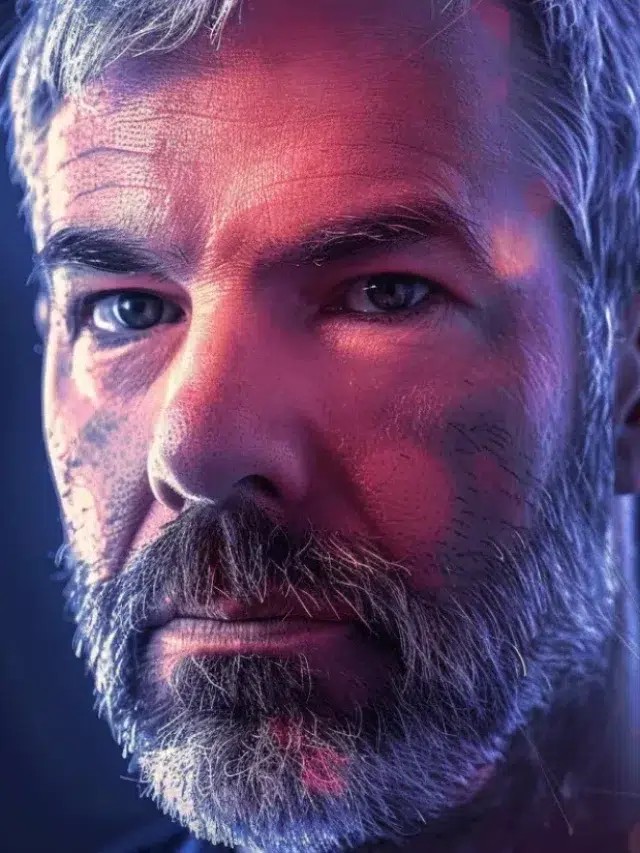

Jurrien Timmer, the head of global macro at mutual fund giant Fidelity Investments, has reiterated that gold is possibly passing the baton to Bitcoin.

“After a strong run by gold, perhaps the baton is being passed again to Bitcoin, with Bitcoin back above $100k and the two Sharpe Ratios now converging,” he said.

His assessment comes after JPMorgan recently predicted that the cryptocurrency could end up outperforming the yellow metal in the second half of the year.

Timmer has endorsed a ratio of 4:1 (gold vs Bitcoin), which would make the volatility of the yellow metal roughly equal to its digital rival.

Dr. Jekyll & Mr. Hyde personality

Timmer has stated that there is no other asset like Bitcoin, adding that the cryptocurrency’s risk-reward ratio continues to impress.

The Fidelity exec has used an unorthodox metaphor, explaining Bitcoin in terms of “The Strange Case of Dr. Jekyll and Mr. Hyde,” the gothic novella by Scottish writer Robert Louis Stevenson.

The novella revolves around Dr. Henry Jekyll, a respected London doctor who has a morally younger and depraved alter-ego (Dr. Jekyll).

Bitcoin, according to Timmer, is a very unpredictable asset due to its Dr. Jekyll & Mr. Hyde personality.

The top coin is capable of simultaneously acting as a gold-like safe haven asset and as an extremely mercurial risk asset. Earlier this year, the cryptocurrency showed its ambidextrous nature on several occasions. After trading in tandem with stocks, it started trading like digital gold during a recent tariff-induced stock market sell-off.

Leave a Reply