- Developer-linked wallet sold $1.27M worth of ZEREBRO tokens.

- Fartcoin struggles to hold key support after recent rally.

- Technical charts suggest further swings are likely across tokens.

The meme coin market is experiencing heightened volatility, with projects like Zerebro, Fartcoin, and Lofi all moving sharply in opposite directions.

Zerebro (ZEREBRO) has plunged over 22% this week following a series of developments involving its developer, Jeffy Yu, including a staged death hoax and a large-scale token dump.

Meanwhile, Fartcoin is undergoing a correction after briefly touching a $1 billion market cap.

In contrast, Lofi has emerged as a breakout performer in the SUI ecosystem, soaring over 321% in the past 30 days and gaining significant investor traction.

The divergence reflects growing speculation and risk across meme coin trading desks.

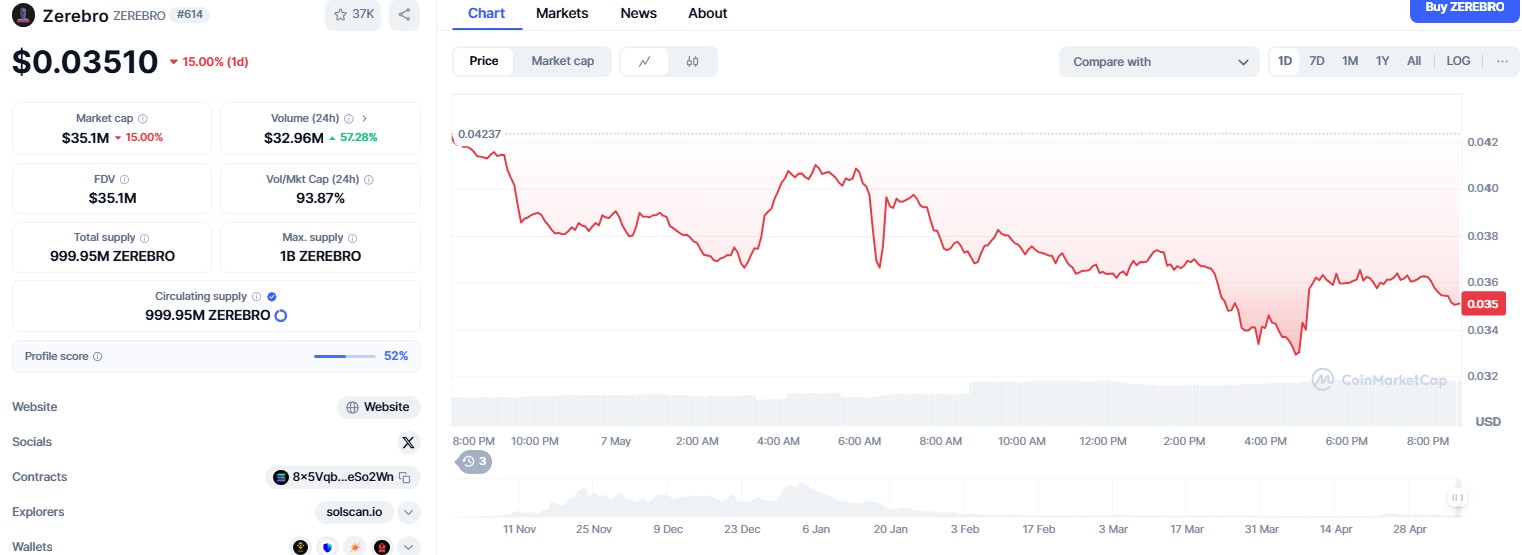

Zerebro developer hoax triggers $1.27M token dump

Zerebro (ZEREBRO), which launched in November 2024 with a maximum supply of 1 billion tokens, has seen its value tumble after a controversial episode involving its creator.

A token named $LLJEFFY was introduced on May 4, accompanied by a blog post from developer Jeffy Yu.

Days later, a fake obituary was posted on Legacy.com, and both Jeffy’s and Zerebro’s official X accounts were deleted, fuelling rumours of his death.

