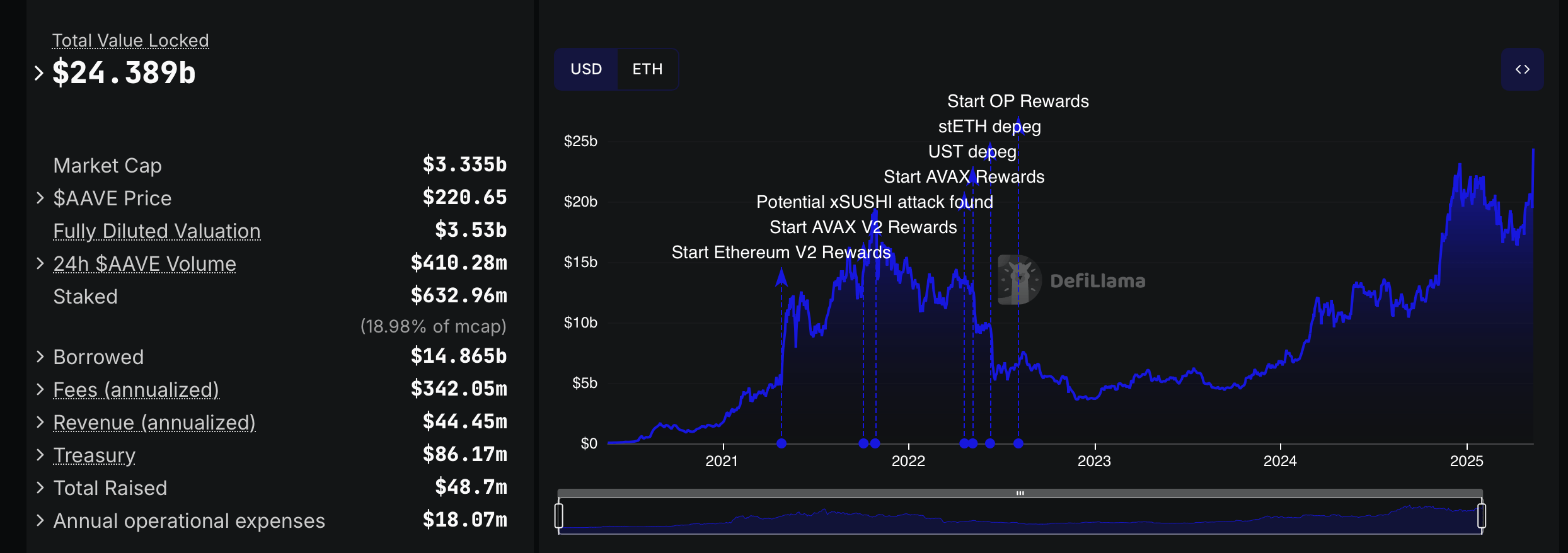

Aave’s total value locked (TVL) has reached an all-time high of $24.389 billion, signaling renewed investor confidence in the decentralized finance (DeFi) protocol.

Onchain Lending Platform Aave Sets New TVL Benchmark

The lending protocol’s latest milestone places it among the largest DeFi platforms by TVL, with a market capitalization of $3.335 billion and a fully diluted valuation of $3.53 billion. Aave’s native token, AAVE, is trading at $222 with a 24-hour volume of $410.28 million.

Source: Defillama.com

Roughly $14.865 billion is currently borrowed on the platform, with $632.96 million in AAVE staked—amounting to nearly 19% of its market cap. The annualized protocol fees stand at $342.05 million, while annualized revenue is recorded at $44.45 million. Treasury holdings total $86.17 million.

The project has raised $48.7 million to date and incurs $18.07 million in annual operational expenses. Activity on the platform appears to be supported by both institutional and retail participation as the broader DeFi sector experiences a resurgence.

Historical events plotted on the TVL chart via defillama.com reflect pivotal moments such as Ethereum V2 and Avalanche (AVAX) rewards launches, the stETH and UST’s depeg, and incentive programs like Optimism (OP) rewards.

Aave is a noncustodial liquidity protocol that enables users to lend and borrow crypto assets without intermediaries. It uses overcollateralized loans and supports a wide range of digital assets across multiple blockchains.

The decentralized finance protocol also includes features like flash loans, interest rate switching, and staking-based governance, offering users flexibility and transparency in decentralized finance operations.

Leave a Reply