A Chainlink ambassador has presented three catalysts he believes could still trigger an XRP rally in 2025 despite current price struggles.

For context, XRP experienced a volatile journey in Q1 2025, rising to impressive highs before struggling amid a broader market downturn. After surpassing $3 in January, it has since dropped to the lower $2 range. Despite this decline, analysts expect massive gains before the year ends.

Amid these expectations, market commentator and Chainlink ambassador Ito Shimotshuma recently outlined three major catalysts that could drive XRP’s resurgence.

According to him, these factors include the potential approval of an XRP exchange-traded fund (ETF), the rapid growth of Ripple stablecoin RLUSD, and the possibility of Ripple launching an initial public offering (IPO) in the United States.

XRP ETF

Notably, one of the most bullish developments for XRP could be the introduction of an ETF. The U.S. SEC has acknowledged multiple applications for XRP-based ETFs from major firms such as Bitwise, 21Shares, Grayscale, and CoinShares.

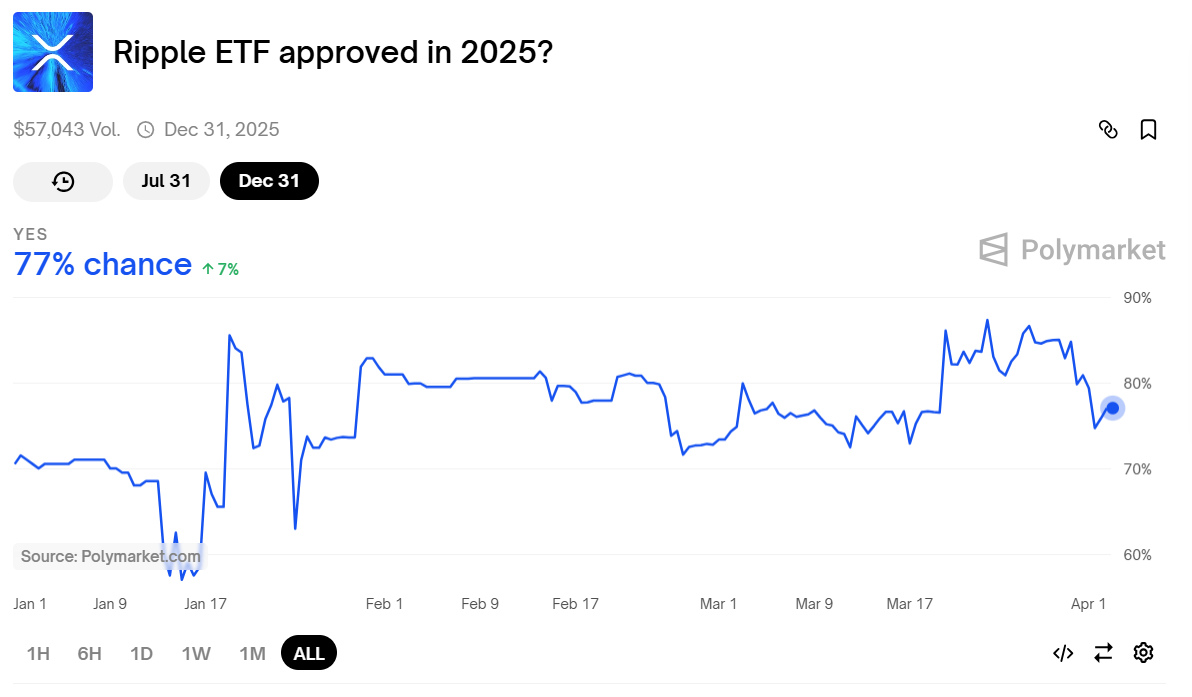

While approval is not a guarantee, market analysts predict a strong likelihood of success, with probabilities ranging between 65% and 87%. On Polymarket, the odds recently fluctuated but currently stand at 77% for approval by the end of the year.

Odds of XRP ETF Approval in 2025 | Polymarket

Moreover, the changing regulatory atmosphere under the Trump administration, combined with Ripple’s legal victories, could improve the chances of ETF approval. Some experts believe an XRP ETF could receive approval as early as the third or fourth quarter of 2025, which could bring increased institutional investment into the asset.

Interestingly, Nate Geraci, president of ETF Store, hinted last month that industry giants like BlackRock and Fidelity may consider filing their own applications once the legal uncertainties surrounding XRP completely subside.

RLUSD Growth

For the second factor, Shimotshuma highlighted RLUSD’s growth. Notably, the progress of RLUSD could bolster XRP’s rally. Since launching in December 2024, RLUSD has rapidly gained traction on multiple platforms, including Uphold, Bitstamp, and Mercado Bitcoin.

Its market cap has surged past $240 million, and at one point, trading volumes spiked by over 220% in a single day. Currently, CoinMarketCap data confirms that trading volumes have steadied at $43 million.

RLUSD’s adoption has been bolstered by integrations with platforms like Zero Hash, as well as a partnership with Chainlink that bolsters its usability in decentralized finance (DeFi) applications.

The stablecoin’s primary use cases include liquidity provision in DeFi pools and cross-border transactions. Ripple executives anticipate that RLUSD could rank among the top five stablecoins by the end of the year.

Ripple IPO

Meanwhile, a third factor that could massively influence XRP’s trajectory is Ripple’s potential IPO. Although Ripple CEO Brad Garlinghouse previously ruled out an IPO in the U.S. due to regulatory uncertainty, recent developments suggest a shift in stance may be possible.

In mid-2024, reports confirmed Ripple was looking to repurchase $1.4 billion in shares. Garlinghouse later stated that an IPO was not an immediate priority but suggested that if they were to move in that direction, it could take about a year to materialize.

Most recently, legal expert Fred Rispoli suggested that the SEC’s decision to drop an appeal against Ripple could indicate ongoing negotiations to lift a regulatory restriction on XRP sales to institutions.

If this barrier goes away, Ripple will have greater flexibility to raise capital and proceed with a public offering. A Ripple IPO would likely increase investor confidence in XRP and boost its market valuation.

Leave a Reply