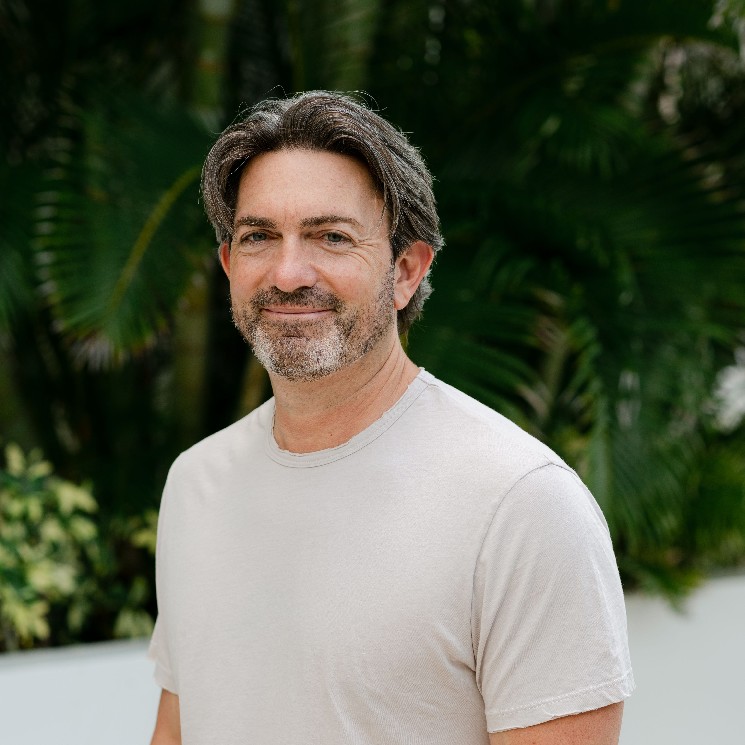

Today, Changpeng Zhao (CZ), former CEO of Binance, shared on X that he advised Kyrgyzstan to include Bitcoin and Binance Coin (BNB) as foundational assets for a proposed National Crypto Reserve. This happened after his appointment to the country’s National Crypto Committee by President Sadyr Japarov, where the committee’s goal is to develop a comprehensive strategy for digital asset adoption and regulation.

CZ was also photographed near a car with a Kyrgyzstan license plate “888 BNB,” reflecting his association with Binance Coin. This sparked some speculations in the community, but he clarified that the car isn’t his.

In other relevant news, Binance has partnered with Kyrgyzstan to launch Binance Pay, facilitating nationwide crypto payments. The collaboration also includes blockchain education programs through Binance Academy, targeting government officials, financial institutions, and the general public.

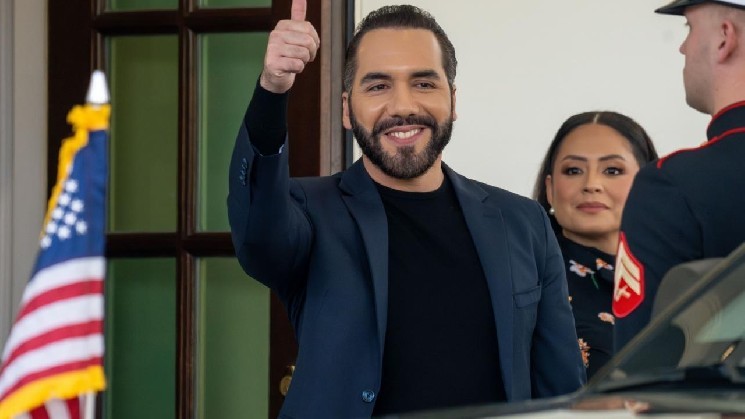

Should Kyrgyzstan adopt CZ’s recommendations for its reserve, it would join a small but growing list of nations actively integrating cryptocurrencies into their national financial frameworks.

Kyrgyzstan’s Broad Crypto Push

This is just one of the several crypto moves the country has made lately. Last month, Kyrgyzstan’s president signed a law authorizing a pilot project for a Central Bank Digital Currency (CBDC). The digital som (national currency in digital form) will be issued and managed centrally by the National Bank of Kyrgyzstan, with plans for a full rollout by 2027.

Also, the country is preparing to launch USDKG, a stablecoin pegged to gold and indexed to the US dollar. Initially backed by $500 million in gold, the reserves are expected to grow to $2 billion.

A Growing Global Trend

CZ’s advice to Kyrgyzstan seems to be a part of a larger movement lately, where countries are considering the adoption of digital assets to improve economic resilience and modernization. At the start of this year, Bhutan’s Gelephu Mindfulness City already announced plans to include BTC, ETH, and BNB in its strategic reserves.

Then, Donald Trump signed an executive order in March 2025 to establish a Strategic Bitcoin Reserve and a Digital Asset Stockpile, positioning the US as a big holder of Bitcoin and signaling a shift towards embracing digital currencies at the national level.

This growing trend has the potential to be very good for the crypto industry. As more and more nations adopt digital assets, institutional confidence in cryptocurrencies may grow, which could lead to broader acceptance and integration into traditional financial systems.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Leave a Reply