The situation escalated when crypto figure Daniele Sesta publicly claimed that Yu was alive, later presenting proof. Jeffy then confirmed he had faked his death in an attempt to escape mounting online harassment.

Notably, on-chain data from Lookonchain revealed that a wallet connected to Yu sold 35.55 million ZEREBRO tokens, worth approximately $1.27 million, just 11 hours before the hoax was exposed.

ZEREBRO’s price has since declined to around $0.035 as it approaches a potential death cross on technical charts.

A further drop below the $0.025 support could send it down to $0.0189.

Source: CoinMarketCap

However, if sentiment improves, the token may retest resistance at $0.041 and potentially reach $0.054 or $0.066.

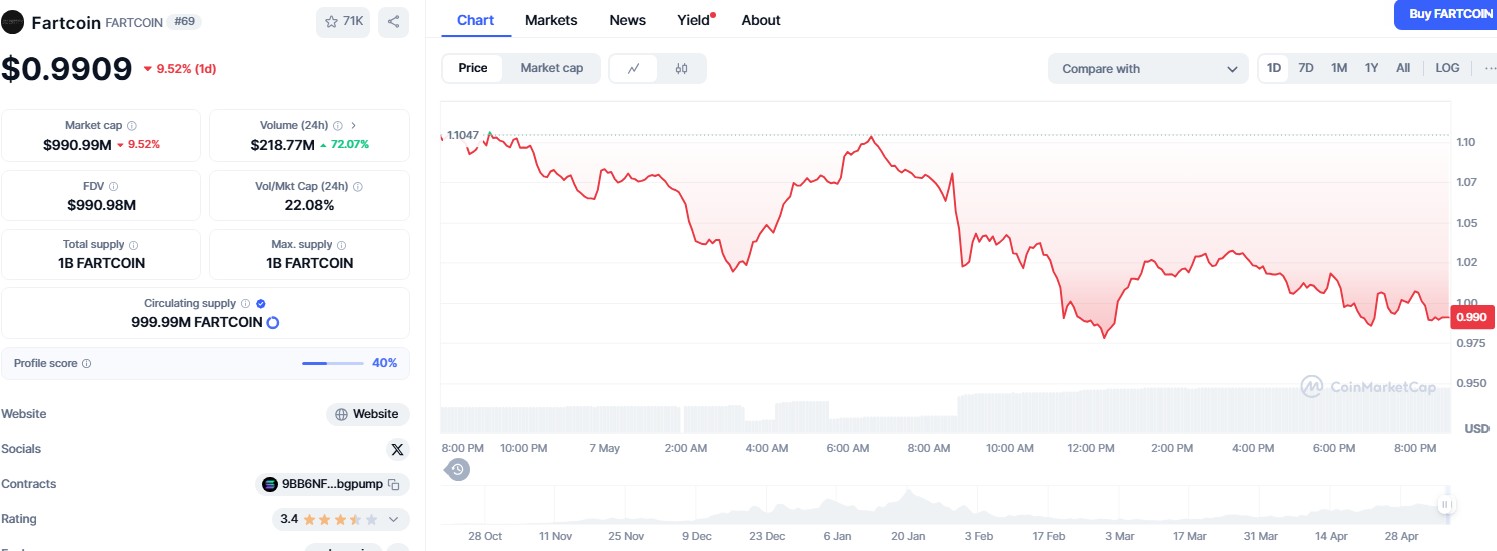

Fartcoin loses steam after hitting $1 billion valuation

Fartcoin, once a trending meme coin, is currently under pressure.

After reaching a peak valuation of $1 billion, the token has entered a correction phase.

While it still retains a significant market cap, the price has dropped back toward key technical levels.

If current losses continue, Fartcoin could fall to support at $0.944.

A breach of this level may lead to further declines toward $0.797 or $0.717.

On the upside, a recovery could target resistance at $1.06, and surpassing that may open the door to $1.20 or even $1.28.

Source: CoinMarketCap

The decline coincides with lower social media mentions and a decrease in meme trading volume, suggesting waning enthusiasm compared to its peak.

