BlackRock, the world’s largest asset manager with over $10 trillion in assets under management, has made headlines again — this time with a big move into Ethereum (ETH). The firm just purchased 10,955 ETH worth approximately $20.1 million.

This purchase follows a previous ETH investment from BlackRock totaling $54 million, showing a clear and growing interest in Ethereum-based ETFs. At the same time, BlackRock also poured $674.91 million into Bitcoin ETFs, showing continued confidence in major digital assets.

BREAKING 🚨 BLACKROCK JUST BOUGHT $20M WORTH OF $ETH pic.twitter.com/bLqf6GInsc

— That Martini Guy ₿ (@MartiniGuyYT) May 3, 2025

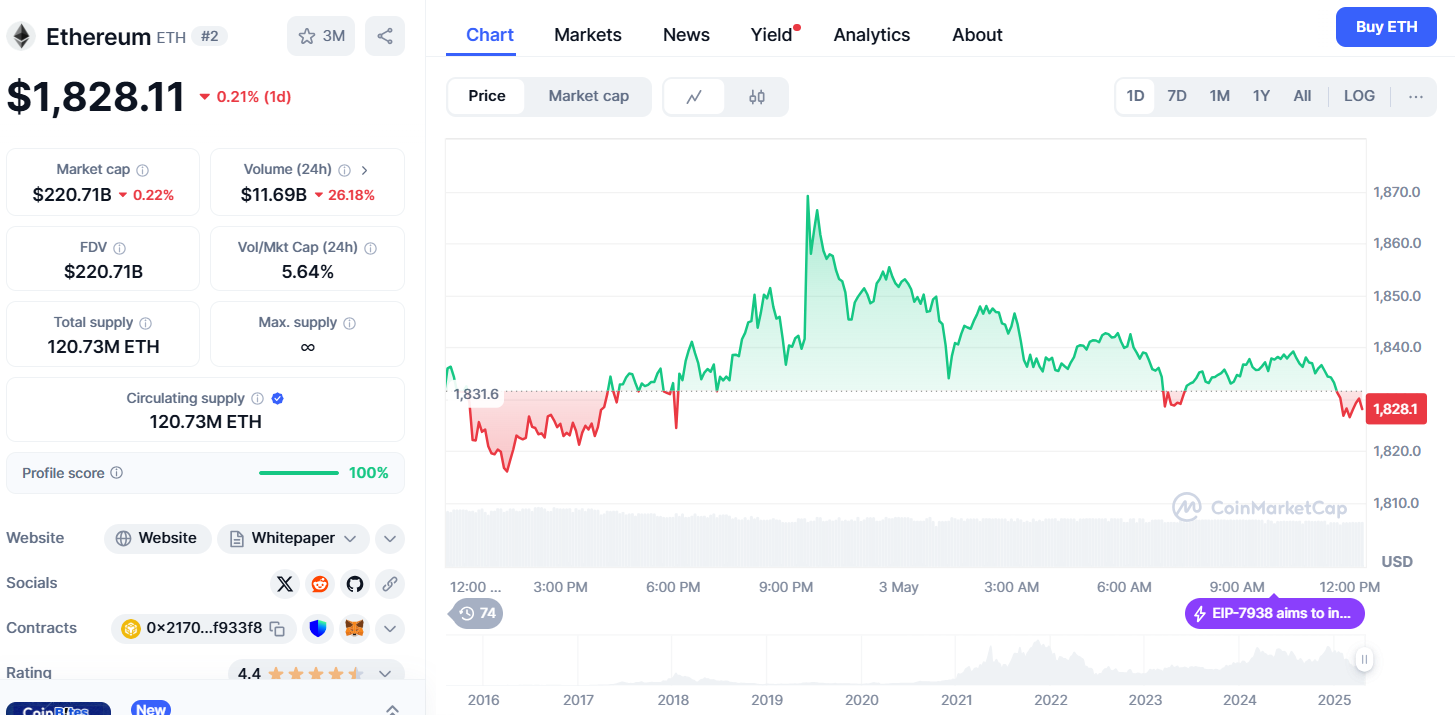

ETH Price Muted Despite Major BlackRock Investment

Despite BlackRock’s aggressive buying spree, Ethereum’s price has remained relatively stagnant. ETH is currently hovering around the $1,860 mark, showing little to no immediate reaction to the news. This lack of movement has surprised some market watchers, especially considering the scale of the investment.

Analysts propose the market may still be absorbing the news or awaiting clearer technical signals before committing to a significant directional move.

Ethereum recently tried to climb past $1,872 but was pushed back down. After that, the price fell to around $1,813, which is seen as a short-term support level. So far, this support has held, meaning the market might still try to move higher.

Related: Ethereum’s Road to Recovery: Will New Market Trends Spark a Bullish Turn?

Technical Outlook: Can ETH Hold Support for Push to $1900?

So far, the $1,813 area has acted as short-term support. If Ethereum can maintain trading above this level, some technical analysts see potential for a move higher towards the $1,925 resistance target.

However, if buying pressure falters and ETH breaks below the $1,813 support, focus would likely shift to the April 30th low around $1,732. Falling below that might signal a deeper pullback, though it wouldn’t necessarily mean the upward trend is over—just that the market would need more signs before moving higher again.

Source: CoinMarketCap

Related: Ethereum’s Q2 Recovery: What Historical Trends Say About Its Potential in 2025

For now, Ethereum remains in a state of technical indecision. Still, the scale of BlackRock’s recent moves suggests that institutional interest in Ethereum is not only intact but growing—possibly setting the stage for larger market moves ahead.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Leave a Reply