Immutable’s utility token, IMX, is today’s top-performing altcoin, climbing nearly 15% over the past 24 hours. As of this writing, the altcoin trades at $0.64.

On-chain data points to a resurgence in bullish sentiment, suggesting that the rally may have legs in the short term. This analysis explains how.

IMX Traders Go Long and Network Activity Supports the Climb

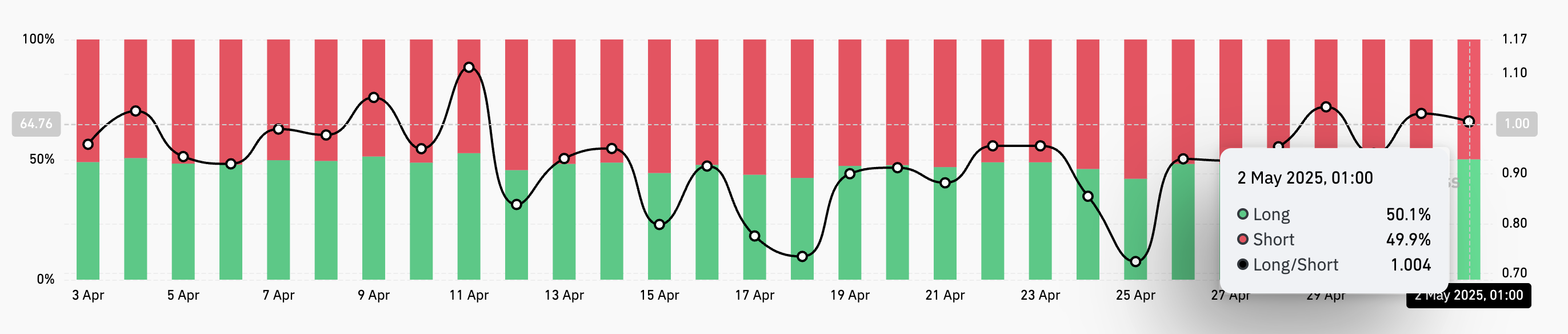

IMX’s long/short ratio has risen above 1, indicating that many market participants are opening long positions in anticipation of continued upside. According to Coinglass, this currently stands at 1.004.

IMX Long/Short Ratio. Source: Coinglass

The long/short ratio measures the proportion of bullish (long) positions to bearish (short) positions in the market. When the ratio is below one, more traders are betting on a price decline than on a price increase.

Converesly, as with IMX, a ratio above one means there are more long positions than short ones. This suggests bullish sentiment, with most traders expecting the asset’s value to rise.

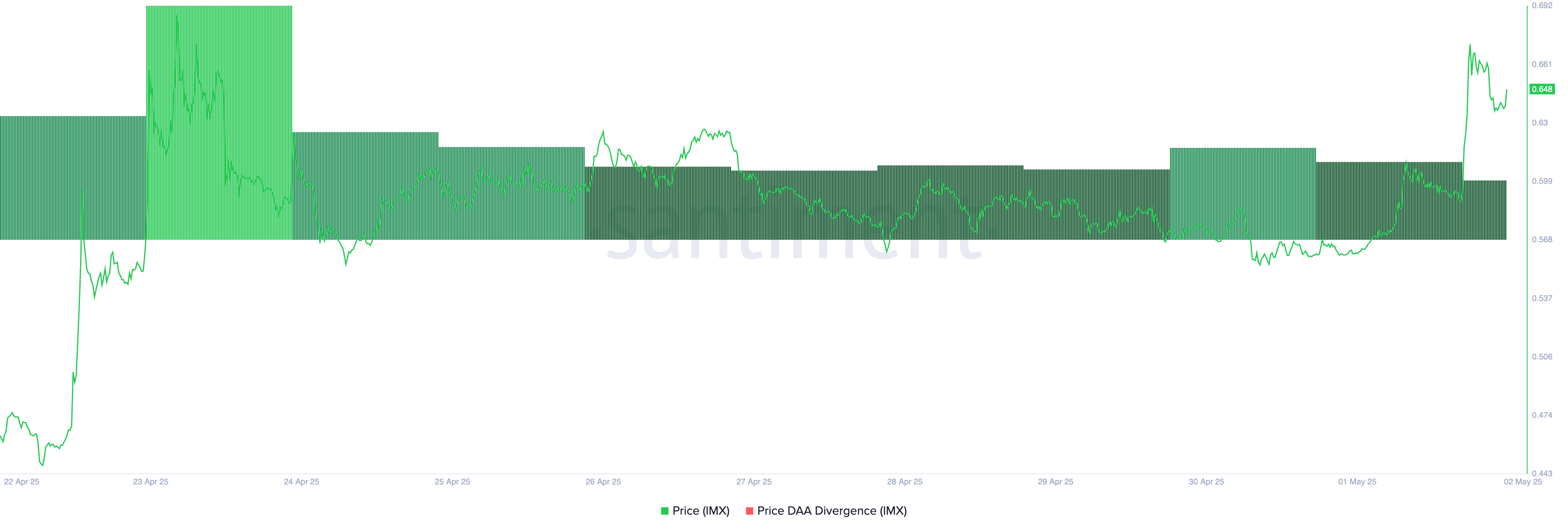

IMX’s price daily active address (DAA) divergence, which remains positive, further strengthens the bullish case. This metric, which measures an asset’s price movements with the changes in its number of daily active addresses, is currently at 63.22%.

IMX Price DAA Divergence. Source: Santiment

When an asset’s price rally is accompanied by a positive DAA divergence, it is considered a bullish signal, suggesting growing interest and the potential for further price appreciation.

This reflects that IMX’s recent price hike is supported by sufficient user activity on the network rather than driven solely by speculative trading.

IMX Price Outlook Strengthens

On the daily chart, the setup of IMX’s Moving Average Convergence Divergence (MACD) supports the bullish outlook above. At press time, IMX’s MACD line (blue) rests above its signal (orange) and zero lines.

An asset’s MACD indicator identifies trends and momentum in its price movement. It helps traders spot potential buy or sell signals through crossovers between the MACD and signal lines.

When the MACD line is above the signal line, buying activity dominates the market, hinting at further price rallies. If this holds for IMX and the token maintains its uptrend, it could break above the resistance at $0.73 and climb to $0.79.

IMX Price Analysis. Source: TradingView

On the other hand, if sellers regain market control, they could drive IMX’s value down to $0.55.

Leave a Reply