Santiment reports large Bitcoin wallets are steadily accumulating as small holders sell, signaling potential for a breakout ahead.

Notably, Bitcoin surged above $97,000 on May 7, marking a significant price breakout following a period of tight consolidation.

Interestingly, amid the renewed momentum, broader market behavior indicates that the underlying support may be driven more by accumulation patterns than by immediate speculative interest.

Whales Accumulate as Small Holders Reduce Exposure

Throughout recent volatility, data from Santiment reveals that wallets holding between 10 and 10,000 BTC—known to correlate closely with market trends—have increased their balances. Specifically, over the past six weeks, these wallets have added 81,338 BTC, a growth of 0.61% in holdings.

🐳 As May progresses, Bitcoin’s key stakeholders are mostly moving in the right direction if you’re rooting for $100K $BTC in the near future.

Wallets with the highest correlation with crypto’s overall market health (10-10K BTC wallets) have accumulated a combined 81,338 more… pic.twitter.com/4DKhOwROgx

— Santiment (@santimentfeed) May 6, 2025

Meanwhile, wallets holding less than 0.1 BTC have reduced their balances by 290 BTC, representing a 0.60% decline. Notably, this divergence aligns with previous patterns where large wallets accumulate during downturns as small holders engage in selloffs.

The behavior of small wallets has remained consistently reactive. These holders tend to sell during dips or periods of sideways movement, while larger entities sustained gradual acquisition.

Santiment indicates that this dynamic, where retail activity contrasts with strategic accumulation, is a strong long-term signal of price bidding time before another breakout. This accumulation pattern persisted even as Bitcoin experienced local pullbacks.

Long-Term Holding Still Strengthening

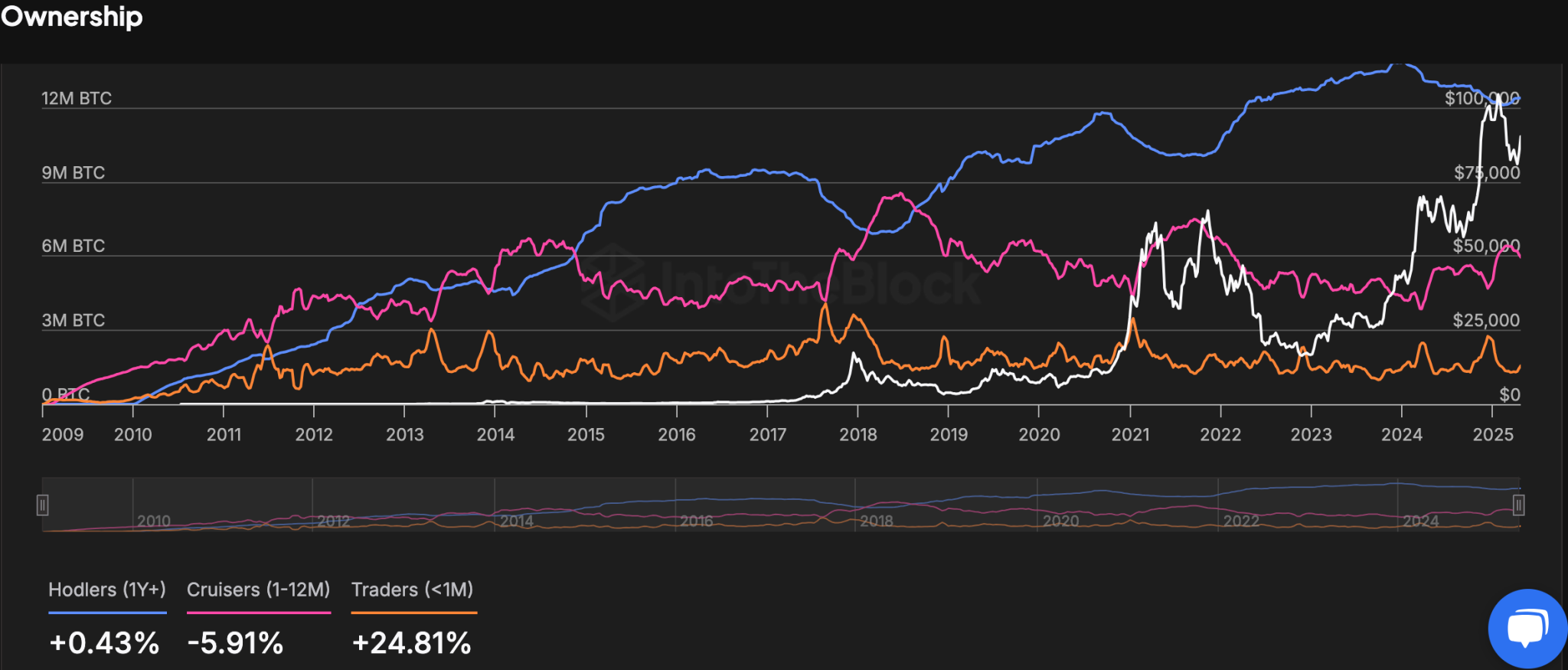

Additional on-chain analysis from IntoTheBlock supports this view. Ownership metrics show a rise of 0.43% among long-term holders—wallets holding Bitcoin for over a year—signaling sustained conviction.