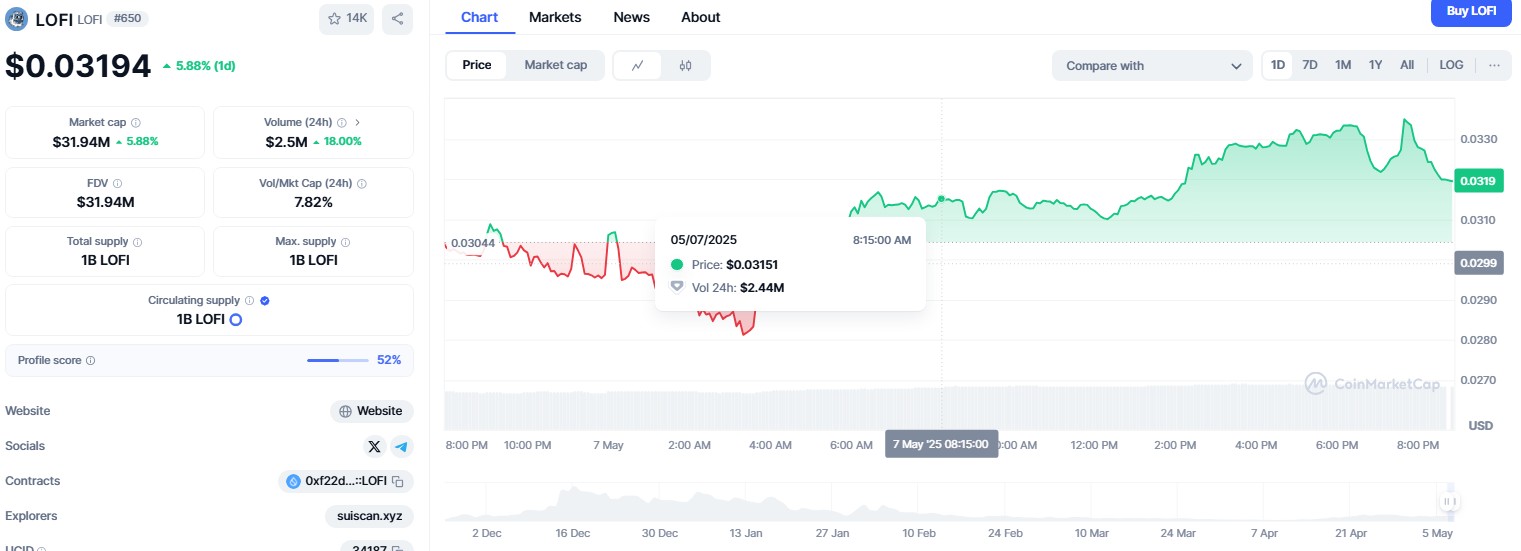

Lofi outperforms with a 321% rise in 30 days

LOFI, which launched in December 2024, has emerged as a top performer within the SUI meme coin ecosystem.

With a circulating and maximum supply of 1 billion tokens, LOFI currently holds a market cap of $31.95 million.

It posted a 13% gain in the past 24 hours and is up 321% over the last month.

Source: CoinMarketCap

The token’s price is currently approaching resistance at $0.042. If the uptrend holds, LOFI could rally to $0.0546.

On the downside, support lies at $0.025, and a break below this level may trigger a correction to $0.0228.

Lofi’s rapid rise positions it as a major contender within the SUI ecosystem, where dominance is still up for grabs.

The momentum suggests that traders are rotating capital into newer meme coins with perceived growth potential.

Market sentiment remains mixed amid rising volatility

The divergent performances of ZEREBRO, Fartcoin, and LOFI reflect a broader theme of unpredictability in the meme coin space.

While developer drama can erode investor trust, as seen with ZEREBRO, strong technical momentum and ecosystem hype, like in the case of LOFI, can still draw in substantial capital.

As retail traders and speculators continue to chase high-risk, high-reward tokens, meme coins remain one of the most volatile segments of the crypto market.

Short-term sentiment, community engagement, and social media narratives continue to exert disproportionate influence on prices.

Leave a Reply