Strategy Chairman Michael Saylor has insisted that Bitcoin would become a global powerhouse asset, predicting an ambitious surge in valuation.

Saylor has dropped another Bitcoin bombshell. Interestingly, each of his statements in a public setting always emphasizes the bullish trajectory of the pioneering cryptocurrency.

Yesterday, he reiterated Bitcoin’s bright future outlook, predicting its growth to become a global powerhouse. Furthermore, he insisted that the asset’s valuation would hit $280 trillion one day.

Saylor Says Bitcoin to $280T

Speaking at Strategy’s Bitcoin for Corporations conference yesterday, Saylor stressed that what most financial advisors term “smart investments” have failed to outperform the S&P 500’s 10% performance in the past ten years. Some of them include hedge funds, pension funds, and endowments.

Meanwhile, the S&P 500, while profitable, has seen its performance trounced by Bitcoin, an asset some once scorned for its volatility. Saylor shared that the pioneering cryptocurrency has an annualized ten-year performance of 79% and has grown to become one of the best-performing assets in the last decade.

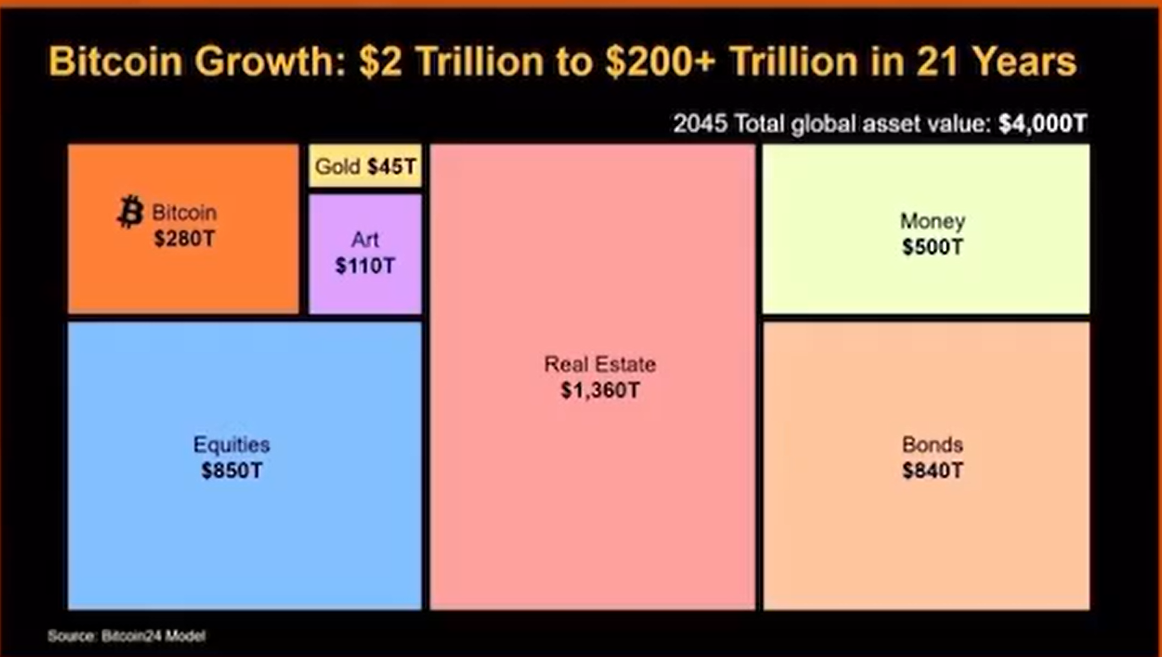

Furthermore, Saylor reiterated that Bitcoin would grow from a $2 trillion to a $280 trillion asset in the next 20 years. He emphasized that while its valuation would still not match the bonds and equity market, it would become more noticeable.

Bitcoin Cap Trajectory per Michael Saylor

His projection also identifies that Bitcoin would be worth over five times the value of gold by 2045. Interestingly, several Bitcoin maximalists have aligned with this long-standing projection, citing a divergence from gold to “digital gold” as the financial scene evolves.

Bitcoin’s Price at $280T Market Cap

Currently at $96,627, Bitcoin’s market cap stands at $1.92 trillion. At $280 trillion, the premier asset’s valuation would have grown a staggering 14,483%.

Meanwhile, at the current circulating supply of 19.8 million, a $280 trillion market cap would culminate in a price of $14.14 million per coin. However, at a maximum cap of 21 million, Bitcoin would trade at $13.33 million.

Interestingly, this aligns with Saylor’s parallel prediction that Bitcoin would hit $13 million by 2045, with widespread adoption as a catalyst.

Strategy and AI

Notably, Saylor also revealed Strategy’s embrace of artificial intelligence (AI), an emerging sector gaining traction in the global market. He shared that the business intelligence firm leverages the powerful digital tool in making deep research and financial decisions.

Furthermore, the executive chairman noted that Strategy’s convertible preferred stock products, Strike and Strife, emerged with the help of AI. For the uninitiated, Strategy launched the Perpetual Strike Preferred Stock (STRK) and the Perpetual Strife Preferred Stock (STRF) earlier in the year as a means of raising capital through stock offerings to buy Bitcoin.

Saylor disclosed that Strategy built the Nasdaq-listed products solely with artificial intelligence, stressing it was the first AI-generated securities product in the industry. Meanwhile, he noted that more productive inventions like that would come into existence, and they all will use Bitcoin as digital capital.

Leave a Reply