Bitcoin Balance by Time Held | IntoTheBlock

However, the mid-term holder segment, or “cruisers” holding assets between one to twelve months, has decreased by 5.91%. At the same time, traders—wallets holding within 30 days—have surged by 24.81%, indicating rising speculative interest amid the recent price surge.

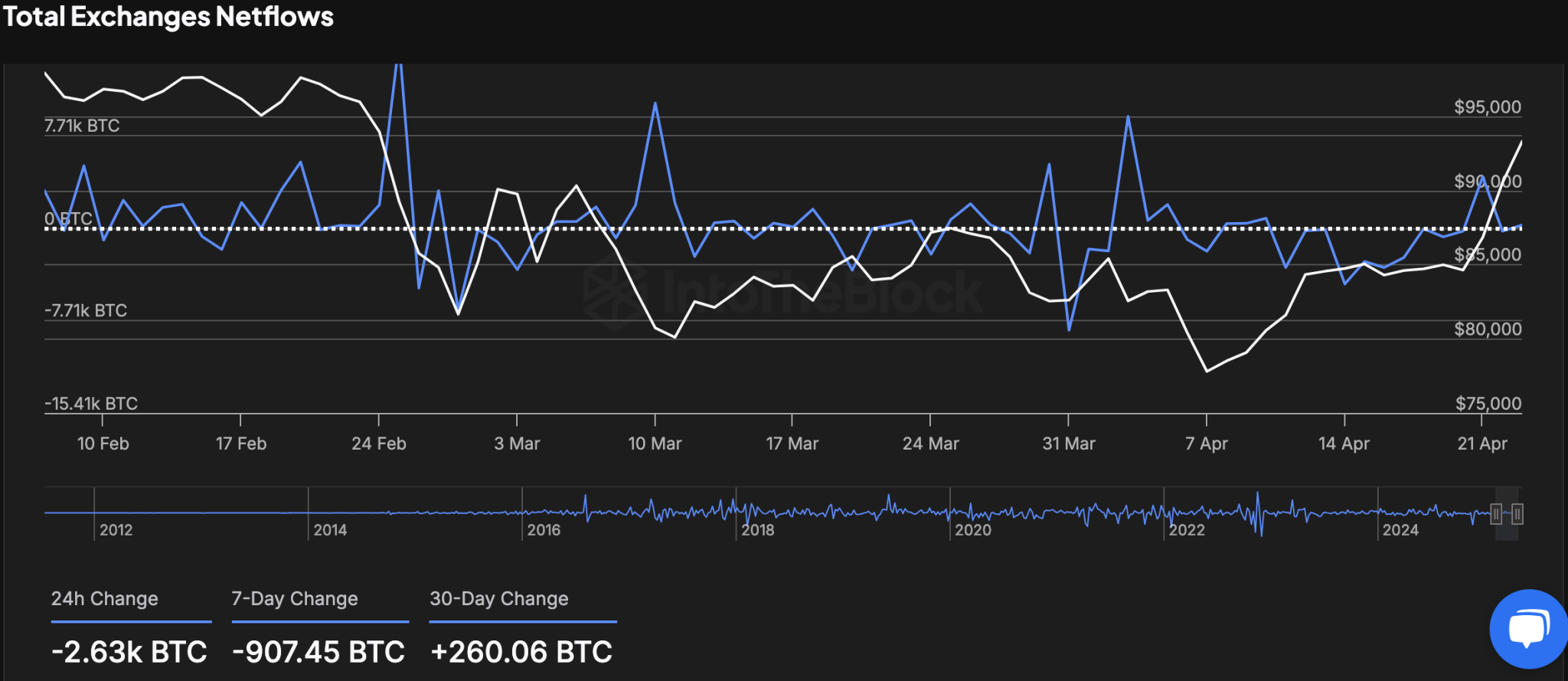

Exchange Flows and Bitcoin’s Next Move

Moreover, netflows across centralized exchanges provide further context. IntoTheBlock’s exchange data shows a 24-hour outflow of 2.63K BTC, paired with a 7-day outflow of 907.45 BTC.

Bitcoin Total Exchanges Netflows | IntoTheBlock

These figures suggest sustained movement of BTC off exchanges, often interpreted as a signal of reduced sell pressure. Over 30 days, however, exchanges saw an inflow of 260.06 BTC.

In the technical space, one market analyst on X, called King of the Charts, notes that Bitcoin is currently completing wave (v) of Minor Wave 1 under the Elliott Wave framework. The pattern projects a near-term pullback after this wave concludes, with a potential retest of the $88,500 level.

This would mark the backtest of a previously confirmed double bottom structure before advancing further. The same analyst forecasts that Minor Wave 3 could push Bitcoin toward $150K to $175K by fall.

Leave a Reply