Explosive institutional demand and surging ETF inflows have shattered legacy market models, triggering a dramatic reversal from a top analyst and setting the stage for bitcoin’s next breakout.

Massive Institutional Demand Forces Top Analyst to Flip on Bitcoin Bull Cycle

Bitcoin’s resilience in recent weeks has prompted a sharp change in outlook from one of the crypto industry’s most followed analysts. Ki Young Ju, founder and CEO of onchain analytics platform Cryptoquant, reversed his earlier bearish position and acknowledged that institutional inflows are significantly reshaping the landscape. On May 9, he wrote on social media platform X:

Two months ago, I said the bull cycle was over, but I was wrong. Bitcoin selling pressure is easing, and massive inflows are coming through ETFs.

The revised view reflects what Ju sees as a fundamental transformation in bitcoin’s market structure. He described the old market dynamics as predictable and driven by cyclical sell-offs from major holders. “In the past, the bitcoin market was pretty simple. The main players were old whales, miners, and new retail investors, basically passing the bag to each other. When retail liquidity dried up and old whales started cashing out, it was relatively easy to predict the cycle peak. It was like a game of Musical Chairs—everyone tried to cash out at once, and those who didn’t ended up stuck with their holdings.” The analyst emphasized that such patterns allowed for clearer timing of market tops, especially during peak retail involvement.

He explained that now the bitcoin market is being shaped by a wider range of participants, rendering previous models outdated. The market has become more diverse, with exchange-traded funds (ETFs), Microstrategy (Nasdaq: MSTR), institutional investors, and even government agencies considering buying BTC.

The Cryptoquant CEO noted that in the past, profit-taking cycles began when whales sold at market peaks, triggering widespread sell-offs and price declines. According to him, this dynamic has changed, requiring a move away from traditional cycle theories. He said new and uncertain sources of liquidity and trading volume indicate a shift as the bitcoin market increasingly integrates with traditional finance (TradFi). The executive opined:

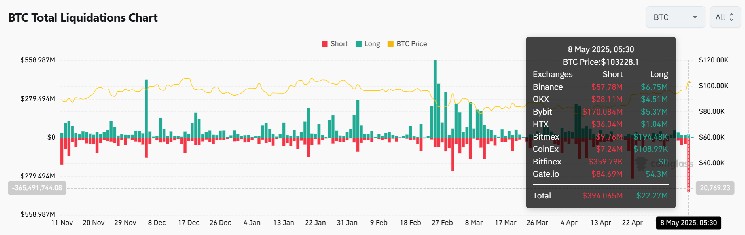

Now, instead of worrying about old whales selling, it’s more important to focus on how much new liquidity is coming from institutions and ETFs since this new influx can outweigh even strong whale sell-offs.

Despite the optimism, he still offered a cautious take on the short-term outlook: “Honestly, I still think the market is sluggish while absorbing new liquidity. Most indicators are hanging around the borderline. It doesn’t feel like a clear bullish or bearish market right now. Of course, the recent price action is extremely bullish, but I’m talking about the profit-taking cycle.”

Leave a Reply